- The US dollar initially tried to rally against the Indian rupee but has given back quite a bit of the gains to turn slightly negative as New York came online.

- Ultimately, this is a market that is hanging around and trying to determine whether or not it can continue its overall upward momentum that it had seen in the early part of March.

All things being equal, this is a market that I think continues to look as a “buy on the dips” type of scenario, as the US dollar course will flourish when there are a lot of concerns. The Indian rupee is an emerging market currency, so therefore it needs to see more of a “risk on attitude” around the world. Furthermore, this is a market that I think does tend to be very noisy overall, and as the Indian central bank is highly influential in this pair, that means that volatility is quite often dampened.

Top Forex Brokers

Technical Analysis

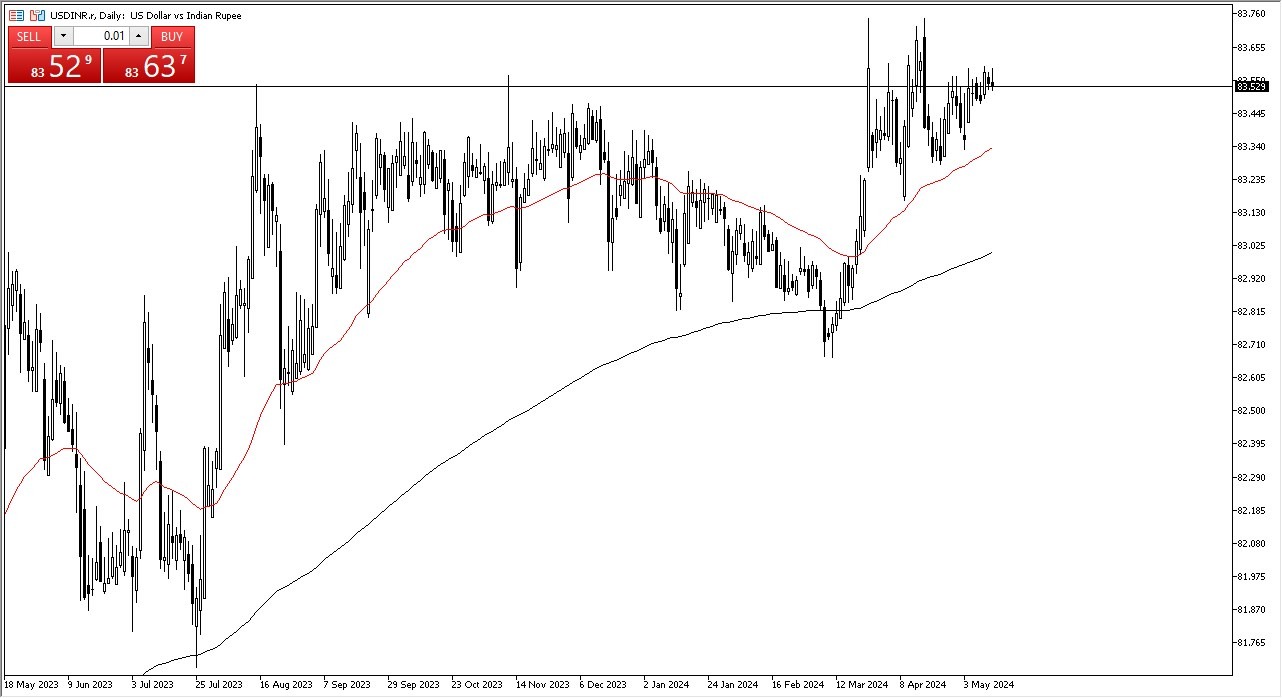

Looking at the technical analysis, it does appear that the market is going to continue to be somewhat bullish overall, but I also recognize that it is a situation where the chop will continue to be a major feature here. The 50-Day EMA sits right around the ₹83.30 level, and therefore I think it does offer a little bit of a support level that people will be paying close attention to, therefore I think you got a situation where it offers similar behavior to an uptrend line.

In general, it’s not until we break down below the ₹83 level that I would consider shorting this market, something that doesn’t look very likely in the short term. On the upside, if we can break above the ₹83.77 level, then I think you have got a real opportunity for the market to break out to the upside and go looking to the ₹85 level before it’s all said and done. Keep in mind that this pair does tend to be very choppy and slow, so with that I think you got to be very cautious about becoming aggressive, but it certainly looks as if the trend to the upside could still be intact.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in India to check out.