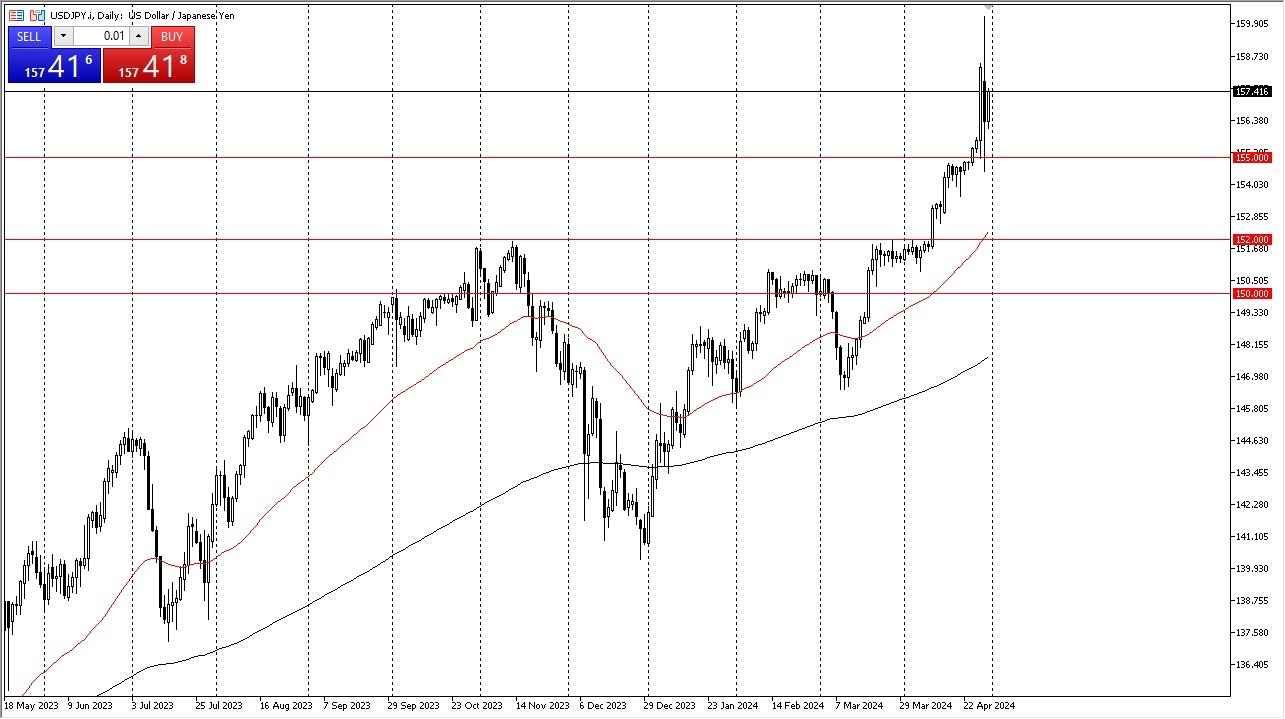

- The US dollar has rallied a bit during the early hours on Tuesday as we continue to see a lot of noisy behavior.

- But ultimately this is a market that I think you have to pay close attention to in the sense that there has been whispers of intervention on Monday by the Japanese regardless, unless they change their monetary policy.

That's a losing proposition and at best can only slow down the depreciation of the Japanese currency. Underneath we have the ¥155 level that, more likely than not, will offer a bit of a floor, as we had seen during the suspected intervention by the central bank in Tokyo. And therefore, it is an area where there should be plenty of buyers willing to get involved.

Buying on the Dip Going Forward

Top Forex Brokers

That being said, I think you continue to look at this market through the prism of buying on the dip because this long term trend has nothing to stop it as longer term you get paid to hang on to this USD/JPY pair. And that's exactly what's pushed this thing so high at this point in time. It would not surprise me at all to see the US dollar trade out of the ¥160 level sometime soon, but that doesn't necessarily mean that it will be straight up in the air from here.

I have no interest in selling this pair, and although there will probably be some volatility around the FOMC meeting, I think any pullback is more likely than not going to offer an opportunity that longer term traders will be more than willing to jump in and take advantage of. Even if we were to break down below ¥155. There's an even harder floor down at the ¥152 level. With that being said, I remain very bullish on this market, and anything traded against the Japanese yen. I am long several different “XXX/JPY” pairs at the moment and continue to collect swap at the end of each day.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.