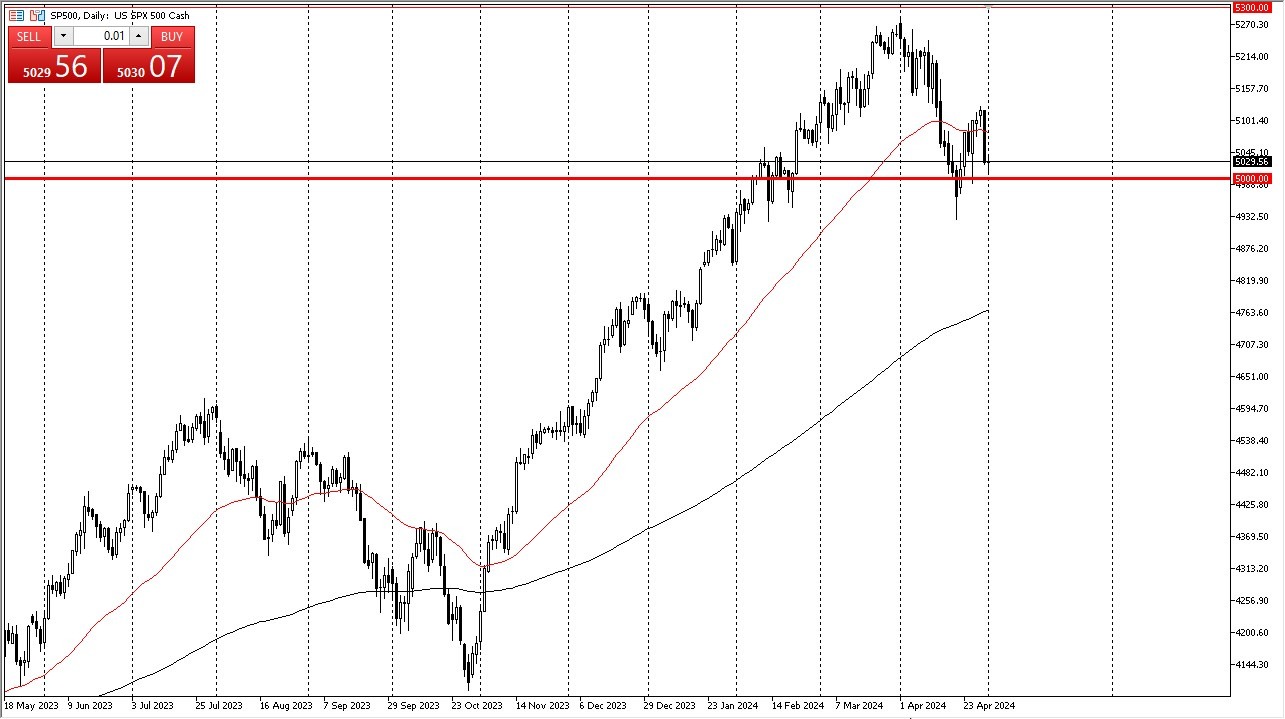

- The S&P 500 has been a little bit negative early in the session on Wednesday, which makes a certain amount of sense considering that the FOMC meeting is later in the day.

- That being said, it's probably worth noting that we are trying to defend the 5,000 level, and if we can keep that, it's likely that the market could bounce a bit, and take off to the upside.

- If we break down below here, the $4925 level comes into the picture for a potential support level as well.

In general, I think this is a market that is still very bullish, mainly due to the fact that the index isn't equally weighted. So, it's all a matter of a couple of particular stocks that people place their trades in the market.

Technical Analysis

Top Forex Brokers

The technical analysis is that the S&P 500 continues to be very bullish, and with that being said the pullback could end up being a nice buying opportunity. However, you also have to keep in mind that there is a lot of volatility during the Wednesday session so with that being the case, being very cautious will pay dividends over the longer term for what I can see.

Over the longer term, it wouldn't surprise me at all to see the S&P 500 go looking to the 5300 level above, but in general, I think this is a situation where each dip will more likely than not be thought of as a buying opportunity. Jerome Powell will be in focus during his press conference, so do pay close attention to that as market participants will be very interested in whether or not he sounds hawkish or dovish. You should recognize that it's the market's perception more than anything else that will come into the picture here either way. As a general rule I don't like shorting indices in the United States particularly because not only are they not equal weighted, but they also just tend to have more of an upward bias. I remain bullish, but I also recognize that a lot of caution will be needed right now.

Ready to trade our S&P 500 daily forecast? Here are the best CFD brokers to choose from.