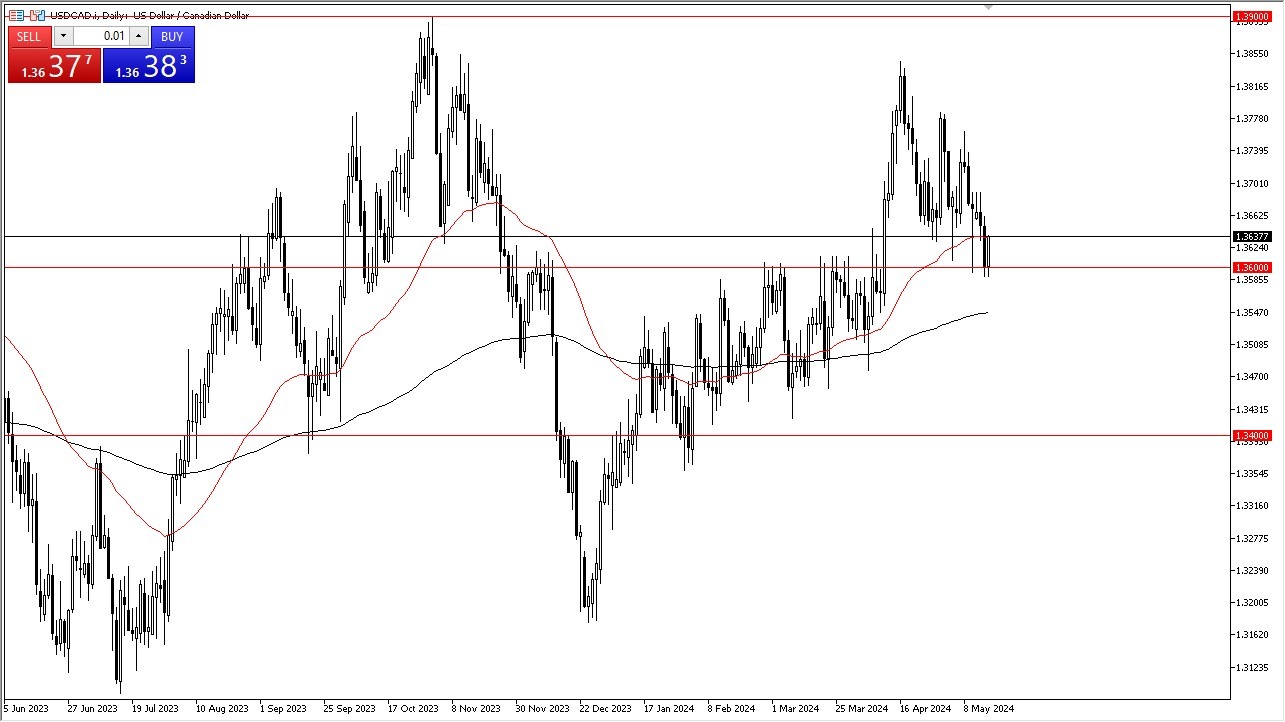

- The US dollar rallied a bit during the trading session on Thursday, as the 1.36 level has offered a significant amount of support and resistance over the last several months.

- The fact that we have bounced from there does suggest that we will more likely than not continue to see the overall uptrend trying to reassert itself.

- This could be particularly telling due to the fact that inflation in the United States remain sticky and the Federal Reserve certainly has its part to play in this equation. However, looking at the charts we can see that there are several levels worth paying attention to.

It's worth noting that the 50 day EMA sits just above the candlestick right now, and if we can break above there, it probably has technical traders looking to get involved. A move above the 50 day EMA then opens up the next big figure at 1.37, which getting beyond that then could have the market looking at the 1.39 level over the longer term.

Top Forex Brokers

Crude Oil Influence? Maybe Not.

Keep in mind the crude oil does have a certain influence on the Canadian dollar, but it may not be as strong in the pair against the US dollar due to the fact that the United States produces so much in the way of crude oil. Now, regardless, this looks like a huge breakout, pullback retest and potential continuation move, and that's something that needs to be paid close attention to.

With that being said, I like the idea of buying this pair, and I think that eventually it does go higher. If we were to break down below the 1.36 level, then the 200 day EMA underneath could be a bit of a support barrier. But in general, I like the look of this market. I do think that it goes higher, especially considering that the Federal Reserve is almost certainly going to be higher for longer, especially in comparison to the Bank of Canada.

Ready to trade our Forex daily analysis and predictions? Check out the best currency exchange broker Canada for you