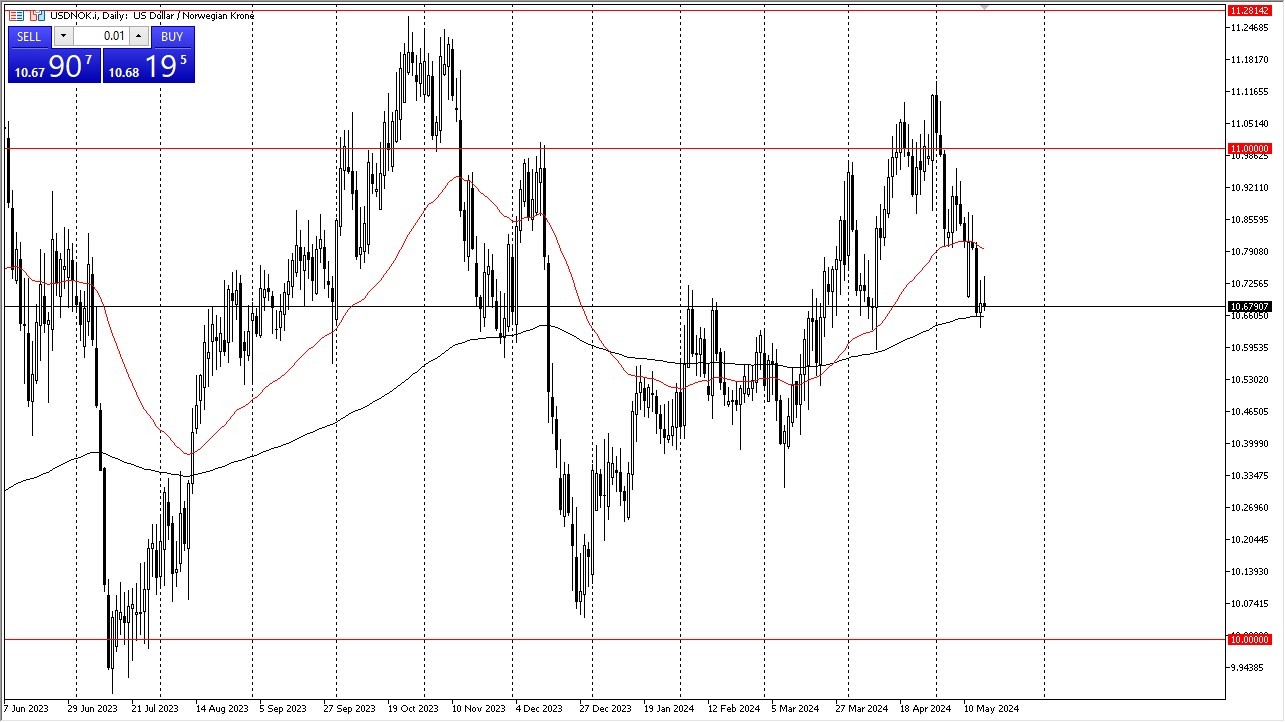

- The US dollar initially rallied against the Norwegian krone during the trading session on Friday, but just as we have seen during the previous session on Thursday, the buyers were squashed, and we ended up turning around to form a bit of an inverted hammer.

- This of course is a fairly negative turn of events, and the fact that the market is done this to days in a row is of course a very negative turn of events.

The Technical Analysis

The technical analysis in this market is quite interesting, as we ended up forming a bit of a significant inverted hammer, especially the fact that we have done it 2 days in row. We are sitting on top of the 200-Day EMA indicator, which of course is very important. This is an indicator that a lot of people will be paying close attention to, as it can quite often determine the overall long-term trend.

Top Forex Brokers

That being said, if we were to break above both of these inverted hammers, then it opens up the possibility of a move to the 10.80 level, possibly even as high as 11 NOK. That’s an area that we have seen a lot of resistance at previously, so to be interesting to see if we go there. On the other hand, if we were to break down to the downside, then the market could go down to the 10.50 NOK level, possibly even lower than that.

Looking at the Norwegian krone it’s important to realize that the interest rate differential between the NOK and the USD is minuscule in comparison to what things have been in the past, and it’s also important to recognize that although the Norwegian economy is highly sensitive to crude oil, the currency pair that we are dealing with here features to petrocurrencies, as the United States is a major driller for crude oil now as well. Because of this, it is a little bit different to what it once was, but at the end of the day oil can have a slight influence.

Not sure which broker to choose? We've made a list of the best forex brokers for you.