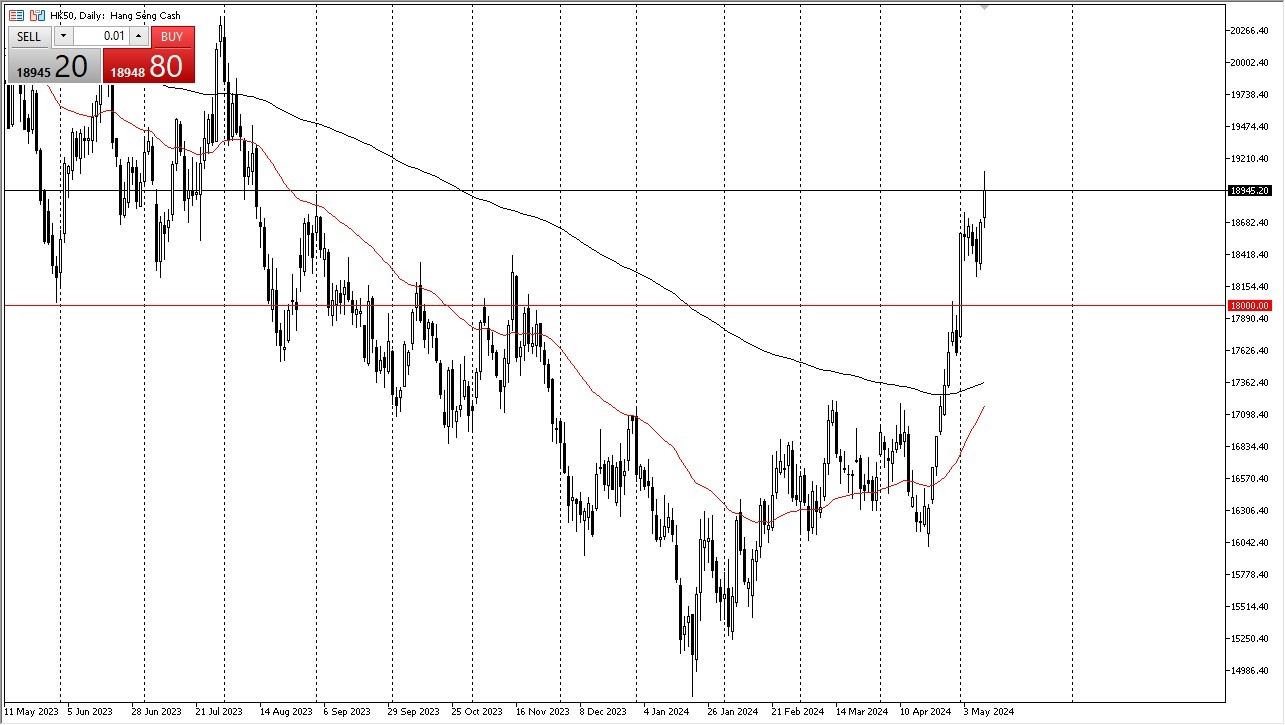

- The Hong Kong 50 index is likely to continue going higher after we have seen a very bullish Friday.

- We are currently hanging around the HK$19,000 level, but more importantly, we have broken out of a bullish flag, and it looks like we are going to continue to see upward momentum come into this market.

This plays out quite nicely with other indices around the world as it looks like traders are starting to bet on loose monetary policy to help stocks overall. Keep in mind that the Hong Kong dollar is pegged to the US dollar and is therefore manipulated by the Hong Kong Monetary Authority. In other words, the Hang Seng and the Hong Kong 50 index by extension will quite often follow Federal Reserve policy more than anything else.

Top Forex Brokers

Furthermore, it’s probably easier to invest in Hong Kong then it is mainland China for most of you, so this is an index that you want to use as an opportunity to take advantage of China perhaps turning the corner when it comes to economics. Short-term pullbacks at this point in time should end up being a nice buying opportunity, and I believe at this point the HK$18,000 level is going to end up being a massive support level, not only due to previous action, but the fact that the psychology attached to a number like that is something worth watching.

HK$20,000 possible

Looking at the longer-term charts, it makes quite a bit of sense that we would see short-term pullbacks as buying opportunities and therefore I think you have to little look at the potential resistance barriers above as a target going forward. Ultimately, I think this is a market that could go all the way to the HK$20,000 level, which obviously has a lot of psychology itself and therefore people will be paying close attention. However, it’s also worth noting that there are a few other minor levels between here and there so that should continue to be a situation where occasionally get a pullback in which to add more to your position.

Not sure which broker to choose? We've made a list of the best forex brokers for you.