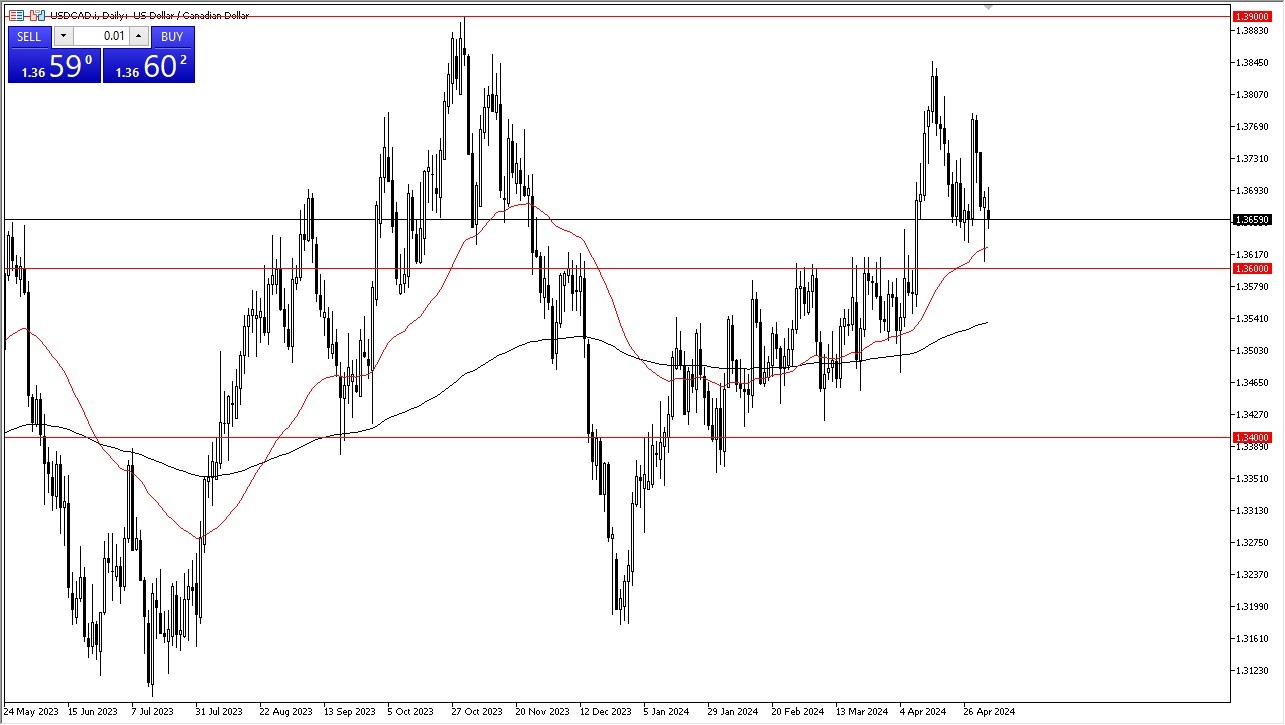

- The U.S. dollar has been choppy against the Canadian dollar during early trading on Monday.

- The market has been very choppy in this overall vicinity, and it's probably worth noting that the 1.36 level underneath is massive support.

- After all, it's an area that previously had seen a lot of resistance, so it does make a certain amount of sense that market memory comes into play here.

We ended up forming a hammer on Friday. And that, of course, is crucial as it is a very important technical signal of support. We also have the 50 day EMA sitting just above the aforementioned 1.36 level. So I think it's likely that this is an area that continues to attract a certain amount of buying. All of that being said, it's likely that the market will continue to be noisy.

Top Forex Brokers

But ultimately, I do think that it tries to rally from here. If we can break above the 1.37 level, then the US dollar will almost certainly go looking to reach the 1.3850 level, possibly even the 1.39 level after that, which has been a major swing high a couple of times in the past. Keep in mind that these pair of currencies tend to be very choppy against each other, due to the fact that there's so much in the way of cross border trade between the two economies.

Ignore the “Crude Oil Correlation” Here

The Canadian dollar, of course, is highly sensitive to crude oil, but won't necessarily show that in this pair as aggressively due to the fact that the United States does produce quite a bit of its own oil. Now. That being said, if we were to break down from here, I would anticipate that the 200 day EMA could come into the picture offering support, followed by the 1.34 level.

As things stand right now. I remain fairly bullish on this pair, but I also recognize that the upside is probably somewhat limited and of course, it's probably going to be more of a grind higher than some type of shot higher, which of course takes a certain amount of patience to deal with.

Ready to trade our Forex daily analysis and predictions? Here's a list of the best Forex Trading platform in Canada to choose from.