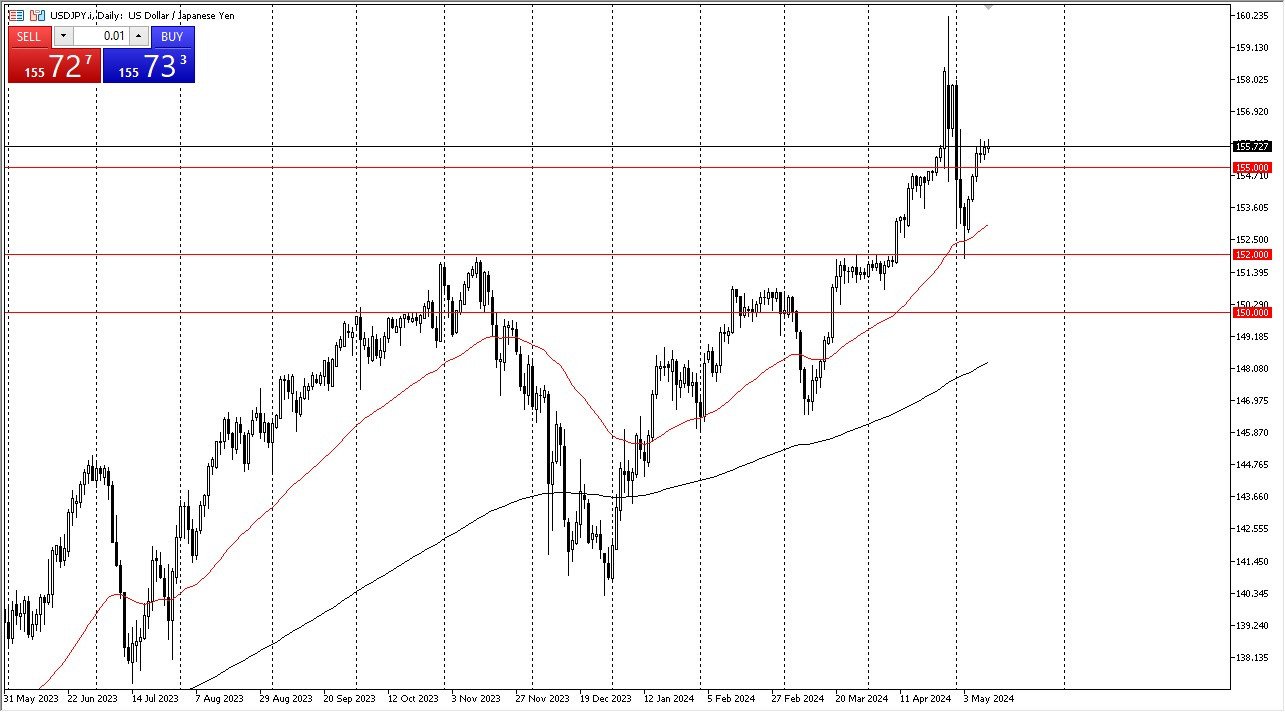

- The U.S. dollar has rallied slightly against the Japanese yen during the early hours on Monday, but I think at this point in time, we are trying to stabilize a little bit above the crucial 155 yen level.

- This is a market that I would have no interest in shorting, and I do think given enough time, we will see buyers step in every time it pulls back.

Keep in mind that recently the Bank of Japan intervened, but quite frankly, there's not a lot they can do with the setup being what it is. You have major issues with debt in Japan, and of course, with that being the situation, they can't afford massive interest rates, so therefore, it's likely that interest rates will continue to stay low because the higher the interest rate payment, the more burdensome this becomes, short-term pullbacks should be a buying opportunity with the 50-day EMA underneath offering support near the 153 yen level, and then perhaps even the 152 yen level comes into the picture as it was previous resistance.

Top Forex Brokers

Either way, keep in mind that the market pays you to hang on to the USD/JPY pair and therefore, it makes quite a bit of sense that buyers will continue to see buying opportunities based on the investment attitude of the market. At this point, the 160 yen level above is a massive barrier that's going to be difficult to get beyond, but if and when we do, that could open up the door to a huge move.

Is the Yen in Serious Long-Term Trouble?

We could be looking at 200 yen being targeted over the next several years, because quite frankly, there's not a lot the Japanese can do. Having said that the Federal Reserve will eventually cut rates so, it'll be interesting to see how that plays out. But right now, despite the intervention, there's only one way to trade the USD/JPY market and that is to get long of the dollar against the yen.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.