- The Japanese Yen is now being sold despite its exceptionally strong rise on Monday after suspected Bank of Japan intervention.

- Yen weakness is supported by market sentiment and fundamental factors.

- Markets seen unconvinced that the Bank of Japan is able and willing to successfully defend the Japanese Yen, although ¥160 seems to be a red line for the Bank in USD/JPY.

- The best Forex opportunities to be short of the Japanese Yen look likely to be in the USD/JPY currency pair, also in the EUR/JPY and GBP/JPY crosses.

- There may be an opportunity to go short of the USD/JPY currency pair if ¥160 is reached and rejected. This could happen after today’s Federal Reserve release.

Top Forex Brokers

Japanese Yen Index (JXY): Technical Analysis

The Japanese Yen has clearly been in a downwards trend since at least mid-March, and arguably since the start of 2024.

There are no clear chart patterns or other technical formations affecting the price action now, but the price chart below shows the Yen falling quite hard over recent days to reach a new 34-year low two days ago. The Yen has continued falling today after being sold during the previous Asian session.

The Index is currently trading near today’s low, which is another bearish sign that we will probably see lower prices today. However, there is a chance that Monday’s low price might act as support if it is tested today, as seems likely to happen.

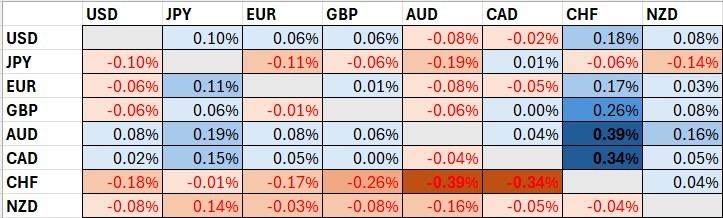

The table below shows that the Australian and Canadian have been the strongest major currencies so far today, although the numbers are relatively small, while the Swiss Franc and New Zealand Dollar have been the weakest. This suggests today, at least until the Federal Reserve release later, may be more of a cross day. However, the US Dollar is showing some strength, and is close to long-term highs.

Japanese Yen Index (JXY): Fundamental Analysis

The Japanese Yen has several fundamental and sentimental reasons for its recent and current weakness:

- The Bank of Japan’s suspected intervention in favour of the Yen on Monday does not seem to have held, with traders selling the Yen for some hours now. It is much easier for a central bank to weaken than strengthen its own currency.

- Questions remain as to how rapidly the Bank of Japan will be able to truly ditch its very accommodative monetary policy, despite a recent switch to positive rates.

- The Yen’s recent strong descents into new 34-year lows attract trend traders as Yen sellers.

Let’s now look at the major Yen currency pair and crosses.

USD/JPY Forecast: Technical Analysis

Recent gains by the US Dollar have been expressed most strongly and dramatically against the weak Japanese Yen. The Bank of Japan has been slow to intervene despite expectations that it would, and it probably made a covert intervention to defend the ¥160 handle in the USD/JPY currency pair on Monday. This sent the price more than 500 pips lower within just a matter of hours, but the price has now clawed back all its losses and is now trading above the weekly open, which is a bullish sign.

Traders will probably be wise to look for long trades, at least until the Fed’s policy meeting later, but there are no obvious supportive entry points nearby due to the wild swings seen Monday. It might be better to day trade this pair and to look to enter long following minor pullbacks on shorter time frames, especially after the New York open settles.

EUR/JPY Forecast: Technical Analysis

We see a similar picture here as in the USD/JPY currency pair, with the Euro seeing a bid. However, it is worth noting that the price remains below the weekly open here.

The price action in the EUR/USD currency pair is quite bearish, but recent days have shown some support levels holding above $1.0600. If these levels continue to hold there, the price in this cross is likely to make up the week’s losses by Friday’s close.

There is not much sentiment around the Euro right now.

GBP/JPY Forecast: Technical Analysis

There is really no difference between the EUR/JPY currency cross and the GBP/JPY currency cross in terms of technical, fundamental, or sentimental analysis. The price chart below shows that maybe the GBP/JPY cross is a fraction more bullish than EUR/JPY.

Other Yen Crosses: Technical Analysis

The natural next crosses to look at for the Yen are the AUD/JPY and CAD/JPY crosses as these are performing the most bullishly today. However, if you go look at their price charts, you will see that these currencies are further away below their weekly opens, so it seems that the other crosses and pairs may be better vehicles to short the Japanese Yen over the longer term. It may be that day traders will get better short-term long results with AUD/JPY or CAD/JPY.

Ready to trade our Forex daily analysis and predictions? Here are the best Asian brokers to choose from.