- Gold was all over the place during the trading session on Friday as the jobs numbers came out lower than anticipated.

- Looking at the shorter term charts, the market had initially swung all the way up to the $2,323 level in the $2,275 level and then turned around to basically close in the middle of the day at the middle of the candlestick.

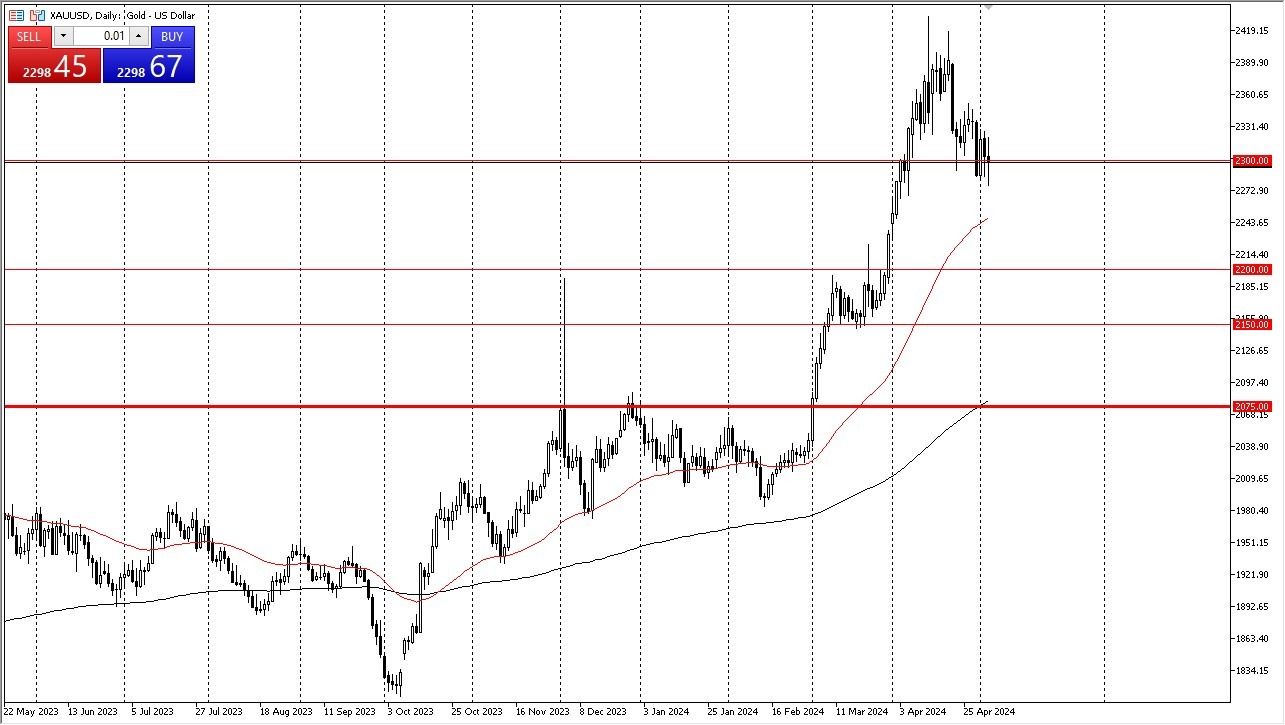

- So, a lot of noise for no particular reason. It is interesting to note that we are right around the $2,300 level and that of course is an area that a lot of people will pay attention to as it is a large round psychologically significant figure.

That being said, if we can take out the top of the candlestick from the Friday session, I suspect that we may continue to see upward pressure. There are plenty of reasons to think that gold may continue to go higher, not the least of which, of course, is geopolitical concerns. Even if we broke down below the bottom of the candlestick for the day, then the 50-day EMA right around the $2,250 level and then eventually the $2,200 level, both could offer a significant amount of support.

Top Forex Brokers

External Pressures

Pay attention to interest rates, because if it looks like traders are betting on the Fed cutting rates sooner rather than later, that will also help gold. This is a chart that is very technically sound and despite the fact that we got thrown around quite a bit on Friday, the reality is, this is still a very bullish market.

Because of this, I have no interest whatsoever in trying to get short of the gold market, and most of my energy is focused on trying to find a decent entry point. Over the longer term, I would not be surprised at all to see the gold market go much higher, perhaps even reaching $2,500 given enough time. On the downside, even if we break down below the $2,200 level, I think there are plenty of buyers underneath it might jump into the market in trying to take advantage of “cheap ounces.”

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.