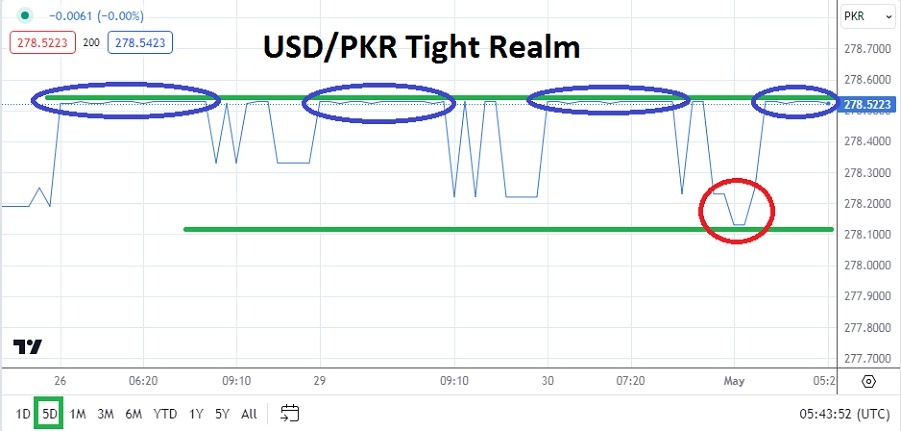

The USD/PKR has hit a higher price level in the past handful of days, but the currency pair’s tight controls by the Pakistan government makes it difficult to trade.

- The USD/PKR as of this morning’s official Forex rate is near the 278.5223 ratio. This high has been tested since last Friday the 26th of April with a steady heartbeat technically.

- The currency pair has traded slightly higher in the past two weeks, but in order to take advantage of the incremental move upwards a speculator will need deep pockets, patience and the ability to absorb carrying charges for positions held while waiting for anticipated results.

The Pakistan government has created a fixed peg of the Pakistan Rupee and while this on the surface creates a known rate of exchange for those holding the currency, it has proven over time to be a rather dangerous practice for nations trying to grow their economy. The results of fixed pegs historically have turned out rather poor because the rates are artificial and do not represent fair value. Traders of the USD/PKR are also at the mercy of the Pakistan government to decide on what the Forex value of the currency pair is even if reality is known to be different when black market transactions take place.

Incremental Climb Perhaps an Admission of Forex Reality

The ability of the USD/PKR to incremental move higher the past two weeks is noticeable technically and the correct direction considering the strength of the USD in the global Forex market. However, the move higher in the USD/PKR has likely not been enough compared the loss of value seen in other major currencies over the past month versus the USD.

If a speculator can buy the USD/PKR and wager on incremental higher moves to happen they can attempt this, but if the government of Pakistan decides to issue an official lower rate of exchange and it is seen on a speculator’s trading platform there is nothing the speculator can do except to swallow their losses and wait for another opportunity.

Top Forex Brokers

Betting on Downside of the USD/PKR

If a person wants to wager on the USD/PKR one enticing – but very dangerous – possibility is to actually wager on downside momentum to burst lower. The USD/PKR via technical charts can be seen to produce reversals lower which are often more swift and dramatic then the upwards climbs. The moves lower frequently happen before the currency pair reestablishes its trend higher. But for a trader to take advantage of these moves lower on a brokerage platform, the speculator needs to be using take profit orders and then hope the broker fills the order and doesn’t claim that there wasn’t enough volume to honor the trading order.

- The move higher in the USD/PKR over the past two weeks is encouraging, but it has been very limited and there are no guarantees the trend will be allowed to continue.

- The Pakistan government is unlikely to remove its rather heavily managed exchange rate of the USD/PKR in the near future.

Pakistani Rupee Short Term Outlook:

Current Resistance: 278.5300

Current Support: 278.4395

High Target: 278.6770

Low Target: 278.2230

Ready to trade our Forex daily analysis and predictions? Here are the best Pakistan trading brokers to choose from.