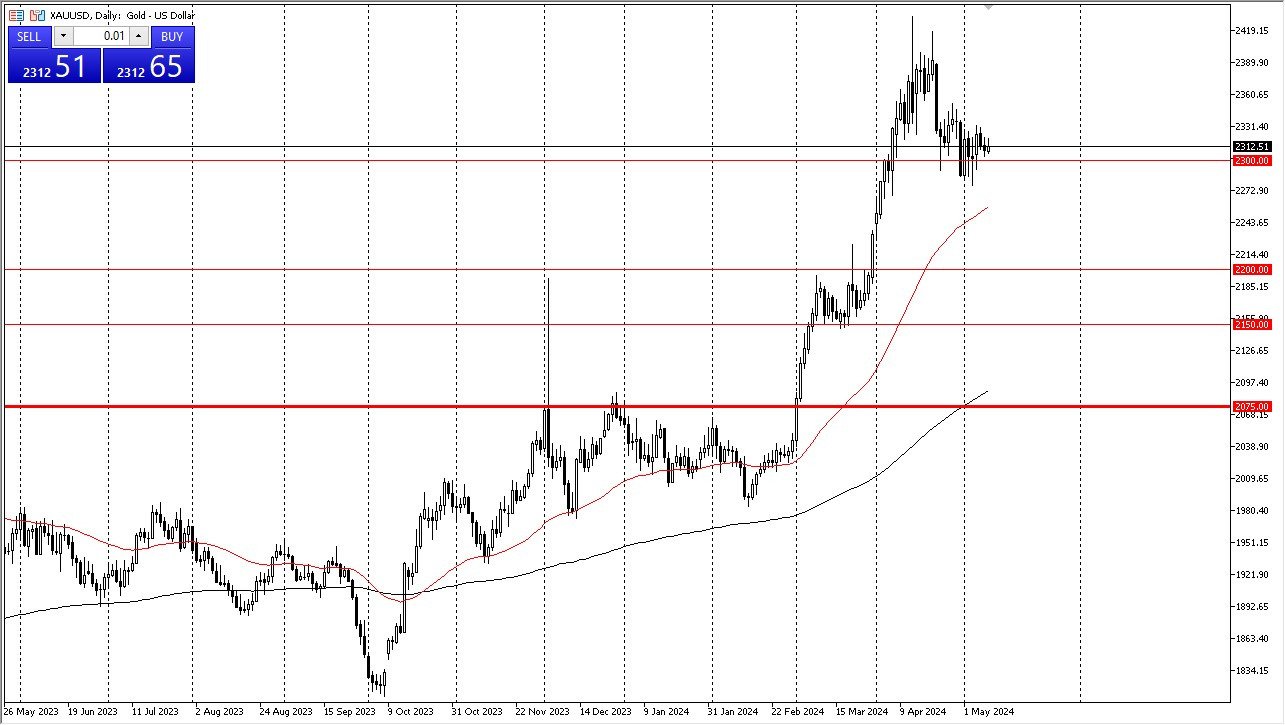

- Gold has been somewhat choppy during the early hours on Thursday, which quite frankly is a repeat of the last several days in a row.

- Gold is currently looking at the $2,300 level with interest and that area seems to be an area where people are willing to step in and support the market.

Gold markets are notoriously technically driven, and that of course is a huge influence on this market as well. While we have had a little bit of a pullback, the reality is that choppy volatility is probably the way forward.

Regardless, I think it's somewhat obvious that gold is not a market you should be selling any time soon because quite frankly, there are just far too many issues in the world right now to think that things are going to be easily patched over. We have central banks getting ready to enter a major easing cycle. And in fact, the Monetary Policy Committee in the United Kingdom this morning had two members vote to cut rates, which was not expected.

Top Forex Brokers

The Swiss National Bank and Others

And then, of course, we've had the Swiss National Bank cut rates. The ECB is likely to cut rates later this year with the big one, the Federal Reserve, standing pat. But eventually they will be more likely than not to start cutting as well. With all that being said, gold should continue to look attractive. Furthermore, we have a lot of geopolitical concerns when it comes to everything that's going on right now, and that, of course, has its own effect.

Ultimately, I do think that the market is looking towards the $2,400 level, but it might be more of a grind than what we had seen previously. After all, the market had shot straight up in the air about 20% since the beginning of March, so a little bit of sideways action and digestion of those gains makes quite a bit of sense. It will take a certain amount of time to get momentum into the market, unless of course we get some type of geopolitical headline crossing the wires assistance everything into a frenzy yet again.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.