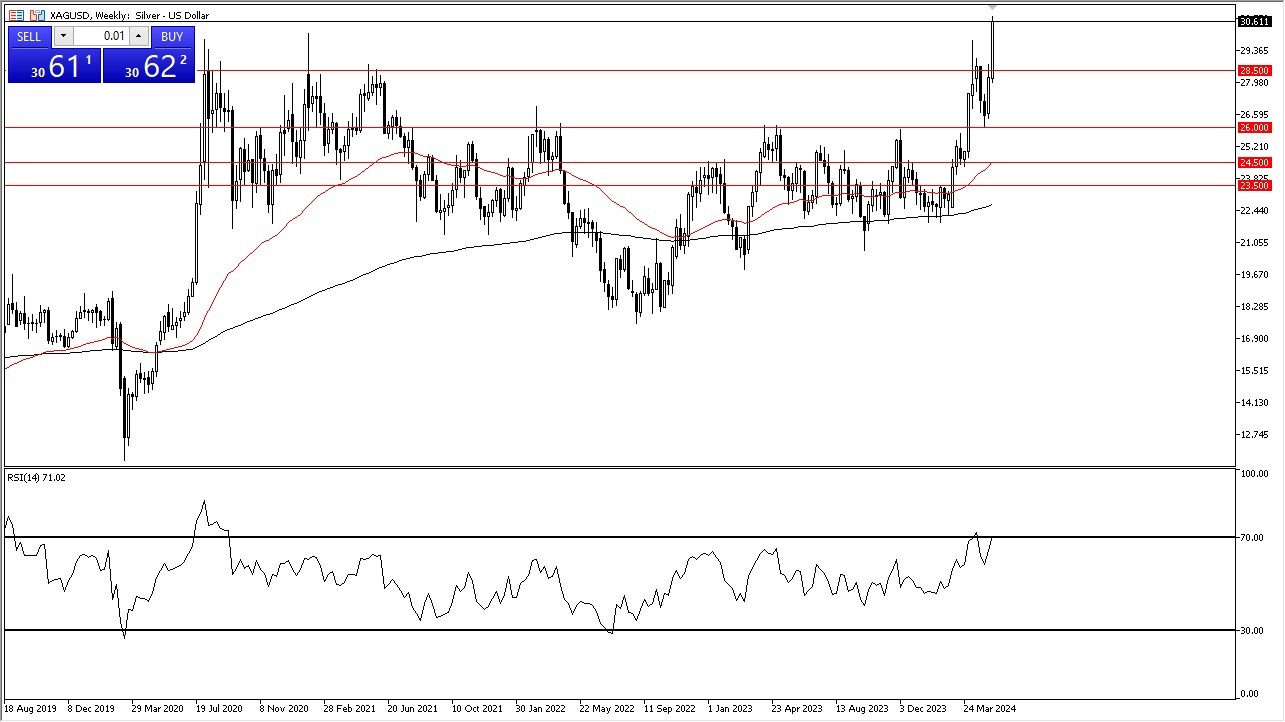

Silver

Silver has been on a tear as of late and has broken above the $30 level. This is a major victory, and I think at this point in time you need to continue to look at silver as a “buy on the dips” type of market, but I would also be very cautious, as moves like this have historically been very dangerous, and normally end up in tears. However, it’s obvious that the buyers are still very much in control, and I fully anticipate that silver continues to be bullish.

DAX

The German index initially tried to rally during the week but gave back gains as we continue to see a little bit of noise in general. That being said, Friday did show a significant amount of support, and I think this suggest that there are plenty of buyers underneath, so you certainly want to follow the trend, meaning that you want to be a buyer overall. I have no interest in shorting the DAX and do believe that we eventually get to the €20,000 level over the longer term. Buying on the dips is my favorite strategy here.

