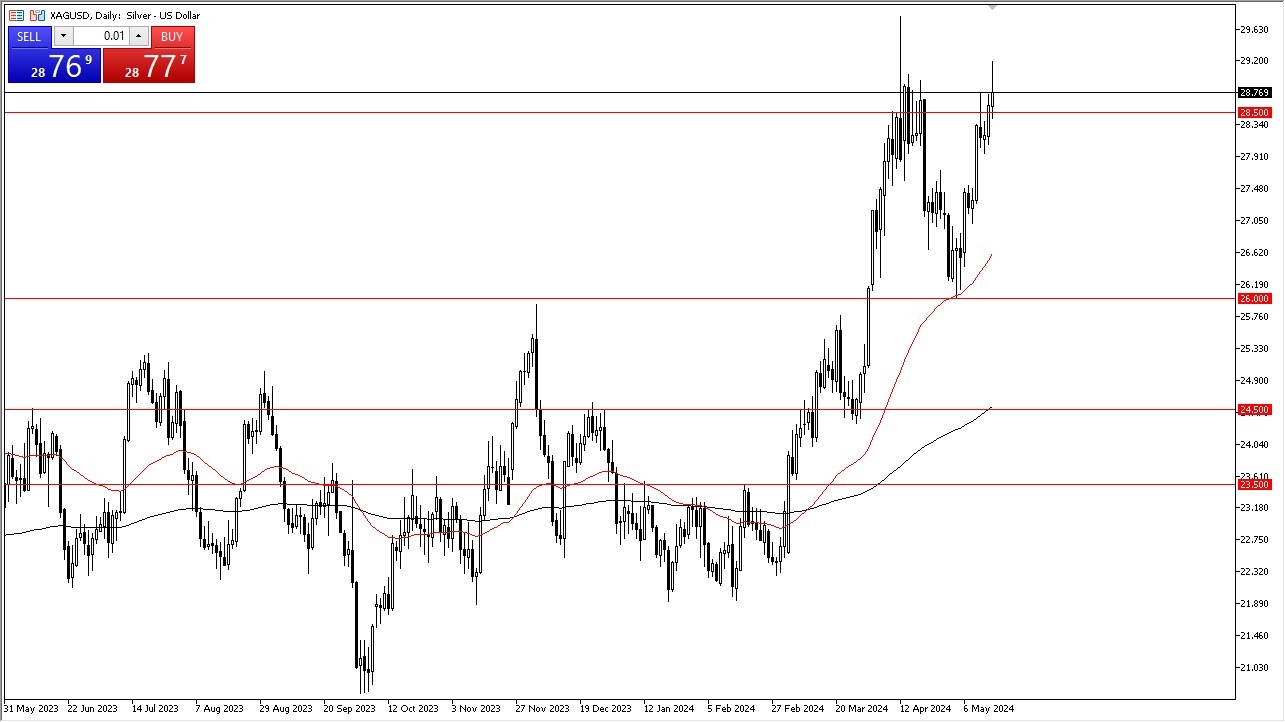

- Silver initially shot higher during the trading session on Wednesday but has given back quite a bit of the gains as we tried to break out.

Ultimately, silver is a market that is highly manipulated, and you need to be aware of this. J.P. Morgan has spent millions paying off fines for doing exactly this, but when you make billions, that’s just the “cost of doing business.” Ultimately, this is a market that I think eventually will have to make a bigger decision and history tells us that we might get a bit of a “blowoff top”, but then silver will get absolutely crushed. It is because of this that I have always been a little bit cautious trading this market, and of course doing analysis for you.

Top Forex Brokers

Exhaustion

It looks as if there might be a little bit of exhaustion in this market, as we have given back so much of the gains once the Americans came on board. There is a huge amount of resistance between the $28.50 level in the $30 level, so that is something that must be paid close attention to as well. Ultimately, this is a market that I think has to settle down a bit, because the only thing that we have to go on from a historical standpoint is that once you break $30, we raced directly to the $50 region. I don’t think that will happen anytime soon, but I do recognize that is a very real possibility in some type of massive, short squeeze. These typically don’t last that long and end up in tears for almost everybody involved.

On the other hand, if we break back down below the $28 level, we could very well see silver ball very hard, perhaps reaching down toward the 50-Day EMA, currently sitting near the $26.50 level and rising. That of course is a technical indicator that a lot of people pay attention to so don’t be surprised at all to see that offer a bit of support. Either way, silver is going to be a very dangerous place to be so please take caution with any position size that you put on. Volatile days are certainly ahead based upon where we are currently sitting.

Ready to trade our daily forex analysis? Here are the best Silver trading platforms to choose from.