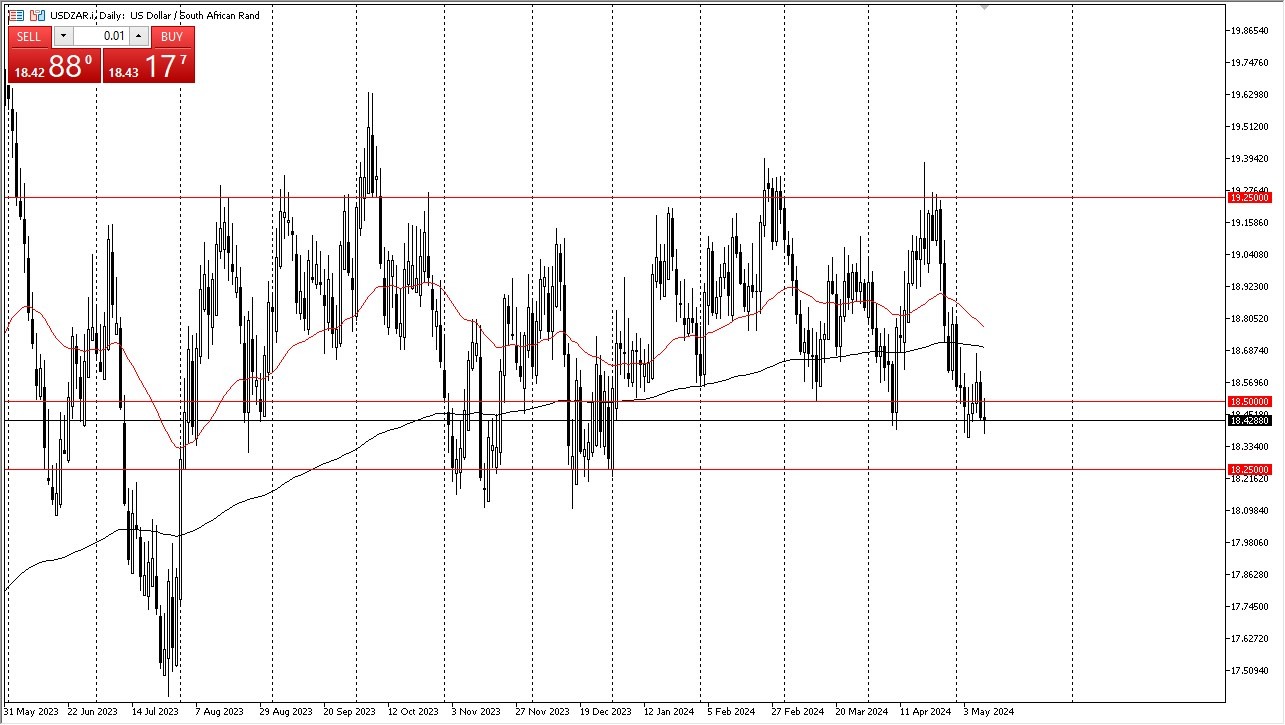

- The US dollar bounced around during the trading session on Friday as it looks like we don’t really have any momentum to say the least.

- Ultimately, this is a market that I think is near the bottom of an overall range that we have been paying close attention to for several months.

- The support level that we are currently challenging is one that has proven itself important more than once.

Technical Analysis

We are currently in the middle of a consolidation area that offered support in the larger consolidation area. What I mean by this is that there is significant support at 18.50 that extends down to the 18.25 level. As we ended up forming a bit of a neutral candlestick on Friday, this suggests that there’s no real momentum one way or the other at the moment, but it is also telling that at least we are not falling from here. The longer this market sit still in this area, the more likely we are to see buyers come in and pick up this pair based upon value.

Top Forex Brokers

If we can break above the 18.65 level, then I think that the US dollar could go looking toward the 19.25 level above, which is the top of the overall consolidation area. With this being the case, it could set up for a nice buying opportunity and a nice long trade. Speaking of long, this is not a trade that will be quick, and therefore it’s very likely that we could see a bit of choppiness but longer-term bullish pressure.

All that being said, if we were to break down below the 18.25 level, then we could see the market drop down to the 18 level, perhaps even lower than that. If we were to break down below that level, it’s likely that we could see the US dollar fell apart. I don’t that happens anytime soon, and especially against the South African Rand as the South African economy is so highly levered to risky speculation most of the time.

Ready to trade our daily Forex forecast? Here’s some of the best trading platforms in South Africa to check out.