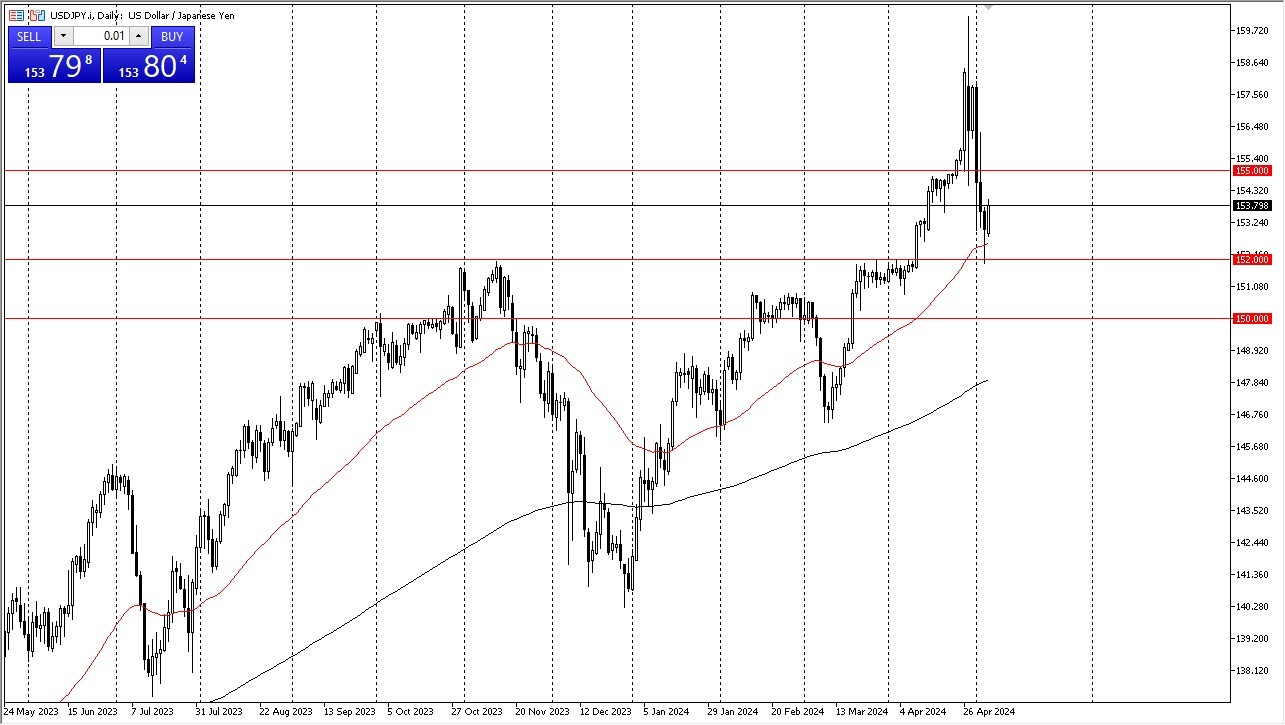

- The dollar yen has recovered quite nicely during the Monday session, and we did start to see US dollar buying late on Friday as we approached the crucial 152 yen level.

- We are now almost 200 pips above there, and it certainly looks as if traders are willing to take on the central banks.

- There was an intervention last week, and that sent the US dollar plummeting against the yen.

Bank of Japan Can Only Do So Much

Top Forex Brokers

But the reality is the only thing that the Bank of Japan can do is slow down the trend, not reverse it. The only way that they can reverse the trend is to either have the Federal Reserve cut rates, which they aren't going to do, or to raise rates themselves, which they can't do. Japan has far too much in the way of debt to do that, so therefore I think you've got a situation where sooner or later this pair goes higher, and by higher, I mean much higher. Longer term it would not surprise me at all to see the US dollar trading at 175 yen. Stretching out even further we could be talking about 200 yen before it is all said and done. The Japanese debt situation is that dire.

The Alternate Scenario is Still Possible

That being said markets can do anything and everything and just when you think everything is crystal clear they do tend to turn around so that's something worth thinking about. If the market were to drop down below the 152 yen level again, we could target the 150 yen level. Anything below the 150 yen level has me concerned about the overall trend. USD/JPY is a market that desperately needed the massive pullback that we had seen during the course of the week. And with that being the case, the 5.5% drop or so, ends up being a value proposition. Trends don't run in one direction forever, and I think a lot of traders forgot about that.

Ready to trade our daily Forex forecast? Here’s a list of some of the best online forex trading platforms to check out.