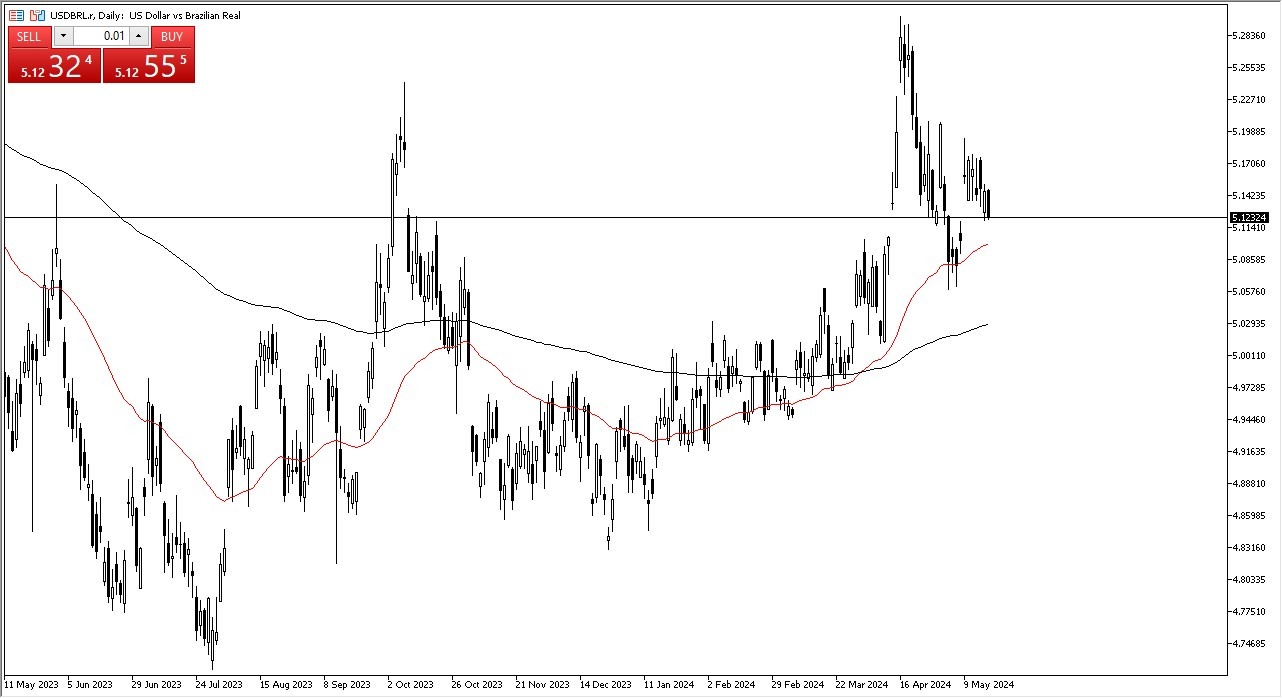

- The US dollar has pulled back just a bit during the trading session on Friday against the Brazilian real, as traders continue to try to price in the any DNA of whether or not risk appetite is going to be “on”, or “off.”

- It’s also worth noting that the interest rate differential does favor the Brazilian real, but with so many issues out there and around the world, it does make a certain amount of sense that is ill may suffer at the hands of fear.

Technical Analysis

The US dollar pulling back the way it has means that we could very well go looking to the 50-Day EMA. The 50-Day EMA of course hangs around the 5.10 level, which is an area that previously has seen both support and resistance. The recent pullback hasn’t exactly been aggressive, so I do think that sooner or later buyers will probably come in to try to pick up the greenback. After all, the Federal Reserve is likely to keep their interest rates tighter for longer, and although it doesn’t favor as far a swap is concerned, that does put upward pressure on this market.

Top Forex Brokers

Ultimately, it comes down to the broker that you use because I know a lot of brokers recently have been putting negative swap in the place of what should be positive. However, you need to keep in mind that institutional trading doesn’t act like that. Quite frankly, institutional traders would just simply take their massive amounts of business somewhere else if a broker treats them this way. Most retail brokers have a very bad habit of keeping the swap for themselves, or perhaps more simply put, not paying for swap that could very well be a major influence. It is because of this that you always need to pay attention to that factor, especially when it comes to exotic currency such as the Brazilian real, South African rand, Mexican peso, etc.

As things stand right now, I suspect that we will eventually get a little bit of a bounce just below, and if we do that, I think it’s a buying opportunity. As far as selling is concerned, I would need to see the market breakdown below the 5.00 level to get aggressive about it.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.