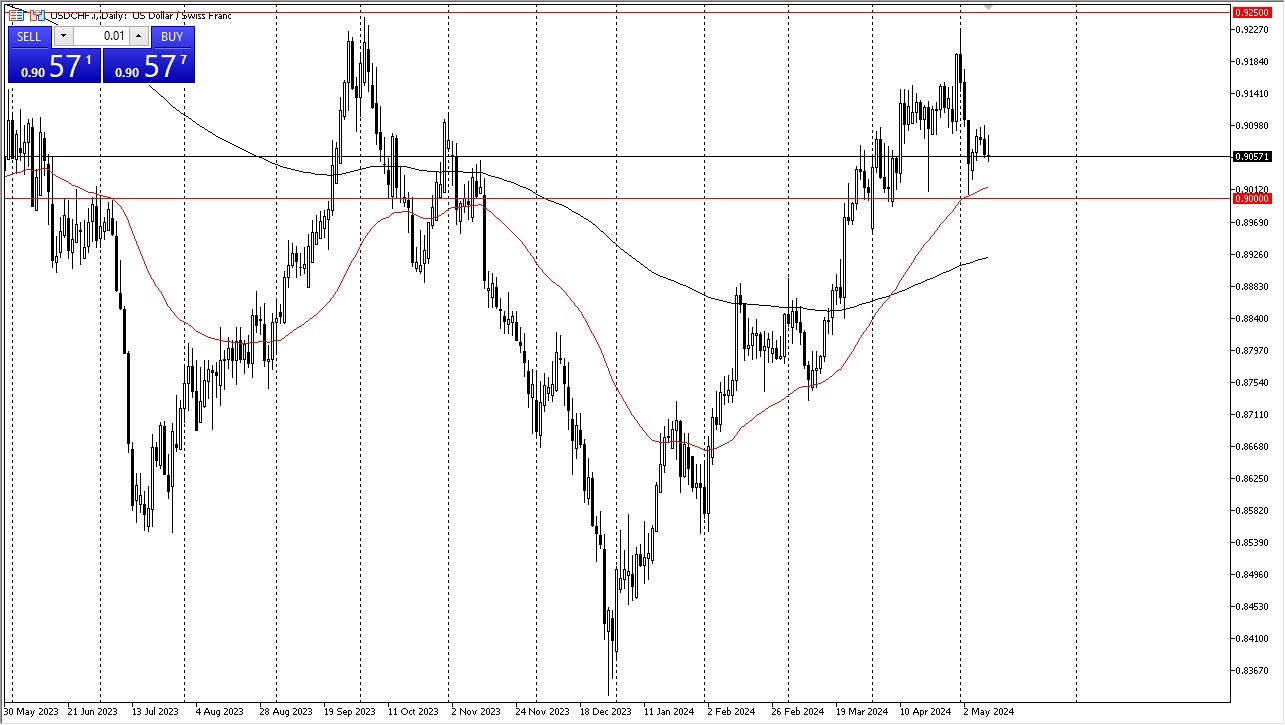

- The US dollar initially rallied against the Swiss franc during the trading session on Friday but gave back gains to show signs of hesitation.

- That being said, the market looks as if we are going to continue to see a lot of noise in this area, and it certainly makes quite a bit of sense that the 50-Day EMA should come into the picture to offer technical support, right along with the crucial 0.90 level.

- With all that being said, I do think that it’s interesting for traders to be seeing this area, because it could set up for something a little bit bigger.

On the other hand, if we can break above the 0.91 level, then we could send this market looking to the 0.9250 level. This is an area that was the top of the larger consolidation area, and if we were to break above that level, we could see this market go much higher, perhaps as high as 0.95 over the next several months.

Top Forex Brokers

In general, this is a scenario that I think favors the US dollar, but it’s worth noting that the Friday session did have a little bit of volatility due to a disappointing economic announcement in the form of the University of Michigan Consumer Sentiment numbers missing the mark. Because of this, it would suggest that the market is worried about the US economy, and perhaps if the consumer starts to slow down its spending, it could have drastic effects on the Federal Reserve rate decisions going forward.

Swiss National Bank

Keep in mind that the Swiss National Bank has already cut rates, so I think at this point in time it is probably more likely than not that we will find buyers underneath to start going long again. After all, you do get paid to hang on to this pair, and that’s not going to change anytime soon. Yes, interest rates drop a little bit every time we get the idea that the US economy is slowing down, but given enough time, I think that the market will eventually go looking to break above the 0.9250 level.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.