- The gold market shot higher during the Monday trading session, as news got out that the Iranian president was killed in a helicopter crash.

- Initially, people thought that perhaps it was some form of terrorism or a military strike, but at the end of the day, the market has to deal with the fact that sometimes, it’s just a weather-related a bit in a dangerous part of the world.

Because of this, the market sold off quite drastically, and could have potentially destroyed several retail accounts during the session. I suspect that a lot of people solve the spike above the resistance barrier and went “all in.” This of course is a market that has a lot of FOMO attached to it, but at this point, I think this is a market that is getting a little overdone.

Top Forex Brokers

Technical Analysis

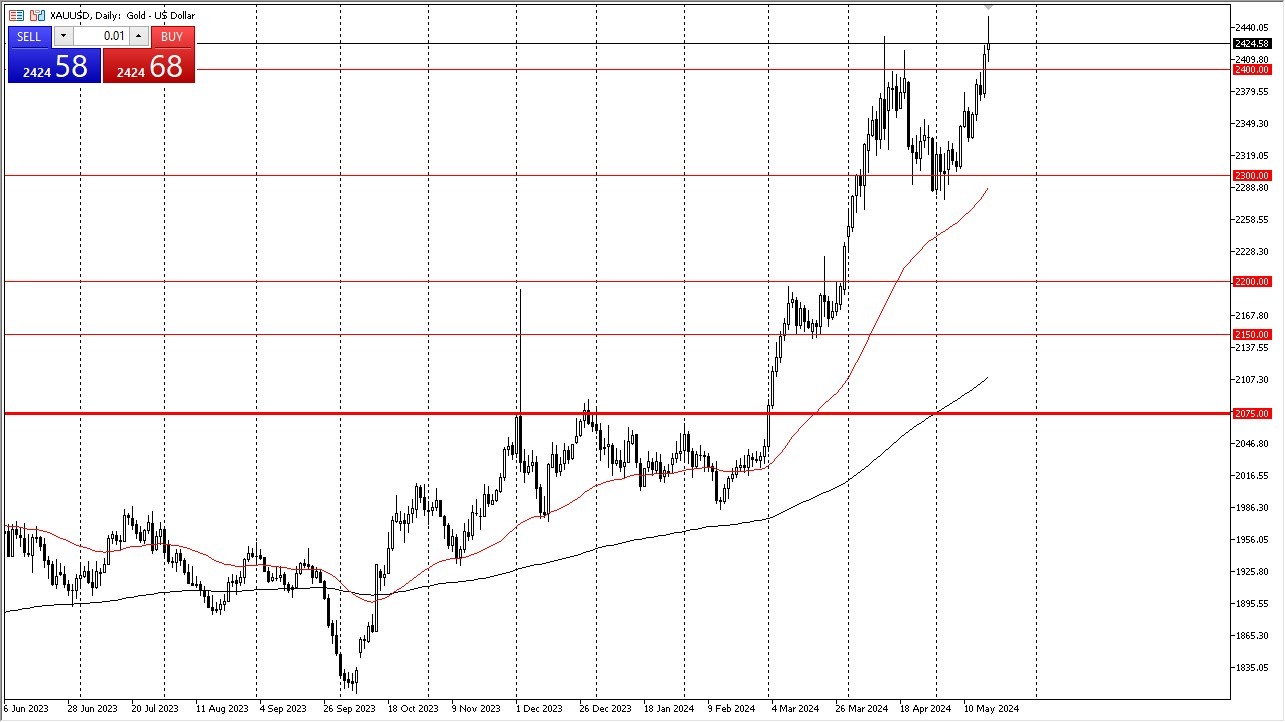

The technical analysis suggests that we are about to see a bit of a pullback, due to the fact that we are trying to form a shooting star. Underneath, we have the $2400 level, which should be a significant amount of support due to the fact that it is a large, round, psychologically significant figure, and an area where we had previously seen a lot of resistance. This makes sense, due to the fact that the market has been so overbought, but at this point in time we could get an even deeper correction, perhaps as low as $2300 where the 50-Day EMA is coming into the picture.

However, the exact opposite could happen, and we could get a massive shot higher. If we can break above the highs of the trading session on Monday, that could lead to another impulsive leg higher. Either way, I do think that it is only a matter of time before we go higher, but I also recognize that this is a situation where we are simply far too bullish to try to short this market, and I look at each time the market falls as a potential opportunity.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.