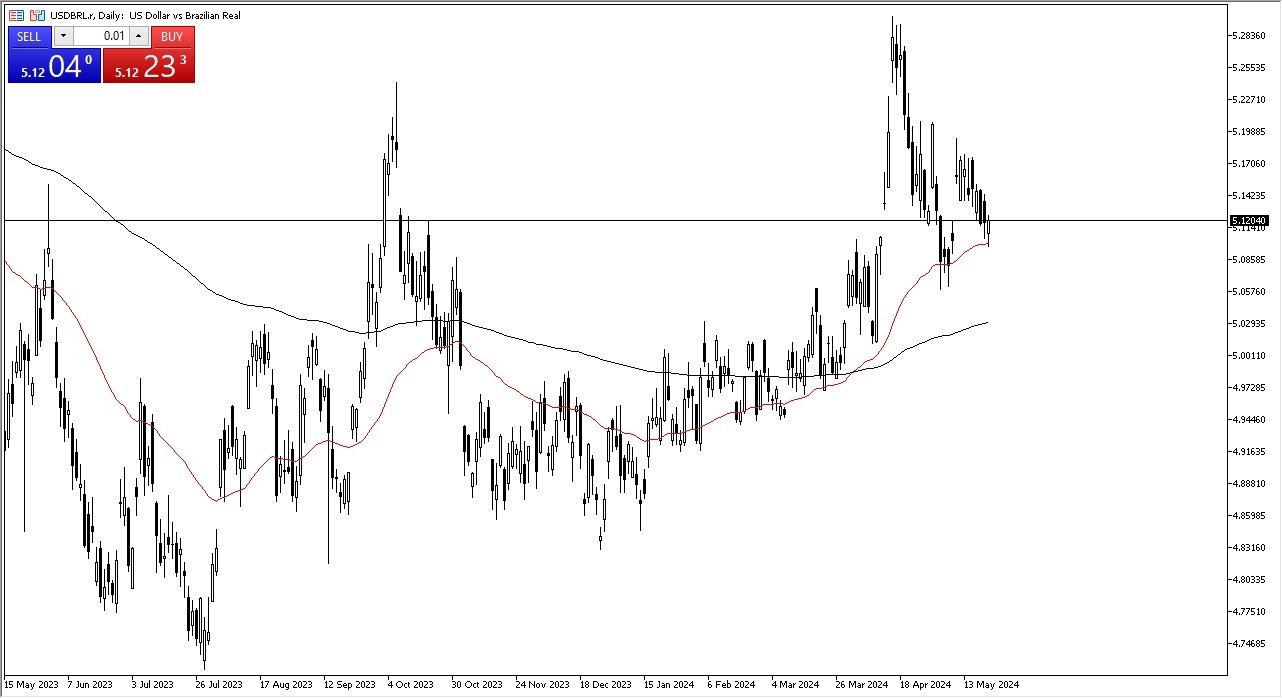

Potential signal:

I am a buyer of this pair at the 5.14 level, with the stop loss tucked just below the 50-Day EMA below. I would aim for the 5.22 region in the short term.

- The US dollar has initially fell during the trading session on Tuesday to test the crucial 50-Day EMA.

- This is an indicator that of course is very important, as a lot of traders will use it as dynamic support.

- In fact, when you look at the 50-Day EMA, it has acted as an uptrend line for some time now.

- Furthermore, it’s also worth noting that we have been in an uptrend for a while, and I think that continues to be a major factor here.

Top Forex Brokers

Even though the Brazilian real has more interest rate help, the reality is that the US dollar is in short supply for a lot of debt around the world, and of course with the Federal Reserve being relatively tight from a historical span, it does make a certain amount of sense that the US dollar continues attract a lot of attention. Furthermore, there are a lot of geopolitical issues around the world that could continue to keep the US dollar healthy and therefore favored against the emerging market currency such as the Brazilian real.

Technical Analysis

The technical analysis for this pair is most certainly bullish as the 50-Day EMA is not only important, but it has been extraordinarily reliable. If we can break above the 5.14 level, it’s very likely that we could go looking to the 5.28 level which was where we had reached previously. Short-term pullbacks at this point in time should continue to be buying opportunities, as the US dollar of course is one of the favorite currencies around the world. Underneath all of that noise we also have the 200-Day EMA, which is near the 5.02 level.

I do recognize that there is a lot of noise above and it will probably be difficult to hang on to this trade to the upside, but over the longer term, I do believe that the US dollar continues to be more desirable than South American currencies. At this point in time, I think that the buyers still have the upper hand in the short term.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.