Signals for the Lira Against the Dollar Today

- Risk 0.50%.

Bullish Entry Points:

- Open a buy order at 32.15.

- Set a stop-loss order below 31.05.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 32.50.

Bearish Entry Points:

- Place a sell order at 32.47.

- Set a stop-loss order at or above 32.60.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 31.95.

Turkish lira Analysis:

The USD/TRY pair has remained stable within a limited trading range during the current week's trading sessions. Despite a series of data showing mixed results, both negative and positive, the lira seems to be constrained by certain movement limits, supported by positive economic outlooks for Turkey and stringent monetary policy, or indirect intervention by the Turkish central bank.

Investors followed closely as President Erdoğan announced an increase in loan limits for young farmers and shepherds. The limits rose from 1.5 to 2.5 million lira for young farmers, and from 400,000 to 600,000 lira for shepherds, aimed at boosting agricultural investment. The planned investment of 13 billion lira in agricultural projects is expected to create 20,000 jobs, enhancing economic growth and rural development. The loan limits for small equipment will increase from 150,000 to 250,000 lira, facilitating access to tools and technology to improve productivity in the sector. There are some concerns that these economic incentives might drive inflation rates higher again.

Nevertheless, optimistic inflation expectations continue in the country. Turkish Treasury and Finance Minister Mehmet Şimşek expressed optimism about inflation forecasts, pointing to the positive results of government policies. Expectations for the next 12 months have significantly decreased, indicating confidence in the effectiveness of anti-inflation measures. Meanwhile, the government anticipates a rapid decline in annual inflation in the coming months, following its peak in May. According to the Turkish minister's statements, efforts to curb inflation are expected to stabilize forecasts and facilitate economic recovery. The government is committed to achieving inflation targets through targeted policies and reforms.

Top Forex Brokers

TRYUSD Technical Analysis and Expectations Today:

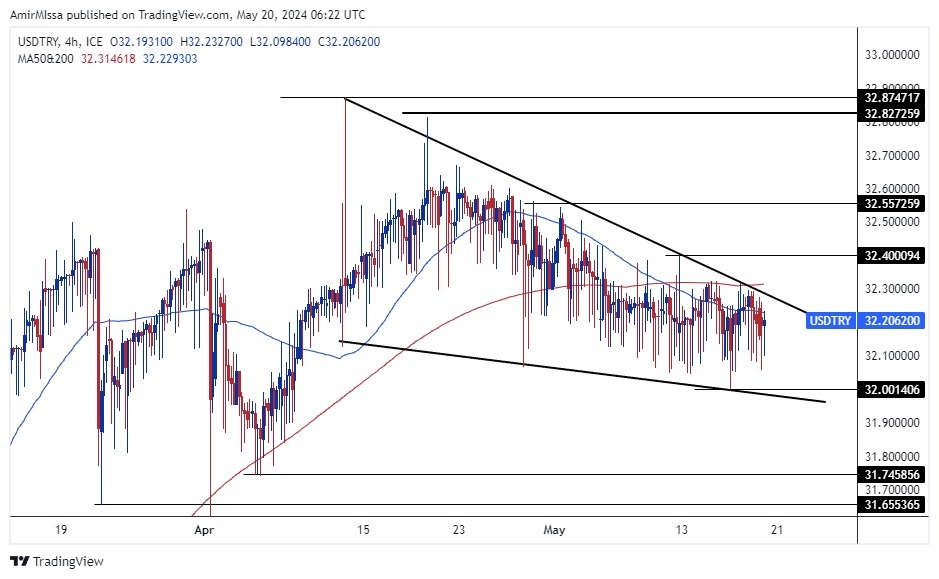

On the technical front, the USD/TRY pair has not seen significant changes over the past week or at the beginning of the current week. Also, the pair continues to move within a limited range inside a descending triangle pattern on the four-hour timeframe, as shown in the chart.

If the pair rises, it is expected to head towards the resistance levels concentrated at 32.38 and 32.40, respectively. On the other hand, the price is trading above the support levels at 32.06 and 31.70, respectively. Moreover, this divergence comes as the pair has maintained its movement above the 50 and 200 moving averages on the daily timeframe while moving around these same averages on the four-hour timeframe, indicating the pair's medium-term divergence. Ultimately, the Turkish lira price forecasts include the pair's divergence if it remains within the indicated triangle pattern.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out.