Top Forex Brokers

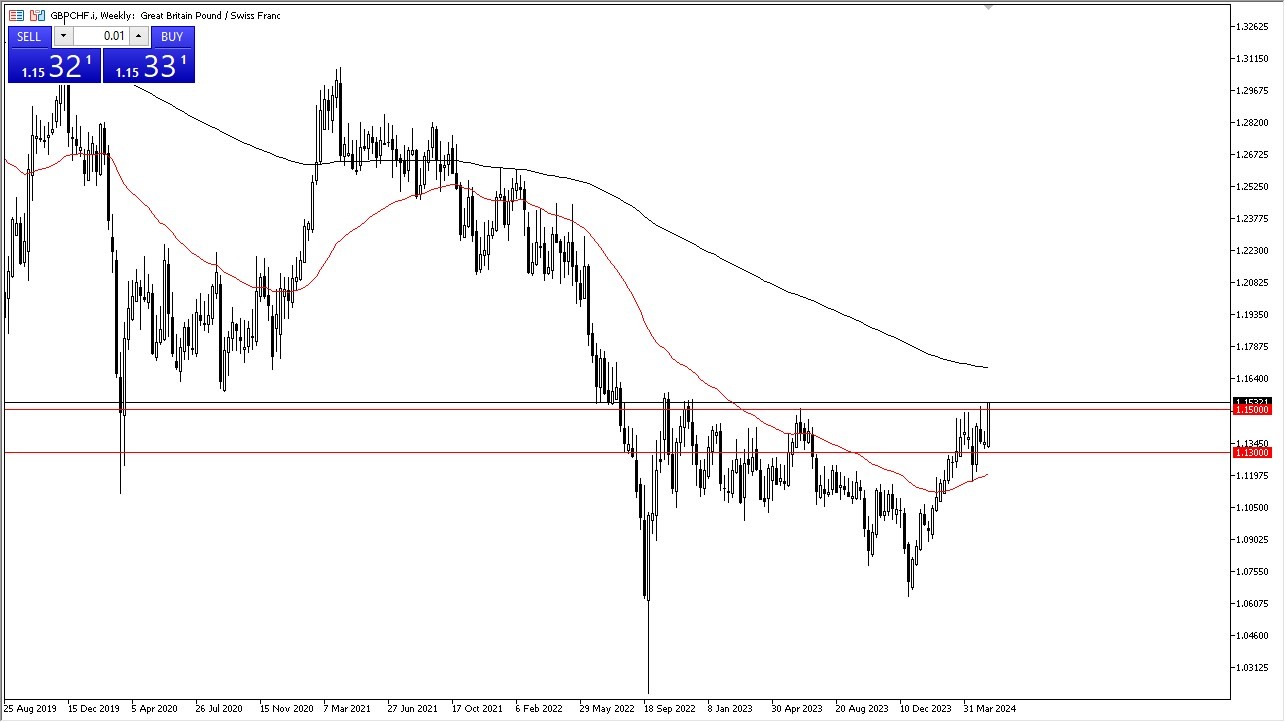

GBP/CHF

The British pound has broken higher during the course of the week, clear the 1.15 level. This is a major victory for British pound bulls, and it now looks as if the Swiss franc is going to continue to be a major funding currency for almost all markets out there. At this point, I’m okay with being long of the market, and I have course would buy short-term pullbacks. The interest rate differential continues to favor a move toward the 200-We EMA at the very least.

AUD/USD

The Australian dollar has broken above the crucial 0.6650 level, an area that has been like a major ceiling for some time. At this point in time, I believe that although the Australian dollar may remain somewhat bullish, it is going to be a very difficult move higher. Quite frankly, there are other currencies that I would prefer to own, but the Australian dollar does have the benefit of being highly levered to commodities, which of course have been on fire as of late.

