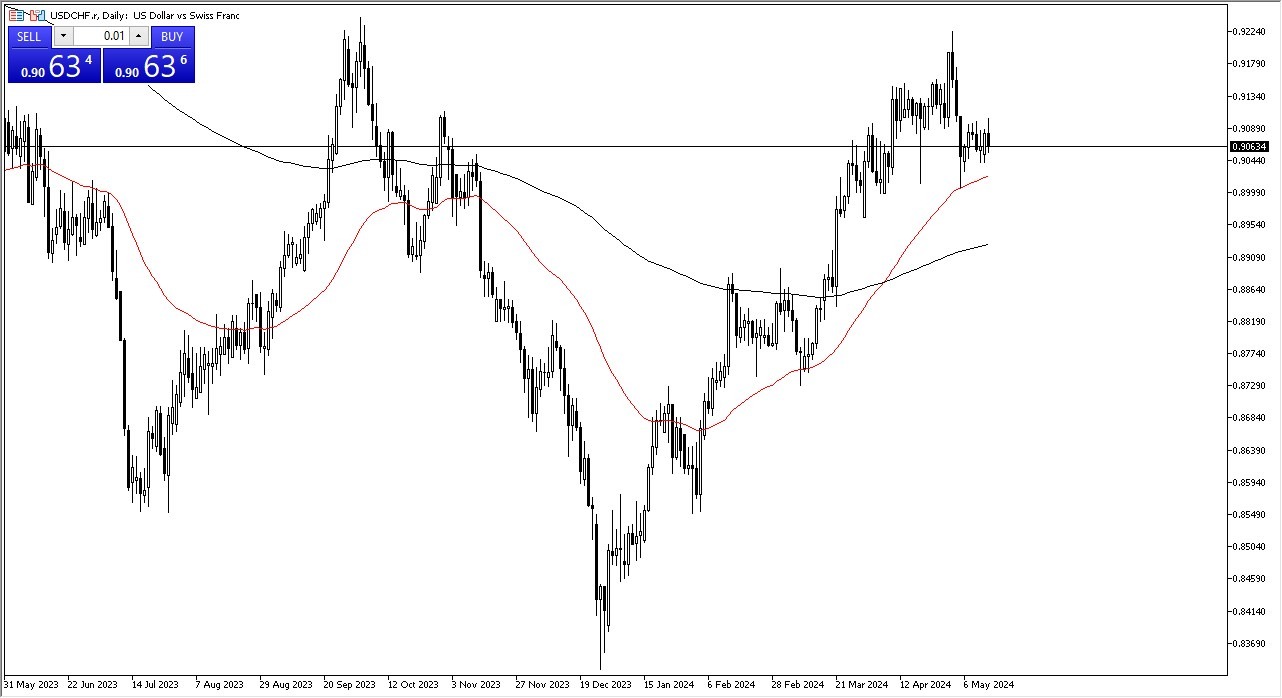

- The US dollar initially rallied against the Swiss franc during the trading session on Tuesday but pulled back as the 0.91 level has offered a bit of a short-term barrier.

- That being said, there is also support underneath that could come into the picture, with the 50-Day EMA coming into the picture as massive support.

- The 0.90 level is an area that I think a lot of people will come into the picture to try to lift the market.

However, despite the fact that the US dollar has been very strong against most other currencies, it seems like the Swiss franc is putting up a much bigger fight. This is interesting, because the Swiss National Bank recently cut rates, and the Federal Reserve continues to look like it is going to remain very tight seeable future. Based on interest rate differential, this pair should eventually break out, and I have been buying this market in order to take advantage of the daily swap. However, this is also a market that has been stubbornly resisted, and therefore I think you get a situation where you are going to have to be very cautious with your position size and recognize that this is a market that you need to be very patient with as it is more or less an investment rather than a trade.

Top Forex Brokers

Swiss Franc Funding Currency

The Swiss franc is a funding currency worldwide, and therefore I think it is likely that we will continue to see the US dollar eventually rally against it, but I also pay close attention to this pair due to the fact that I have also been trading other pairs like the GBP/CHF pair, the NZD/CHF pair, etc. In general, this is a market that I think continues to see a lot of volatility and choppiness, but eventually if we can break out to the upside, we could see the Swiss franc it absolutely hammered, which I think eventually happens over the longer term, unless of course some type of financial crisis starts again, something that it is very much still a real possibility. As things stand now, I like the idea of buying short-term dips in this pair.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.