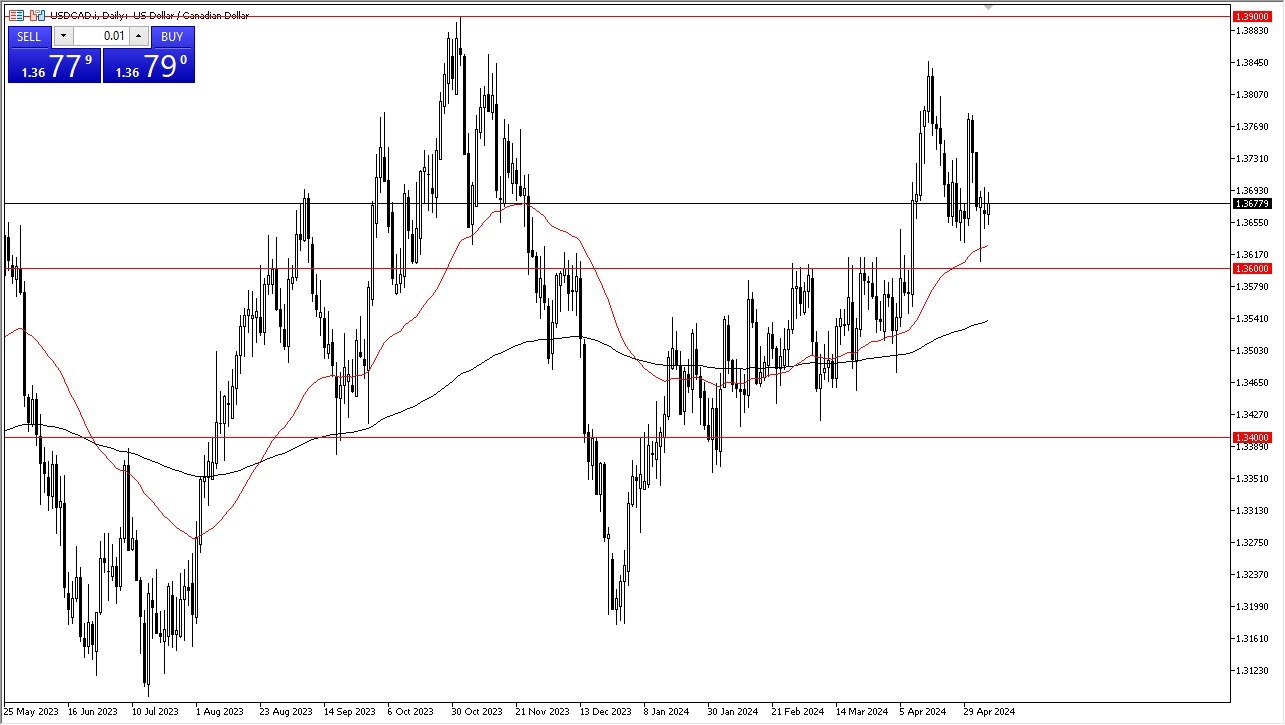

- The US dollar rallied slightly during the trading session on Tuesday, as we continue to try to find some type of basing pattern that we can use to go higher.

- The 50 day EMA sits underneath, and it could offer a significant amount of support.

- This is an indicator that a lot of people will use as an entry point in a longer-term trend, something that could certainly come into play at this point in time.

The 50 day EMA also sits just above the 1.36 level and therefore I think the 1.36 level is your floor in the market at the moment. That does make a lot of sense, considering that we had previously seen a lot of resistance in that area. So, I think it's a situation where market memory trumps all. The US dollar, of course, has had a bit of a bid due to the interest rate markets, and I think that continues to play in its favor, especially against the Canadian dollar due to the fact that the Canadian dollar represents an economy that's more likely than not going to have to cut rates much quicker than the United States.

Top Forex Brokers

The 1.38 level could be targeted, and then after that, the 1.39 level. Keep in mind that crude oil is traditionally thought of as having a massive influence on the Canadian dollar. And while that may be true against other currencies, it won't matter as much against the US dollar due to the fact that the US produces so much in the way of crude these days.

Remember this pair is often choppy

With that being said, I remain bullish, but I do recognize that it is going to be a bit of a noisy, choppy move. But that's normal for the US dollar against the Canadian dollar as the two economies are so intertwined. This pair does tend to trade quite a bit like other currencies that are so highly connected, like the euro and the pound, or the Australian dollar and the New Zealand dollar.

Ready to trade our daily Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.