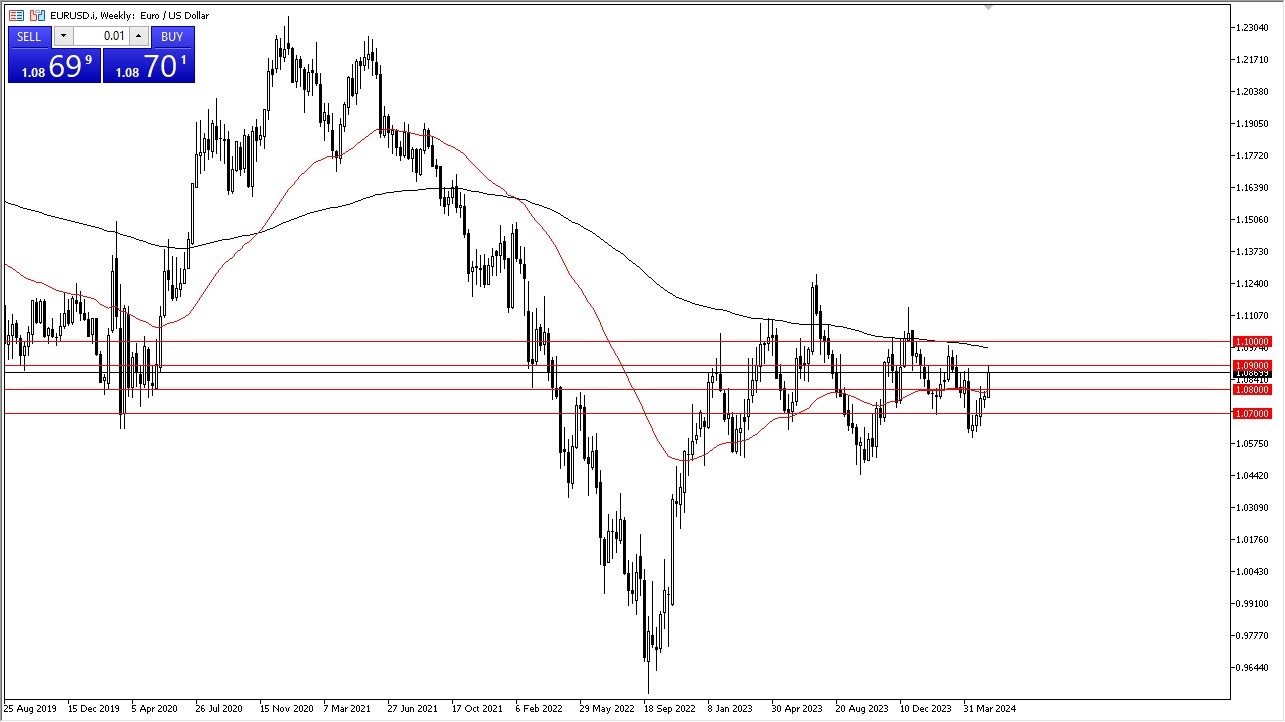

EUR/USD

The euro has rallied during the week, but quite frankly struggled at the 1.09 level to show signs of hesitation. All things being equal, this is a market that I think continues to go back and forth and is probably best served as a representation of what’s happening with the US dollar, and whether or not Wall Street still believes that the Federal Reserve is going to cut rates. All things being equal, we can break above the 1.09 level, then we might have another 50 pips ahead.

NASDAQ 100

The NASDAQ 100 had another bullish way, breaking down to an all-time high. At this point in time, it’s obvious that Wall Street is going to continue to push this market higher regardless of what happens, and quite frankly they are basically ignoring anything outside of the idea of momentum. They have convinced themselves that they are going to get interest rate cuts later this year, and the Federal Reserve has given them a reason to believe it due to the fact that they have been held hostage by Wall Street for several years now. Because of this, buying on the dip continues to be important, and the 17,850 level is probably your short-term floor. I believe we will get to the 20,000 level eventually.

