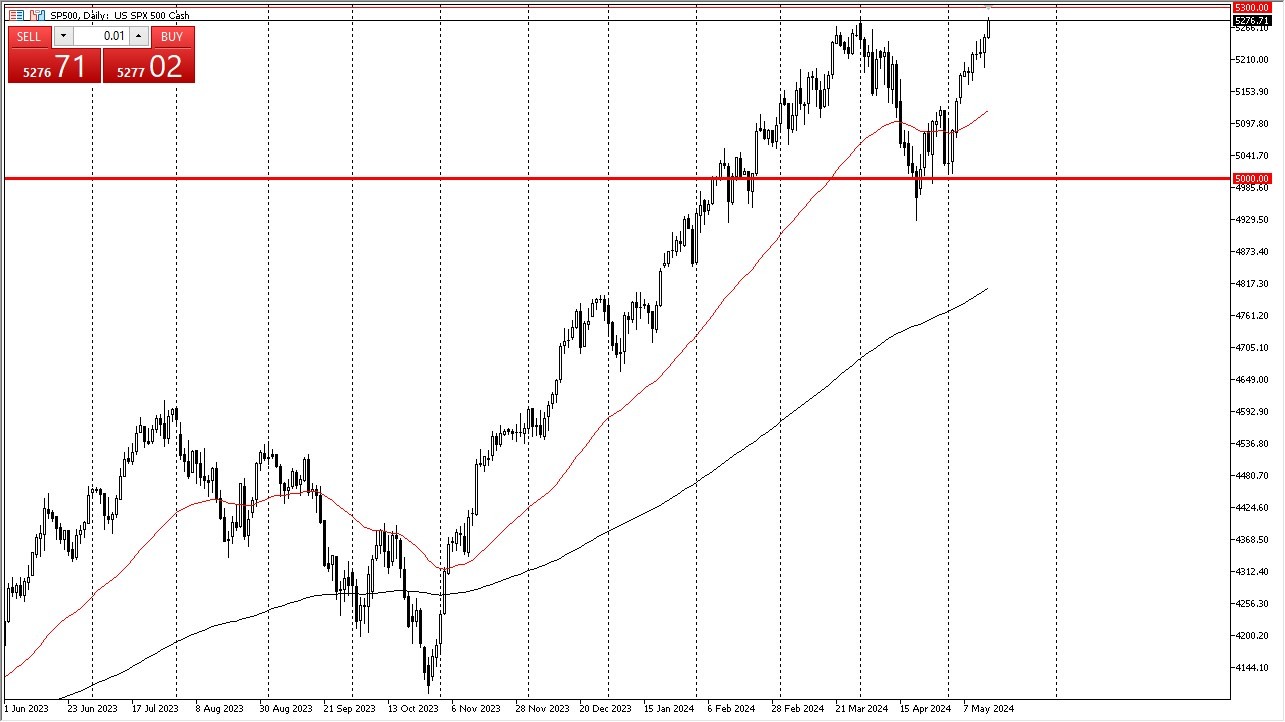

- The S&P 500 rallied rather significantly during the course of the session on Wednesday, as we are now threatening to break an all-time high.

- At this point in time, I believe that the S&P 500 not only will do so, but it’s likely that we will threaten the crucial 5300 level.

- The $5300 level is an area that has a lot of psychology attached to it, and I would have to assume that there is a certain amount of options being traded near that area.

Speaking of options, it is an options expiry session on Friday, so I think that comes into the picture as well. We can break above the 5300 level, then it’s likely that we race toward the $5500 level over the longer term. Short-term pullbacks at this point in time continue to be interesting for those take advantage of the longer-term trend, but it’s probably worth noting that there are several support levels underneath that could come into the picture.

Top Forex Brokers

Support Below

I believe there is plenty of support below, especially near the 5150 level, which besides being a great Van Halen album, is also roughly where we had seen support in the early part of April. There’s also the 50-Day EMA racing toward that level, so it all comes down to whether or not technical traders come in and support the market. Quite frankly, there’s nothing on this chart that suggests cannot go higher, and therefore you have to assume that we will eventually do so.

It’s likely a bit of a reaction initially during the day when we fell due to the retail sales coming in flat, but ultimately Wall Street will find one reason or another to buy stocks, because that’s quite frankly the business that it is then. Furthermore, keep in mind that the S&P 500 only has a handful of stocks that move it anymore, as it’s essentially an ETF of the top 7 to 10 companies by market cap. Always keep this in mind, and understand that bad news is actually good news because it has Wall Street looking for the Federal Reserve to loosen monetary policy.

Ready to trade our S&P 500 analysis? Here’s a list of some of the best CFD trading brokers to check out.