The USD/PKR remains in a very tight official rate range as the currency pair moves according to the pronouncements from the State Bank of Pakistan.

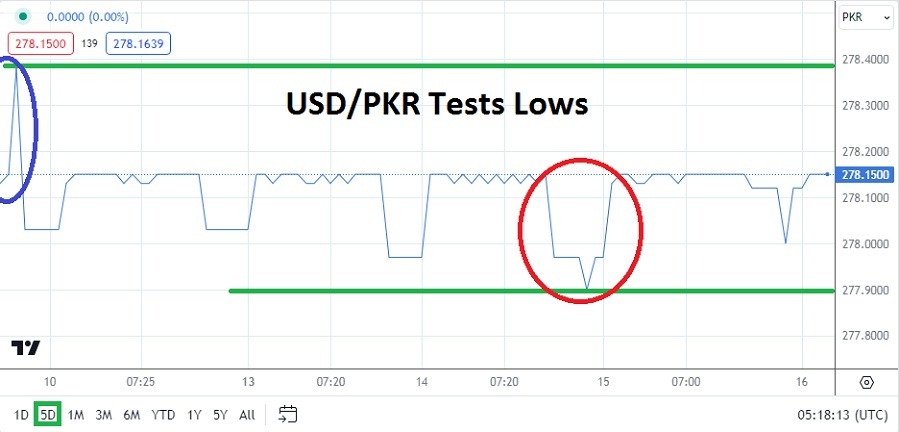

- Tuesday’s trading in the USD/PKR produced a low around the 277.9000 ratio briefly. Yesterday’s low only managed to touch the 278.0000 level very late in the day.

- The prices should be compared because on Tuesday the PPI numbers from the U.S came in stronger than anticipated, yet the USD/PKR dropped in value.

- Yes, large global financial institutions on Tuesday did cause volatility, so in one respect the USD/PKR could be said to have correlated to the leanings of large traders who were still maintaining their weaker USD centric outlooks.

However, yesterday’s Consumer Price Index numbers did come in weaker than anticipated in the U.S and the USD in most major currency pairs lost value. While the USD/PKR lost some value yesterday it did not exactly correlate to the broad Forex market. Traders trying to gain insights regarding potential sudden gyrations in the USD/PKR are advised not to expect lightning quick responses from the State Bank of Pakistan. You have to actually bet before they make their decisions.

Wagering on the USD/PKR in Short-Term Positions

Trying to wager on the USD/PKR in the short-term remains a game of trying to guess what the State Bank of Pakistan is going to do. Knowing what the official exchange rate is going to demonstrate and having working orders within a trading platform to try and take advantage is not particularly easy, but with patience and a conservative amount of leverage it can be done. It is wagering however.

One of the more important considerations for day traders within the USD/PKR is picking targets that are close by and making sure the take profit goal can be hit. If a technical trader is trying to rely on what the highs and lows have been within the USD/PKR technically because of its recent trends, it might prove difficult to get cashed out of a trade if it only touches a ratio momentarily. This because a broker could make the claim the value was not sustained long enough.

Top Forex Brokers

Lower Movements via the Use of USD/PKR Resistance

It is better to choose a price target that it within an incremental step close to the resistance or support level you are looking for direction to take hold, meaning a value within proximity of the high and lows that have been demonstrated recently.

- The recent ability of the USD/PKR to trade slightly lower is not new, and it might make sense for traders to use values that touch technical resistance to launch their selling positions.

- As always traders wagering on the USD/PKR need to make sure they can withstand the potential that a trade may have to be carried overnight to achieve a goal.

- Traders should not use market orders to get into the USD/PKR because the price fills may not match expectations.

Pakistani Rupee Short Term Outlook:

Current Resistance: 278.2000

Current Support: 278.1000

High Target: 278.2555

Low Target: 278.0310

Ready to trade our Forex daily analysis and predictions? Here are the best trading platforms in Pakistan to choose from.