- The US Dollar has bounced back firmly since Tokyo opened today, after making a low at 103.67.

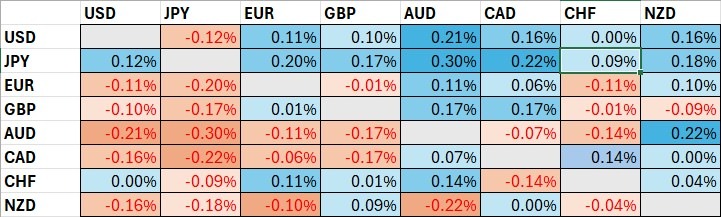

- The Yen the strongest currency so far today, followed by the US Dollar.

- The best opportunities which may set up are likely to be long trades in the EUR/USD or GBP/USD currency pairs.

Top Forex Brokers

US Dollar Index (DXY): Technical Analysis

The US Dollar has been falling for the past week. This bearish movement saw a new low printed a few hours ago at 103.68. Sine the Tokyo session got underway earlier today, the Dollar has rebounded from its losses, which were given a tailwind by lower than expected US CPI data released yesterday.

The short-term price action looks bullish. However, it has already bumped into probably resistance confluent with the round number at 104.00 which looks likely to be today’s pivotal point.

If the price can get established above 104.00, it is likely to rise further so that could facilitate a good long trade. Alternatively, if the price keeps rejecting the resistance at 104.00, it will likely turn bearish again and resume its earlier fall.

The table below shows that the Euro has been the strongest major currency so far today, while the New Zealand Dollar has been the weakest. The overall numbers are low though, suggesting this may not be significant.

US Dollar Index (DXY): Fundamental Analysis

Yesterday’s US CPI data came in slightly lower than expected. Although the headline annualized rate fell as expected from 3.5% to 3.4%, the month-on-month change was only 0.3%, while 0.4% was expected. According to the CME Fedwatch tool, the consensus forecast for the initial rate cut has increased in certainty that the first cut will be at the Fed’s November meeting, expected by about 70%.

Recent losses by the US Dollar have been expressed most strongly against the weak Australian and New Zealand Dollars, but I do not think there is anything of significance in that. We are just seeing a natural recovery price swing, so the most volatile currencies are just being the most volatile.

USD/JPY Forecast: Technical Analysis

The Japanese Yen is the strongest major currency, having gained today against every major currency. It is the only currency stronger than the US Dollar, which arguably makes the short term outlook for the USD/JPY currency pair bearish, but the success of that would probably depend upon Yen weakness and not Dollar strength.

The price is now trading above support, but is in a zone of likely resistance, so it may struggle to rise higher. If the price reverses bearishly off the resistance level at ¥155.05, a short trade entry could be a good idea, as the US Dollar Index is also struggling at resistance simultaneously.

Support Levels:

- ¥154.59

- ¥153.32

- ¥152.97

Resistance Levels:

- ¥155.05

- ¥156.25

- ¥157.00

EUR/USD Forecast: Technical Analysis

The Euro is showing mixed strength today. However, the technical situation shown within the price chart below certainly looks bullish, with the price having risen quite strongly before making a bearish retracement today. The price is now just sitting on resistance and looking quite likely to reject it, which could provide a great long trade entry signal if we get a good bounce. The long lower wicks of the recent hourly candlesticks are a good sign that this long trade looks likely to set up.

So the best opportunity in the EUR/USD currency pair might be a long trade from $1.0872 or even a few pips lower as its hard to place that horizontal level precisely.

Support Levels:

- $1.0872

- $1.0831

- $1.0821

Resistance Levels:

- $1.0920

GBP/USD Forecast: Technical Analysis

The British Pound is behaving very similarly to the Euro, so a long trade will probably be preferable. The opportunity that really stands out in the price chart below for the GBP/USD currency pair is the level at $1.2647. A bullish bounce here which also rejects the half number at $1.2650 could be a good opportunity for a long trade, especially if the US Dollar Index clears its resistance level at 104.00.

I will enter a long trade here if we get a bounce at $1.2647 during today’s London session. If the price gets established instead below that level, then the outlook would likely turn more towards a choppy consolidation.

Support Levels:

- $1.2647

- $1.2603

- $1.2592

Resistance Levels:

- $1.2710

- $1.2732

- $1.2759

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers for forex trading in the US worth trading with.

daily price chart.jpeg)