Potential Signal:

The US dollar is by far the strongest currency around the world right now, at least as far as majors are concerned. I am a buyer of this pair right here, right now. I would have a stop loss near the 89.50 ruble level, with a target closer to the 93.75 ruble level above.

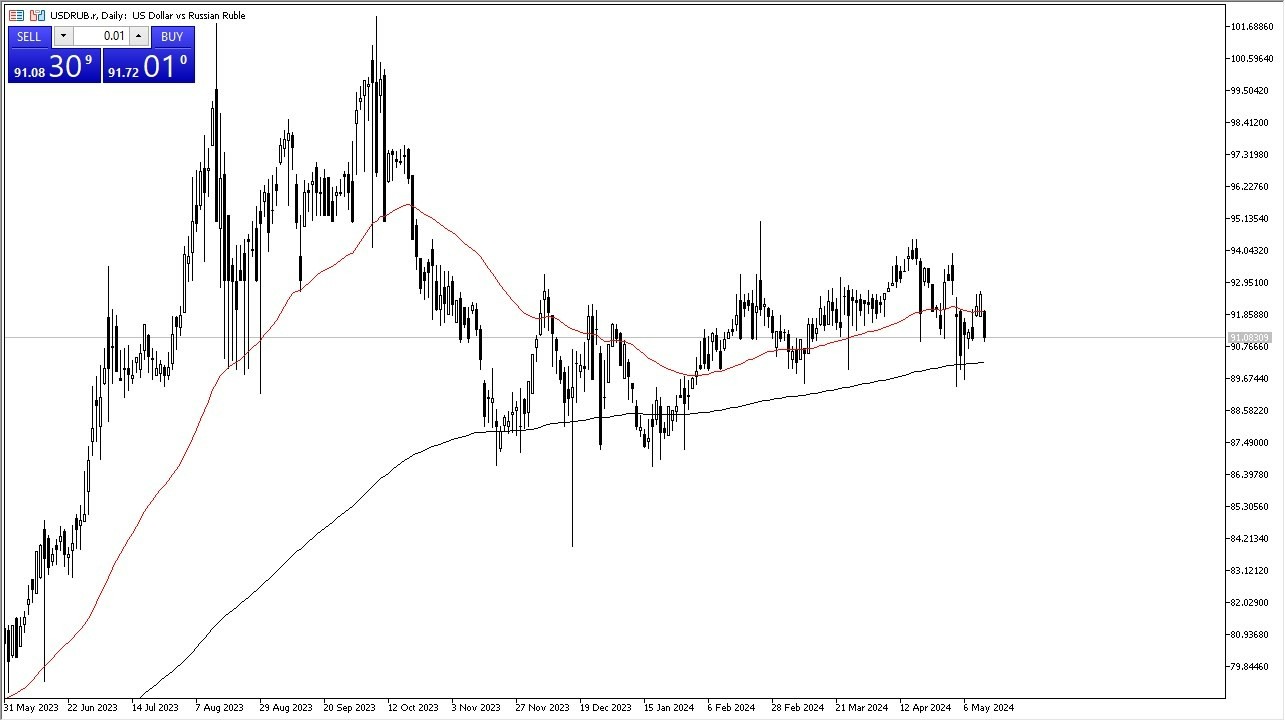

- The US dollar has dropped a bit against the Russian ruble during the trading session on Monday, as we continue to dance around the 91 Ruble level.

- This is an area that is also bordered by the 200-Day EMA in the 50-Day EMA indicators, suggesting that we could see a lot of noise here. With that being said, it is very likely that we will continue to hear a lot of noise in the pair.

- When I look at this chart, I see a couple obvious levels that everyone should be watching.

Top Forex Brokers

Major Levels

I believe that the 94 Ruble level is major resistance, while at the same time, the 89 Ruble level underneath is major support. We are to simply killing time at the moment, as we are bouncing around in this area, which does make a certain amount of sense considering that there is so much going on around the Russian economy and the Russian currency.

It is probably worth noting that the Russian ruble is down 40% from its strongest levels in January 2022, but it does also look like we are going to continue to see a lot of choppy behavior because quite frankly there are a lot of moving pieces at the same time. While Russia is somewhat suffered at the hands of tariffs, the reality is that there is quite a bit of trade between Russia, China, and India when it comes to commodities, and while commodities continue to skyrocket in value, that ends up helping the Russians, assuming that they can sell their products somewhere. (Here’s a little bit of a reality check: Russian oil does get into the European Union, despite the fact that it isn’t supposed to.)

All things being equal, I think the 50-Day EMA underneath should continue to offer quite a bit of support, currently hanging around the 89 ruble level. If we can find buyers on dips, then we could go looking toward the 95 ruble level, but ultimately this is a pair that I think is going to continue to favor the US dollar in general, not necessarily because of anything going on in Russia, the fact that the Federal Reserve is going to stay “tighter for longer” is the primary culprit here.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.