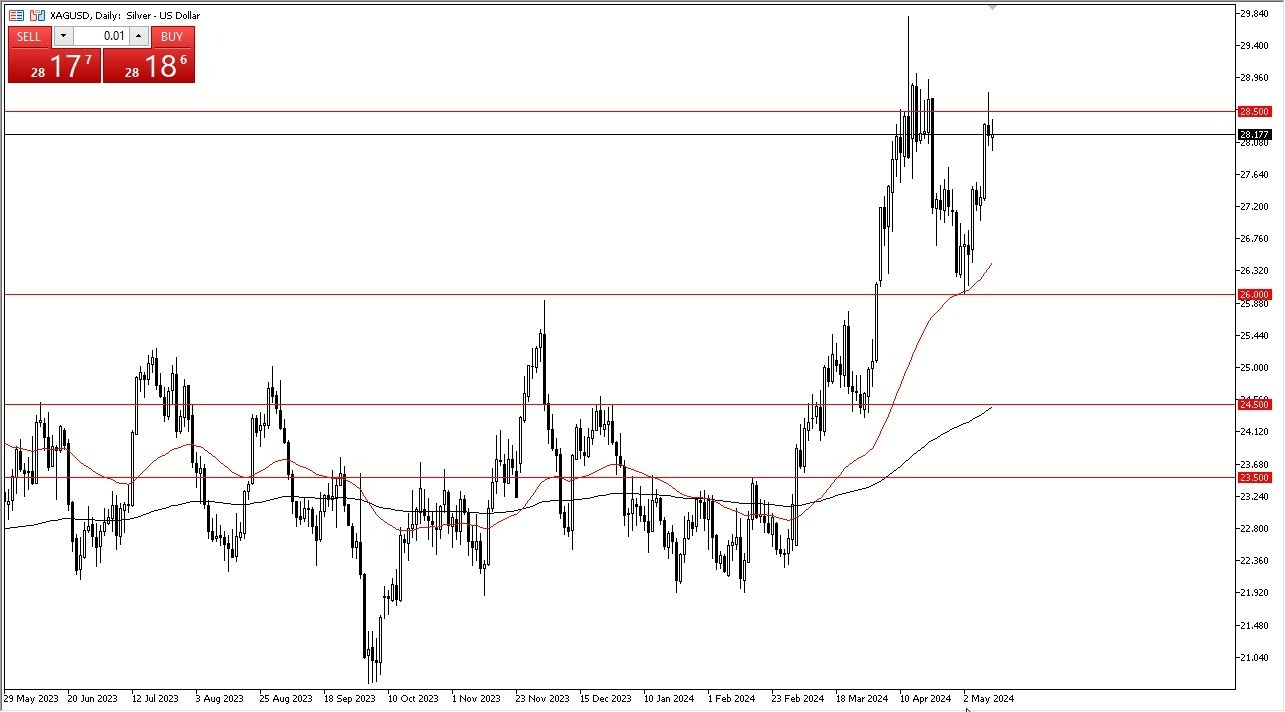

- Silver has been rather noisy during the trading session on Monday, as we are bring in our hands against the major resistance level.

- The $20.50 level continues to be important, and the fact that we ended up forming a shooting star during the trading session on Friday only reiterated this.

- Underneath, we have the $28 level that could offer support, and has so far during the trading session on Monday.

However, I don’t like the idea of chasing this market, because quite frankly we have gotten far too bullish and far too short of a time, and therefore the market is probably right for some type of pullback. That pullback should be thought of as a potential opportunity though because the silver market has plenty of reasons to be bullish over the longer term.

Top Forex Brokers

Technical Analysis

The $20.50 level has been significant resistance for multiple attempts over the years, and I think that probably continues to be the case. The fact that we formed a shooting star during the Friday session of course also suggest that perhaps we have a situation where we are going to continue to see a lot of concerns above that level in the silver market. When you look at the longer-term charts, the area between $20.50 and $30 has historically been very difficult to get beyond. It is because of this that I think the market continues to struggle.

That being said, I would be a buyer of dips, but this is going to be a trading vehicle, not in investing one. The 50-Day EMA currently sits right around the $26.50 level, and the $26 level itself is a major support level as well. I think we are more likely than not to continue to bounce around between the $26 level in the bottom, and the $28.50 level on the top of this range. If we were to break above the shooting star from the Friday session, that could lead to a major short covering rally, but I would be very cautious with that attempts, and would not go in with a huge position.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.