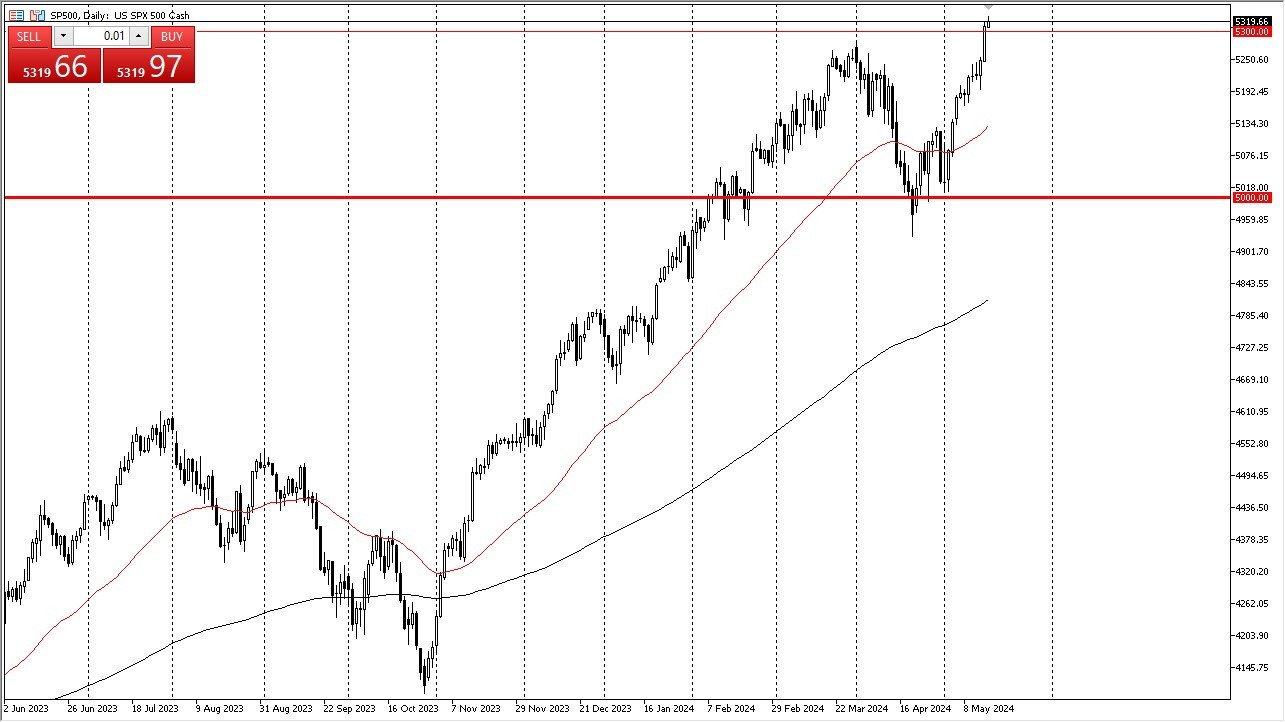

- The S&P 500 has rallied a bit during the early hours on Thursday as we continue to see upward pressure.

- The 5300 level now looks as if it could offer a little bit of a support level, which is also an area that previously had been significant resistance.

- It’s interesting to see that the large, round, psychologically significant figure is offering a bit of action, which makes quite a bit of sense considering that we have the options expiration situation on Friday when a lot of volatility will almost certainly pick up.

Monetary Policy

The monetary policy coming out of the Federal Reserve will be a major factor in what happens next, as Wall Street only seems to care about liquidity, and not so much about the economy, at least not whether or not it is strong or weak. What they truly care about is whether or not liquidity will be increased coming out of the central bank. At the end of the day, this seems to be the only thing anybody cares about.

Top Forex Brokers

Wall Street always has a narrative

Wall Street always has a narrative to push stocks, so I’m not overly concerned about any type of pullback. A pullback at this point in time will more likely than not offer plenty of support near the 5300 level, but then again at the 5250 level, and then finally the 5200 level. If we were to break down below there, then it would be a much more significant pullback, but it’s not a trend that I am worried about until we break down below at least the 5000 level, which seems very unlikely in this environment.

In general, this is a situation where you continue to buy the dip going forward, recognizing that although the S&P 500 is a very bullish market, we will eventually get some type of profit-taking. The market will eventually go looking to the 5500 level over the longer term, but over the next couple of days we may have a little bit of noise to be bothered with and trying to sort out. Either way, shorting this market is all but impossible.

Ready to trade the Forex S&P 500? We’ve made a list of the best online CFD trading brokers worth trading with.