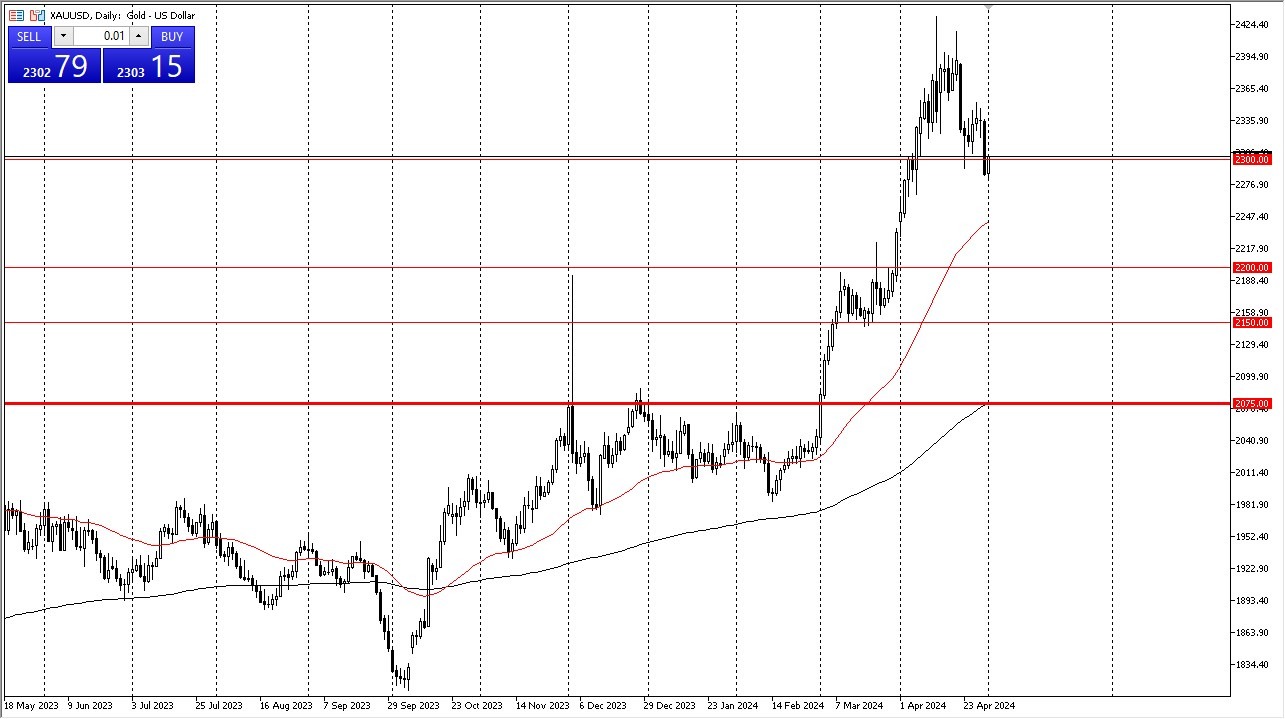

- Gold markets rallied significantly during the early hours on Wednesday, as we have recaptured the $2300 level.

- This is a level that I think is going to continue to be crucial for the market, and the fact that we have bounced back a bit is a good sign.

- However, Wednesday of course features the FOMC announcement, and therefore we will have a lot of noise to deal with.

Technical Analysis

The technical analysis for this pair obviously is very bullish, despite the fact that we have seen a couple of really ugly negative candlesticks over the last couple of weeks. The $2300 level of course is an area that previously had been resistance and is now support, and beyond that there are reasons to think that the market has support just below near the 50-Day EMA, which is near the $2250 level. Obviously, we also have the $2200 level underneath that could offer support, so it all ties together quite nicely.

Top Forex Brokers

If we can take out the top of the nasty candlestick on Tuesday, that would obviously be a very strong sign as well, and it could send gold on a path toward the $2400 level above. The $2400 level of course is a large, round, psychologically significant figure, and an area that would attract a lot of attention in and of itself.

I think at this point in time gold is essentially a “buy on the dips” type of situation, of course the biggest question is where is that dip that you’ll be buying at? Ultimately, I do think that we will go higher eventually, but we have a lot of questions to ask in the short term. After all, keep in mind that there are a lot of geopolitical concerns out there, and of course there is a lot of concerns when it comes to the massive amount of spending coming out of the United States in the Biden administration. Adding $1 trillion worth of debt every 90 days is not exactly fiscal responsibility, and therefore gold could be used as a bit of a hedge for that as well.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.