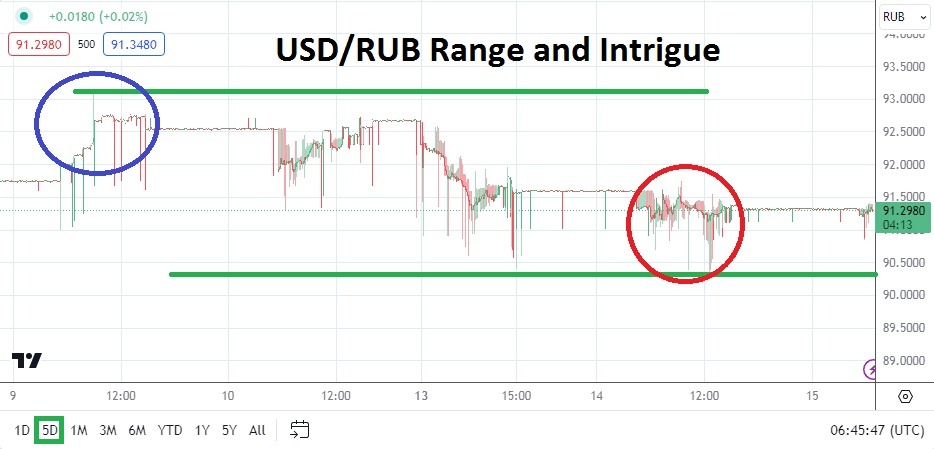

The USD/RUB has challenged lows again early this week, and yesterday’s slight move higher has turned into sideways price action for the moment.

- The USD/RUB continues to correlate to the broad Forex markets in a remarkably healthy manner.

- While it is difficult to know what internal decisions are being made via the Russian government regarding fiscal and treasury policy, the Russian Ruble has exhibited a clear ability to hold onto to a rather steady range and move in a way that often mirrors USD centric influences.

The current value of the USD/RUB is near the 91.3050 ratio and is showing steady price fluctuations. Yes, the Russian Ruble remains under a gauntlet of international sanctions, but the ability of the currency to maintain its stronger stance amidst political slings and arrows is intriguing. It is also known Russia has been able to sustain the export of its Crude Oil and other energy commodities which creates a source for Forex. India and China are certainly two of the nations that are active with Russia.

Lower Movement in the USD/RUS

Since trading around the 94.7530 ratio in the middle of April which came in sight of highs that climbed above the 95.3000 mark briefly in the last week of February, the USD/RUB has trended lower. No, the movement lower has not been a steady one way avenue. Like all other Forex pairs, day traders need to respect the potential of reversals occurring. However, the USD/RUB has certainly moved lower in the past two weeks correlating to weaker USD sentiment which is being practiced it appears by global financial institutions.

Thus, the door must be opened to the potential of U.S economic data today actually affecting the USD/RUB like other major currency pairs. Yesterday’s higher than anticipated PPI reports from the U.S were a definite warning shot from the States that inflation remains troublesome. Today’s Consumer Price Index readings from the States should certainly be monitored because it is likely the USD/RUB will react to the outcomes.

Top Forex Brokers

Support Level Consideration in the USD/RUB

The USD/RUB touched a low of nearly 90.3000 yesterday before climbing. The ability of the USD/RUB to remain within eyesight technically of this low shows that large players within the currency pair may be leaning towards more bearish tendencies. If the U.S inflation number comes in weaker than expected today via the CPI reports, the USD/RUB is likely to challenge lows seen yesterday.

- The support level of 90.0000 is technically important in the USD/RUB and needs to be considered by traders considering speculative bets on the currency pair.

- It is advisable that traders use take profit orders to try and capture their targets before the risk of sudden reversals occur.

USD/RUB Short Term Outlook:

Current Resistance: 91.3650

Current Support: 91.1925

High Target: 91.5040

Low Target: 90.4080

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Russia to check out.