- The S&P 500 rallied early during the trading session on Monday, as it looked like money was flowing back into Wall Street and stocks overall.

- This does make a certain amount of sense, because people are starting to celebrate the idea that the jobs report in the United States was fairly weak, and therefore we could possibly be seeing the potential scenario setting up that the Federal Reserve could actually cut rates.

After all, this is what Wall Street cheers. They cheer unemployment. This should bring down inflation and therefore stocks should perform a bit better as rates in America drop. Speaking of rates, you will have to pay close attention to the interest rate situation which has been falling, but certainly looks as if it could turn around at any moment. If rates start to spike in America, that could very well put downward pressure on stocks.

Top Forex Brokers

Not Equal-Weighted

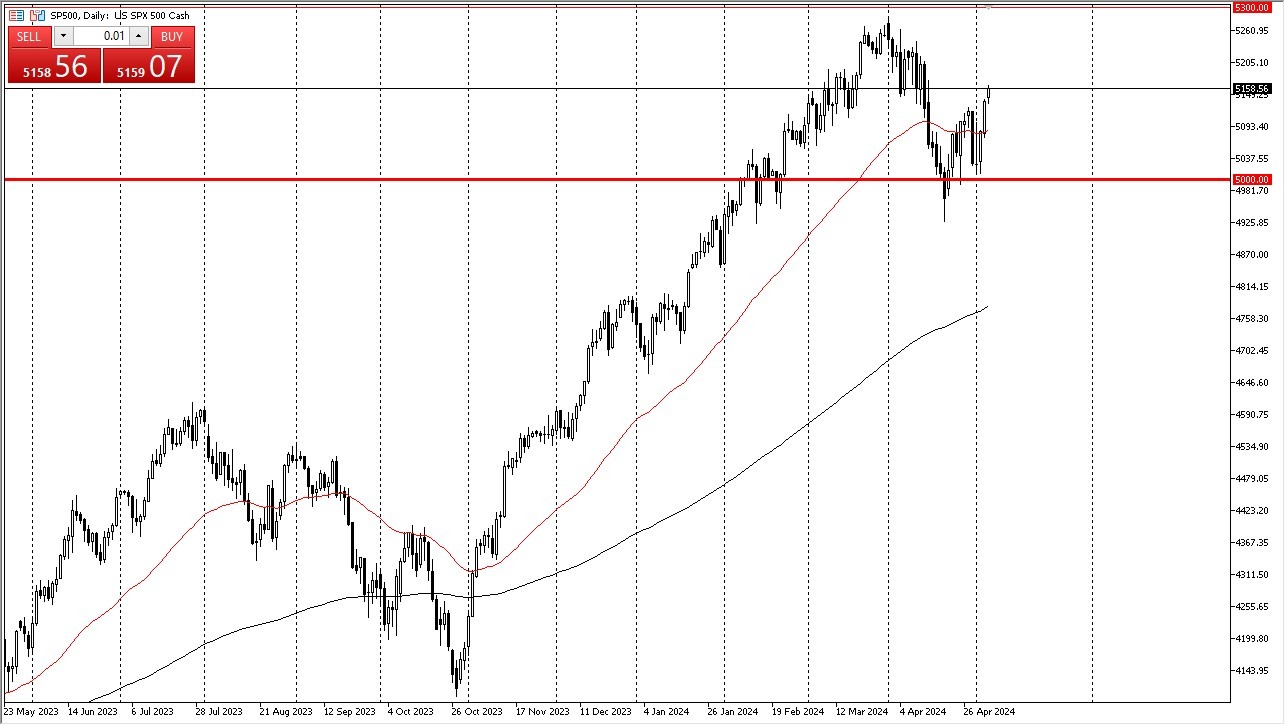

The S&P 500, of course, is not an equal weighted index. So, you have to keep that in mind. But I think ultimately as long as the top ten stocks or so are doing fairly well, you have a situation where the S&P 500 will rally. Underneath we have the 50 day EMA hanging around the 5090 level. And then underneath there we have the 5000 level which could be massive support as well, both from a structural and psychological standpoint.

It looks to me like the market is going to continue to be a buy on the dip scenario, and that we will eventually try to go looking toward the 5300 level, which is essentially where we topped out at recently. In general, this is an uptrend that had a nice correction of roughly 6 or 7%. And now those who are willing to follow the trend are starting to put money to work. That being said, you need to be very cautious about jumping in with both feet as there have been a lot of issues out there as of late, some of which have nothing to do with the stock market itself such as the geopolitical risks. Ultimately, I am bullish of this market, but I also recognize that there are a lot of exterior pressures out there that could come into the picture. Obviously, comma the fact that we are in the midst of earning season is a major issue as well.

Ready to trade the Forex S&P 500? We’ve made a list of the best online CFD trading brokers worth trading with.