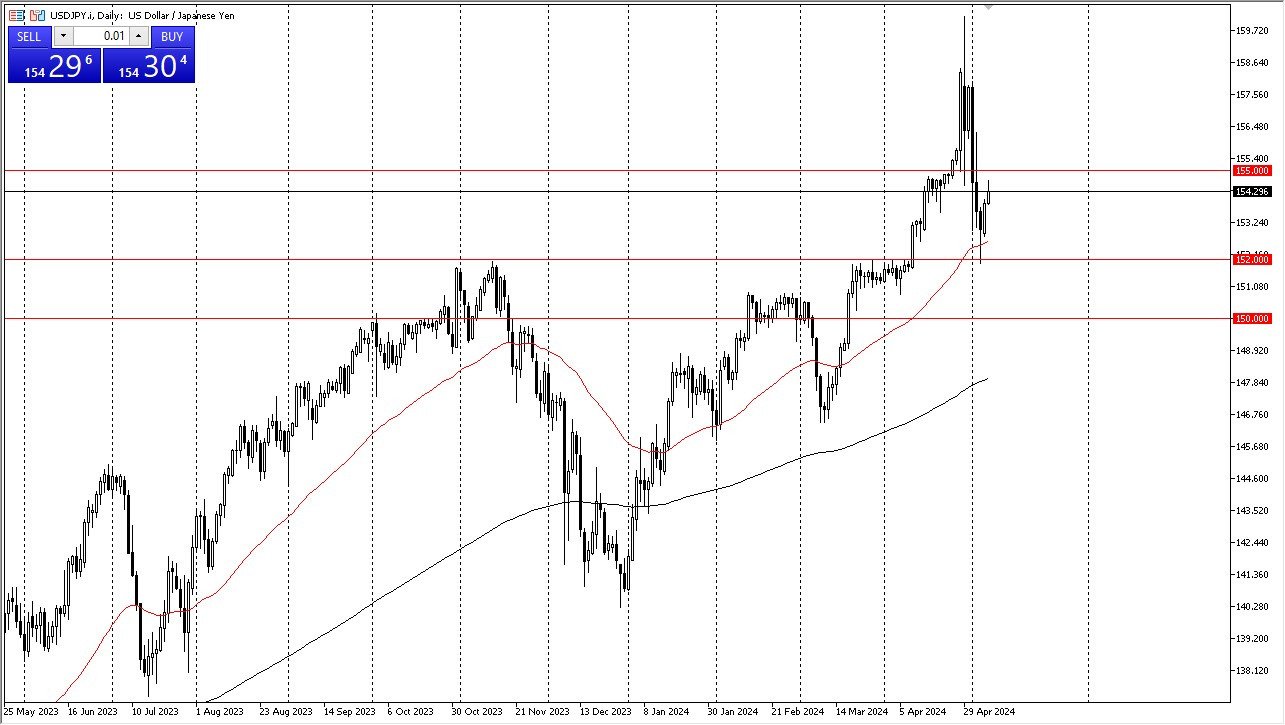

- The US dollar rallied a bit during the trading session on Tuesday but has run into a little bit of noise just below the ¥155 level.

- This is not a huge surprise: it's an area that's been resistant previously and of course is a large, round, psychologically significant figure.

- This is an area that I think will continue to be important to traders, if for now other reason that the options markets, and of course psychological influences.

So therefore, we could expect a bit of noise here anyway. It has been a nice bounce as of late, and I think we will continue to see the US dollar favored over the Japanese yen. But we have a lot of wall of worry type of trading ahead of us. After all, the central banks did intervene, specifically the Bank of Japan and therefore traders have gotten a little bit nervous. However, the easy trade is rarely the one that makes the most return, so this is something worth pondering.

Top Forex Brokers

Interest Rate Situation Matters

That being said, the interest rate differential will continue to favor the US dollar to such an extent that this market almost certainly has to go higher. I certainly would not want to short this market and pay for the privilege of doing so at the end of every day. It is not a market that has a trajectory going much lower than it already has.

I suspect that the absolute floor in the market is probably close to the ¥150 level, and reaching even that level would be a huge stretch. If we can clear the ¥155 level to the upside. I think at that point in time you have the next leg higher, perhaps running to the ¥157.50 level. After that, then we have the ¥160 level.

All things being equal, this is a market that continues to be very volatile and positive overall. I think you have to scale into a position you can't get over levered, but over the long term the bulls are certainly going to be the winners here. Nonetheless, I think this is going to be a very noisy market, but in the end, it is a situation where the interest rate differential is going to be far too much to ignore at this point.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.