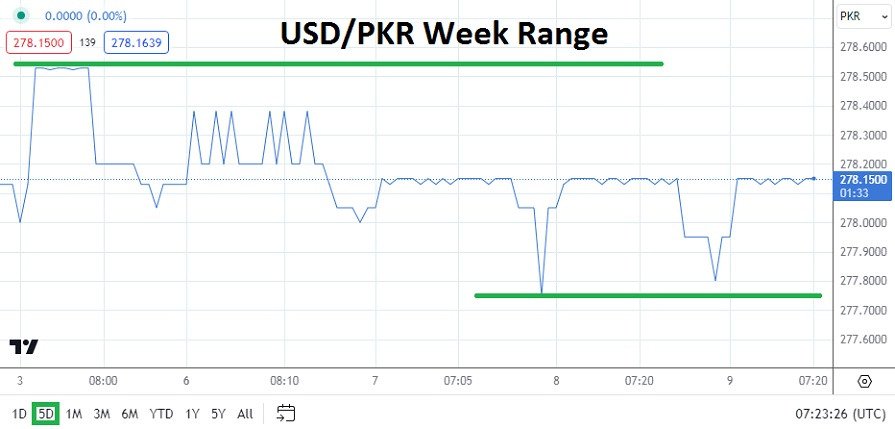

- The USD/PKR is near the 278.1500 ratio as of this writing.

- The currency pair has achieved a downwards turn over the past handful of days.

- A low of nearly 277.7500 was touched Tuesday.

If experienced traders didn’t know better, they might be tempted to look at technical charts and proclaim the USD/PKR is correlating to the broad Forex market. However, let’s not get ahead of ourselves because the currency pair remains within the heavy grasp of the Pakistan government which doesn’t allow for a free floating Pakistan Rupee.

A simple test of reality for speculative wagers on the USD/PKR pair needs to start with a question regarding the health of the Pakistan economy within the global sphere. Pakistan to be polite is not one of the world’s largest economies. The USD/PKR is not one of the heavily traded currency pairs for global financial institutions. Yet the USD/PKR has remained extremely stable and is essentially trading near a value it traversed on the 22nd of March with reversals higher and lower having been displayed.

USD/PK Consists of Eye Candy and Artificial Sweeteners

The price action of the USD/PKR over the past three and six months makes it one of the most stable currency pairs in the world. In fact the ability of the USD/PKR to incrementally trade lower and be able to sustain its lower mid-term depths is remarkable. However traders need to accept the official rate of the USD/PKR is dictated by the Pakistan government, and if the currency pair were allowed to freely float it is likely the value would be in a much higher range, which would then correlate to the global Forex market.

When the USD/PKR climbed slight upwards going into last week and was testing and then bouncing around a high of 278.5310 ratios, it looked as if the currency pair was being allowed to follow the broad Forex market for a moment. Then on Friday of last week when the U.S jobs numbers came in weaker than expected, the USD/PKR dropped to around the 278.0500 level. Again, this value was per the listed rate that financial institutions had to deal with while making official transactions, and it too correlated rather nicely.

Top Forex Brokers

Speculation on the USD/PKR

Traders can certainly wager on the USD/PKR, but they have to understand the currency pair is being manipulated by the Pakistan government. As a reader you are free to believe what you want and if your perspective is that the USD/PKR is indeed one of the strongest currency pairs in the world be my guest.

· However, for those that simply want to trade the USD/PKR they should look at technical charts and try to guess what the Pakistani government will do as it reacts to domestic needs and the global financial landscape.

· Traders are warned to take into consideration timeframes, transaction costs and tactical entry orders while trying to wager on the USD/PKR.

· The incremental lows are enticing, but questioning the reality of the values seen remains perplexing from a speculative view. Good luck.

Pakistani Rupee Short Term Outlook:

Current Resistance: 278.2000

Current Support: 278.1275

High Target: 278.2480

Low Target: 278.0025

Ready to trade our Forex daily analysis and predictions? Here are the best Pakistan trading brokers to choose from.