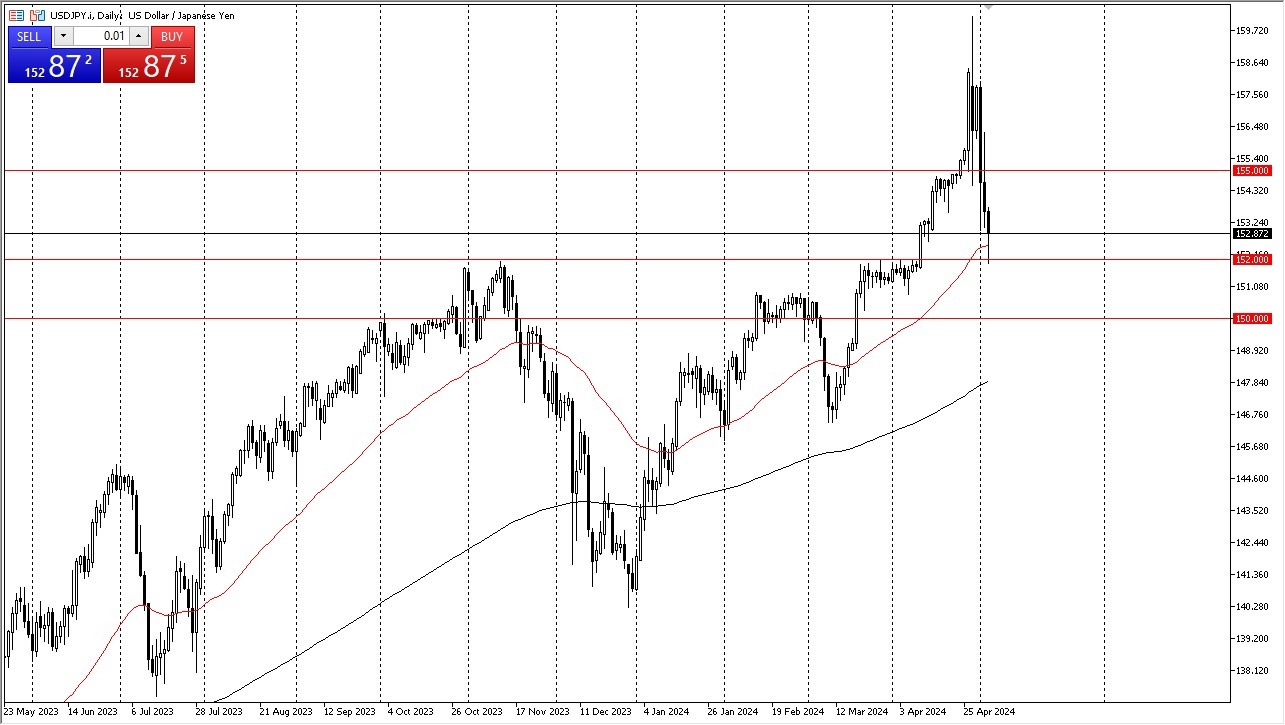

- The US dollar has fallen rather significantly during the course of the trading session on Friday as we continue to see a massive correction.

- However, it is worth noting that we have bounced rather hard from the 152 yen level, an area that previously had been significant resistance.

I do think that there are a lot of buyers in this general vicinity, despite the fact that the Bank of Japan has done everything it can to drive the value of the yen back up. Ultimately, we are testing the top of the previous ascending triangle, and this is classic technical analysis. If we do in fact turn around and start rallying, this would be a perfect entry point.

Top Forex Brokers

Support Below

If we break down below the 152 yen level, then we could see the market try to get down to the 150 yen level, but ultimately, that would be very difficult to break through below. So, I think generally what you're looking for is the USD/JPY market to bounce a bit and then to follow. The Bank of Japan cannot raise rates and they can only intervene for so long. Ultimately, the Federal Reserve, even though they got pretty bad jobs numbers in so far as they weren't anywhere near expectations. It might be a one-off, and if that's the case, it doesn't change the Federal Reserve's trajectory, and you will still get paid to short the Japanese yen. It's been a very tough week for those who have been long of this market. I am very sympathetic to that, as I have seen quite a bit of back and forth in my own portfolio, but at the end of the day, the trend has not changed in the slightest.

So therefore, I think you've got a situation where you have to look at this through the prism of a market that you are buying dips, but you want to see momentum work in your favor before you put actual money to work.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.