- The S&P 500 rallied slightly during the early hours on Monday. But really at this point we are getting a little stretched.

- A lot of this will come into the picture in suggest that there might be more upward pressure over the longer term, but I think short term pullbacks are probably more likely than not.

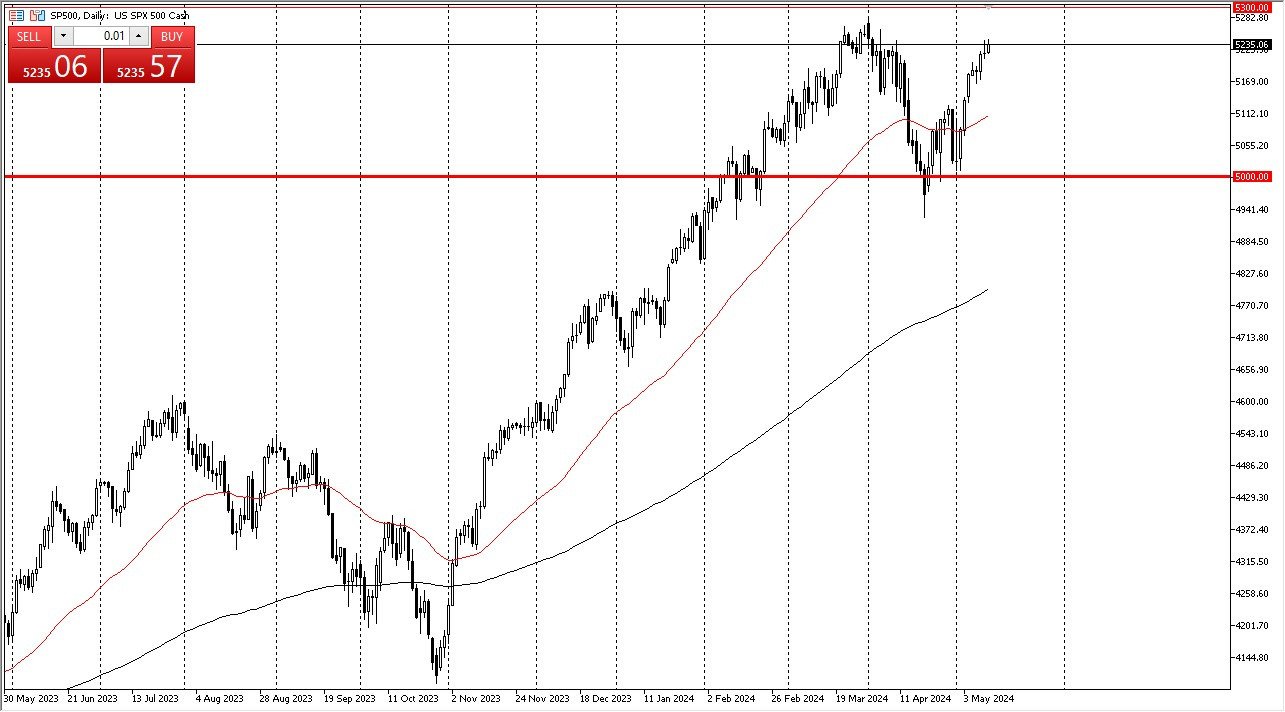

That has been the attitude for quite some time, and I just don’t see how the changes anytime soon. After all, it’s all the usual suspects that are leading the way higher. If we do pull back from here, I think there are plenty of buyers out there willing to take advantage of cheap contracts. The 5100 level underneath also features a 50 day EMA, so I think that is significant as far as support is concerned. After that, then we have 5000 as a hard floor to the upside. The 5300 level continues to show a lot of resistance.

Top Forex Brokers

If We Can Break Higher…

If the S&P 500 index was to break above there, then we could go much higher. I think in the meantime it's going to be very noisy and choppy, but it still favors the upside because quite frankly, momentum is the only thing that Wall Street pays attention to. Well, that and liquidity. As long as they believe that the Federal Reserve is going to cut rates later this year, it's likely that stocks will have a little bit of a bid underneath them.

All things being equal, it's really not until we break down below the 4900 level before I would drop a short in this market, and even then, I would probably be very cautious due to the fact that these indices are just not made to fall for a longer period of time, as they are not equal weighted. So, it's all the usual stocks out there that will push this market one way or the other as per usual, and therefore we need to pay attention to some of the upcoming earning such as Nvidia, which is in a little over a week from now, but there are also other ones between now and then that will continue to have major influences.

Ready to trade our S&P 500 analysis? Here’s a list of some of the best CFD trading brokers to check out.