- The US Dollar has continued to sell off slowly over recent hours, off the new lower resistance level at 105.28.

- The Euro and the British Pound are the strongest currencies today, suggesting the best opportunities might be long trades in either of these currency pairs.

- The US Dollar Index has several support and resistance levels close by, so its price action will likely be choppy today.

Top Forex Brokers

US Dollar Index (DXY): Technical Analysis

The US Dollar has been falling slowly since the start of this calendar month. This bearish movement has seen a new lower resistance level print at 105.28.

The short-term price action looks bearish. However, there is nearby support close by at 104.72 so it is not clear how much further the downwards movement will go. There is reason to expect anything will happen today to change that sentiment. Any movement today in the greenback is likely to be choppy.

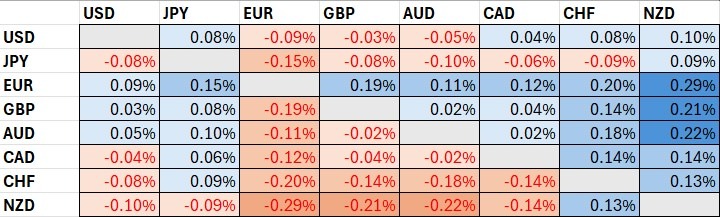

The table below shows that the Euro has been the strongest major currency so far today, while the New Zealand Dollar has been the weakest. The overall numbers are low though, suggesting this may not be significant.

US Dollar Index (DXY): Fundamental Analysis

The US Dollar has suffered from a feeling in recent days that the recent bullish run was overdone, as expectations for a rate hike shift to slightly sooner rather than later. According to the CME Fedwatch tool, the consensus forecast for the initial rate cut has shifted from the Fed’s November meeting to the September meeting.

Recent losses by the US Dollar have been expressed most strongly against the weak New Zealand Dollar, which has declined in recent hours against every major currency. This may have something to do with the fact that New Zealand Inflation Expectations data released earlier today showed a meaningful decline in the expected rate of inflation there.

Traders will probably be wise to look for trades in non-Dollar currency crosses, or short of the US Dollar in short-term day trades if the current weak selling of the greenback continues. Another alternative would be to trade another asset class, such as major US stock market indices which have been moving quite bullishly, suggesting trades on the long side might be a good opportunity.

USD/JPY Forecast: Technical Analysis

There seems to be a little residual weakness in the Japanese Yen, which declined notably last week. The price has been making a bullish consolidation above the support level at ¥155.28. There might be a chance to enter a long trade there in the USD/JPY currency pair, but the success of that would probably depend upon Yen weakness and not Dollar strength.

EUR/USD Forecast: Technical Analysis

The Euro has been the strongest major currency today. We are seeing a weakly bullish consolidation below $1.0800 and above $1.0758.

As the Euro is strong and the Dollar is showing some weakness, the best opportunity in the EUR/USD currency pair might be a long trade from a retracement to $1.0758 followed by a bullish bounce. However, I think this is unlikely to happen except maybe right at the end of today’s session.

GBP/USD Forecast: Technical Analysis

The British Pound is the second strongest major currency today, after the Euro, so a long trade will probably be preferable. The opportunity that really stands out in the price chart below for the GBP/USD currency pair is the level at $1.2538. The price action is quite tightly compressed by this resistance level, so a bullish breakout beyond it could be a great signal to enter a long trade, as the price would likely then rise to at least $1.2575.

I will enter a long trade here is we get two consecutive hourly closes above $1.2538 during today’s London session.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.