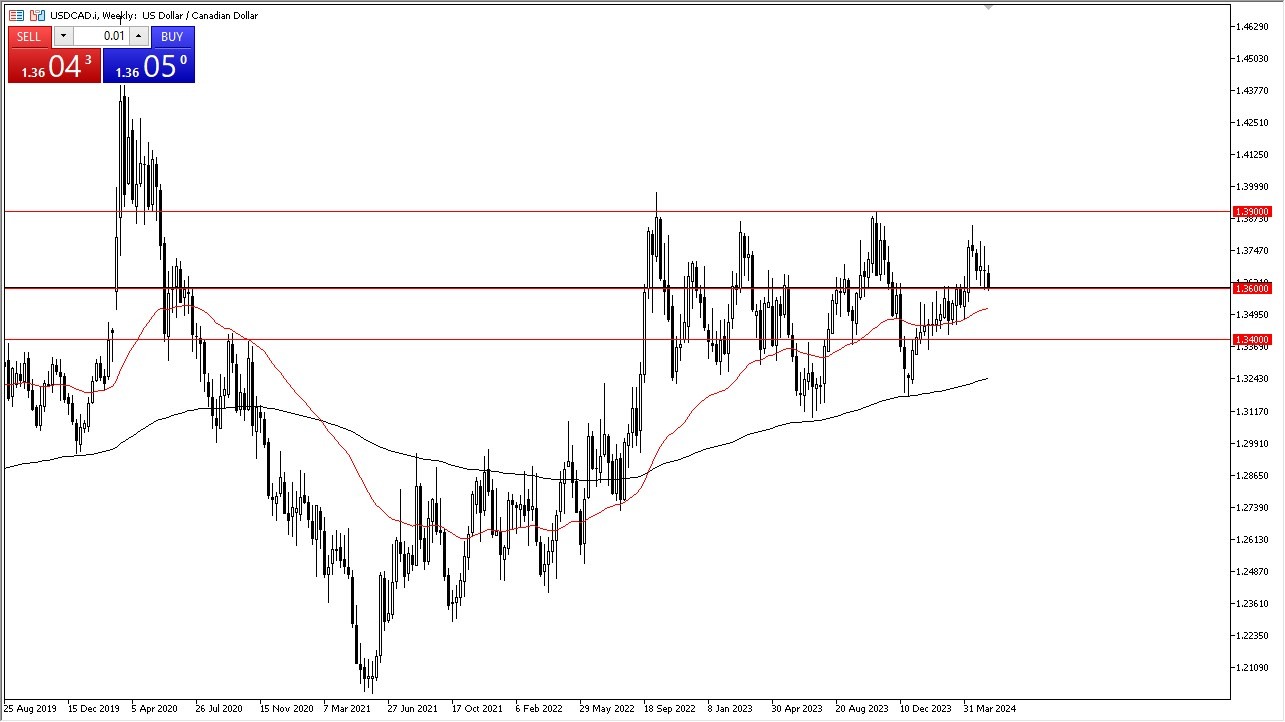

USD/CAD

The US dollar initially did try to rally a bit during the course of the week, but then plunged to hit the 1.36 level. The 1.36 level is an area that is crucial as far as support and resistance is concerned, so I think at this point in time we are at an inflection point in this pair. I have a very neutral outlook on it, unless of course we can take the top of the candlestick from the past week and go to the upside. In that environment, I think the market could go looking toward the 1.39 level.

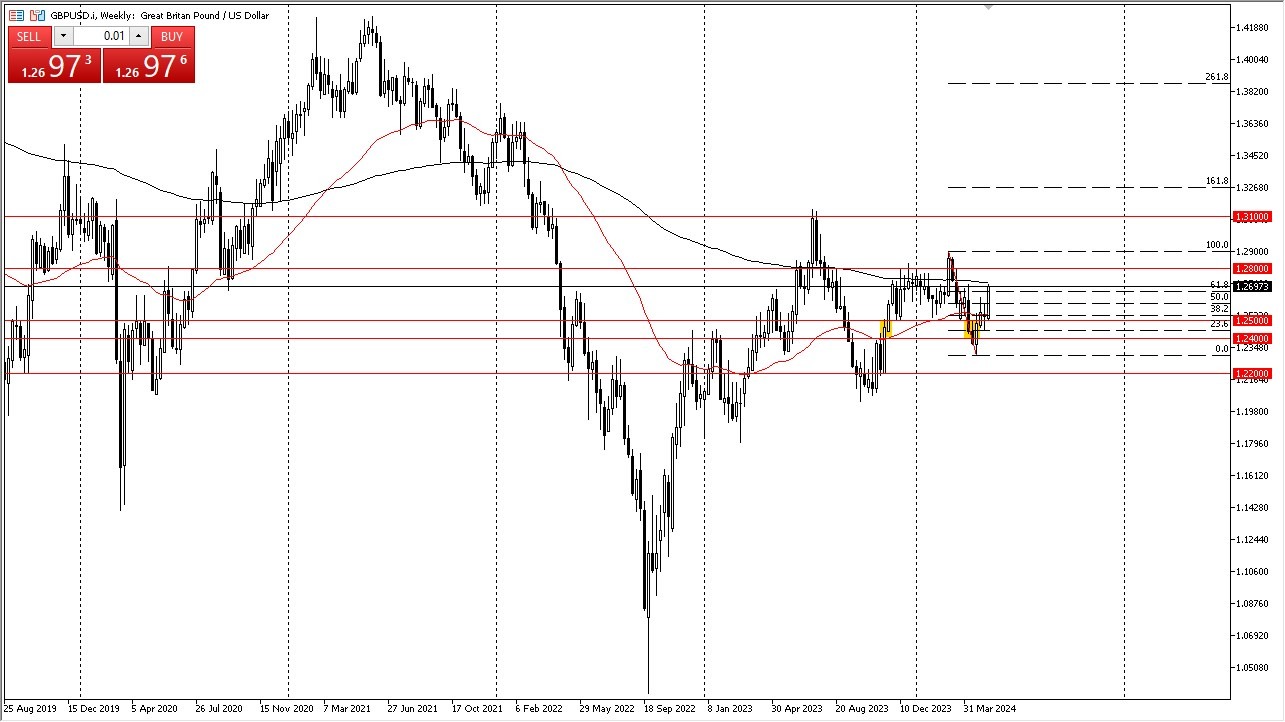

GBP/USD

The British pound took off to the upside during the course of the week, slamming into the 61.8% Fibonacci route level in the 1.27 level. At this point, it’s difficult to get bearish of this market, but quite frankly there is a lot of resistance above that could cause significant problems. In other words, although I think that the market is bullish, you don’t have a lot of runway to take advantage of it. If we turn around and fall from here, we could drop all the way down to the 1.25 level underneath which is the bottom of the weekly candlestick.

Ready to trade our Forex weekly forecast? We’ve made a list of some of the best regulated forex brokers to choose from.