- The Japanese Yen is now being bought despite its earlier bullish bounce after suspected Bank of Japan intervention, which seems to have been more successful than it was on Monday.

- Yen strength may begin to be supported by market sentiment.

- The best Forex opportunities to be long of the Japanese Yen look likely to be in the EUR/JPY and GBP/JPY crosses.

Top Forex Brokers

Japanese Yen Index (JXY): Technical Analysis

The Japanese Yen has clearly been in a downwards trend since at least mid-March, and arguably since the start of 2024.

There are no clear chart patterns or other technical formations affecting the price action now, but the price chart below shows the Yen making a dramatic move higher today. This was probably the result of the Bank of Japan intervening during the Tokyo session to prop up the Yen, like last Monday, but the Bank has again refused to confirm or deny this. If there was an intervention, it was more successful than Monday’s, although the price chart below shows that the Yen has given up much of its earlier gains.

It is worth noting that there is a long-term bearish trend that is going to weigh on any gains the Yen can make, and that there are many professional institutions betting on a weaker Yen. It is much harder for a central bank to strengthen its own currency, as is the case here, than it is to weaken it.

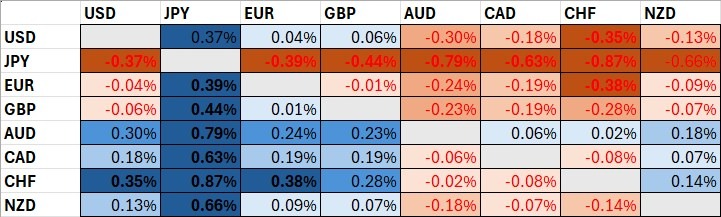

The table below shows that the Swiss Franc, and the Australian and Canadian Dollars have been the strongest major currencies so far today, while the Japanese Yen has been the weakest. This suggests today, may be more of a cross day, as the US Dollar is more mixed after falling yesterday.

Japanese Yen Index (JXY): Fundamental Analysis

The Japanese Yen has several fundamental and sentimental reasons for its recent and current weakness:

- The Bank of Japan’s suspected interventions in favour of the Yen on Monday and earlier today do not seem to have held very strongly, with traders again selling the Yen for some hours now. It is much easier for a central bank to weaken than strengthen its own currency.

- Questions remain as to how rapidly the Bank of Japan will be able to truly ditch its very accommodative monetary policy, despite a recent switch to positive rates.

- The Yen’s recent strong descents into new 34-year lows attract trend traders as Yen sellers, although after today’s probable intervention, they may start to be more deterred from shorting the Yen.

Let’s now look at the major Yen currency pair and crosses.

USD/JPY Forecast: Technical Analysis

Recent gains by the US Dollar were partially erased by the dovish tilt taken by the US Federal Reserve yesterday in its policy meeting, with Jerome Powell emphasising there will not be a rate hike, but a rate cut later this year. However, the past few hours have seen the Yen start to gain again against the greenback.

The suspected intervention by the Bank of Japan during the earlier Asian session sent this currency pair 450 pips lower, like the 550-pip drop seen last Monday. However, the support level at ¥153.87 held and produced a bullish bounce.

Traders will probably be wise to look for long trades, but there are no obvious supportive entry points nearby due to the recent wild price action seen this week. It might be better to day trade this pair and to look to enter long following minor pullbacks on shorter time frames, especially after the New York open settles.

A long trade from ¥153.87 or a short trade from ¥157.00 could be interesting today if either or both levels are reached.

EUR/JPY Forecast: Technical Analysis

We see a very similar picture here to the USD/JPY currency pair, but the situation is a little more bearish. We see the price chart below showing stronger short-term bearish momentum than the USD/JPY. There is a descending wedge chart pattern.

The price action in the EUR/USD currency pair is quite bearish, but recent days have shown some support levels holding above $1.0600. This may help strengthen the support here at ¥165.00.

There is not much sentiment around the Euro right now.

A long trade ¥165.00 or a short trade from ¥167.35 could be interesting today if either or both levels are reached. I would prefer the short trade.

GBP/JPY Forecast: Technical Analysis

There is really no difference between the EUR/JPY currency cross and the GBP/JPY currency cross in terms of technical, fundamental, or sentimental analysis. The price chart below shows that maybe the GBP/JPY cross is a fraction more bearish than EUR/JPY.

Other Yen Crosses: Technical Analysis

The natural next crosses to look at for the Yen are the AUD/JPY and CAD/JPY crosses as these are performing the most bullishly today. However, if you go look at their price charts, you will see that they are showing price action which is extremely similar to the other Yen crosses covered earlier, so it might not make sense to be looking for short trades in these crosses.

In the AUD/JPY cross a long trade from ¥100.00 or a short trade from ¥102.00 could be interesting today.

In the CAD/JPY cross a long trade from ¥111.32 or a short trade from ¥113.81 could be interesting today.

Ready to trade our Forex daily forecast? Here are the best forex brokers in Asia-pacific to choose from.