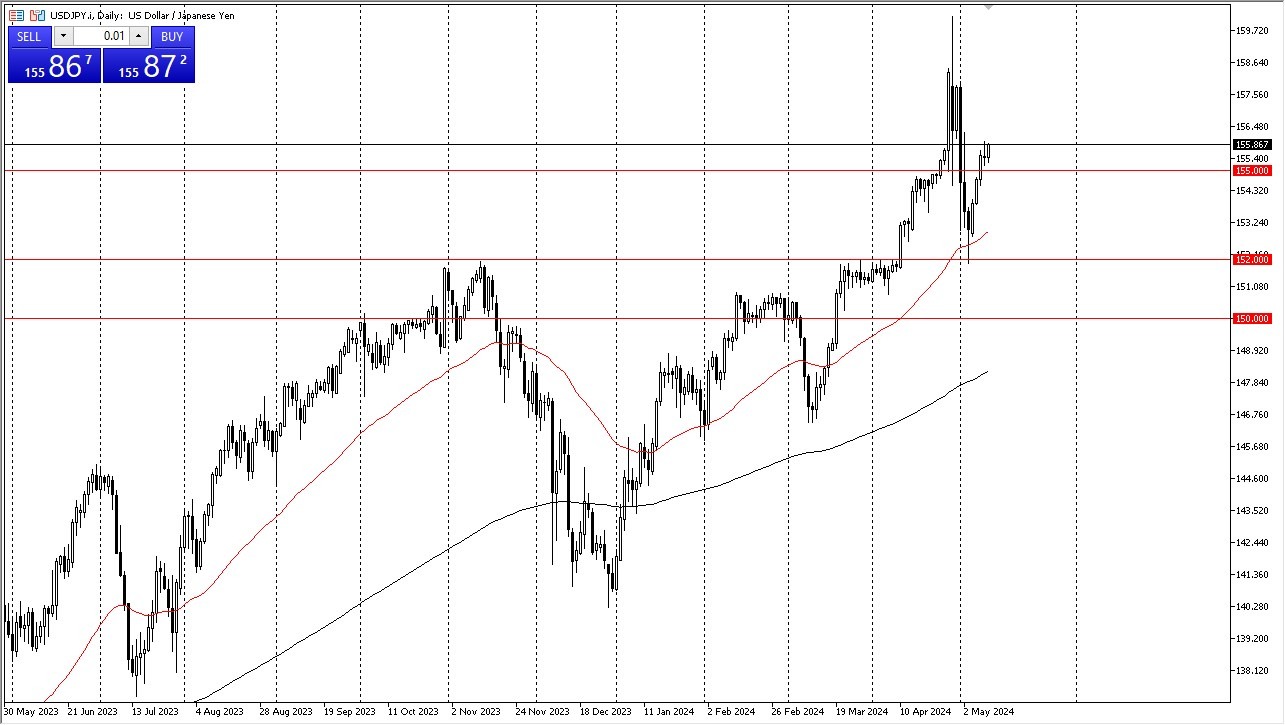

- The US dollar initially pulled back just a bit during the trading session on Friday, only to turn around and show signs of strength.

- The shooting star from the Thursday candlestick of course is a very negative turn of events and if we were to break above the top of that shooting star, then it allows the US dollar to go much higher.

- Ultimately, I assume this is a “one way trade” just waiting to happen, despite the fact that we had been so bullish getting to this level.

At this point in time, the 158 yen level above could be a target, but I think it's going to take a certain amount of momentum to make that happen. In general, I am a buy on the dip type of trader here, and I think that the 155 yen level is going to be a short-term support level. If we break down below there, then we have a move down to the 50-day EMA possible, or even the 152 yen level which of course is an area that previously had been major resistance. In fact, that's the top of the previous ascending triangle that we broke out of then plunged towards as the Bank of Japan got into the markets. Yes, the Bank of Japan could intervene, but the reality is there's only so much they can do at this point in time to change the overall trend.

Top Forex Brokers

Interest Rates Continue to Matter

The interest rate differential will continue to favor the greenback, so therefore, USD/JPY is a market that will more likely than not offer the possibility of going to the 160 yen level, given enough time, and eventually higher than that. I just don't see how the trend changes anytime soon, and at this point, it's very likely that the Federal Reserve will continue to stay higher for longer as far as interest rates are concerned, and the interest rate differential will continue to get you paid at the end of the day if you are long of this market.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.