Signals for the Lira Against the Dollar Today

- Risk 0.50%.

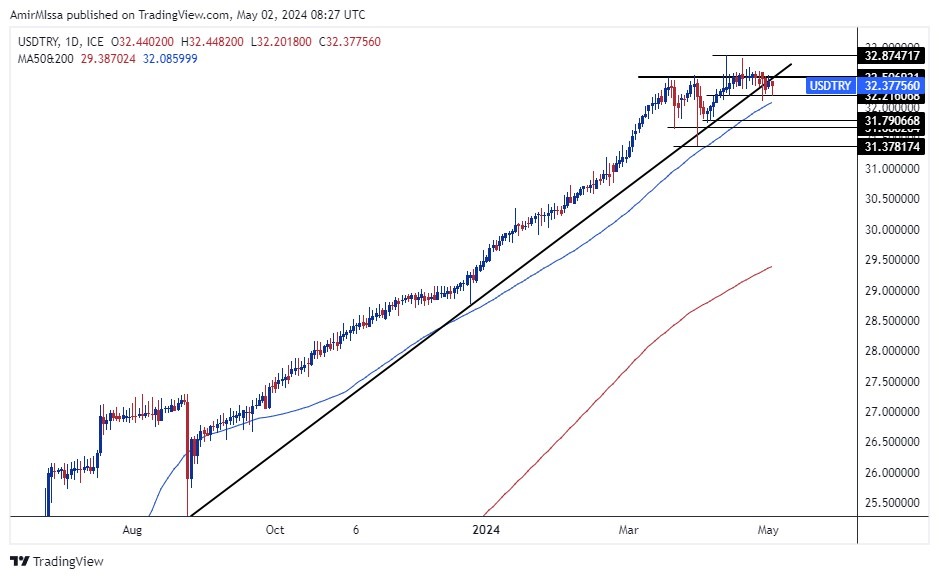

Bullish Entry Points:

- Open a buy order at 32.25.

- Set a stop-loss order below 31.10.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 32.50.

Bearish Entry Points:

- Place a sell order at 32.77.

- Set a stop-loss order at or above 32.98.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 31.95.

Turkish lira Analysis:

The trading of the US dollar against the Turkish lira stabilized, recording slight changes during Thursday's trading. The Turkish Central Bank revealed an increase in the tax rate on Turkish lira deposits for accounts due for six months by about 2.5% to reach 7.5%. Similarly, the tax rate deducted from accounts due for a one-year term increased by about 2% to reach 5%. Likewise, the tax on deposits due for longer than a year was raised by 2.5%, and the tax rate on interest-directed investment funds was set at 7.5%.

Meanwhile, investors followed statements by Turkish Finance Minister, Mehmet Şimşek, about Turkey's plans to attract $100 billion in investments in renewable energy over the course of a decade, with electricity generation rates from renewable sources increasing by about 50% in March 2024. The minister highlighted the country's reliance on imported fossil fuels, making renewable energy sources essential for energy security. Minister Alb Arslan Biçerdkar shed light on Turkey's shift towards renewable energy, with renewable energy sources accounting for 63.6% of electricity generation in March 2024, up from 51.3% in 2023. However, renewable energy faces challenges such as weather dependence. Ultimately, the Turkish government aims for renewable energy to constitute 55% of Turkey's total electricity capacity.

Top Forex Brokers

Data revealed a decline in the country's oil and gas imports by $27 billion in 2023 to reach $70 billion, attributed to falling oil prices. Eventually, local oil and gas production is targeted to cover 25% of consumption in the future.

USD/TRY Technical Analysis and Expectations Today:

Technically, the USD/TRY pair remained stable without significant changes during the current week, maintaining its limited movement during European trading this morning. The pair retained its trading around the upward trend line on the daily timeframe, as depicted in the chart. The pair traded below the peak levels concentrated at 32.87 and 32.50, respectively. On the other hand, the nearest support levels are at 32.25 and 32.10, respectively. Also, the pair traded above the 50 and 200-day moving averages on the daily timeframe, while moving between the same averages on the four-hour timeframe, indicating a corrective downward correction against the overall upward trend exhibited by the pair in the long term. Expectations for the Turkish lira price include a decline if it remains below the peak recorded during the past few months.

Ready to trade our Forex daily analysis and predictions? Here are the best Turkish brokers to choose from