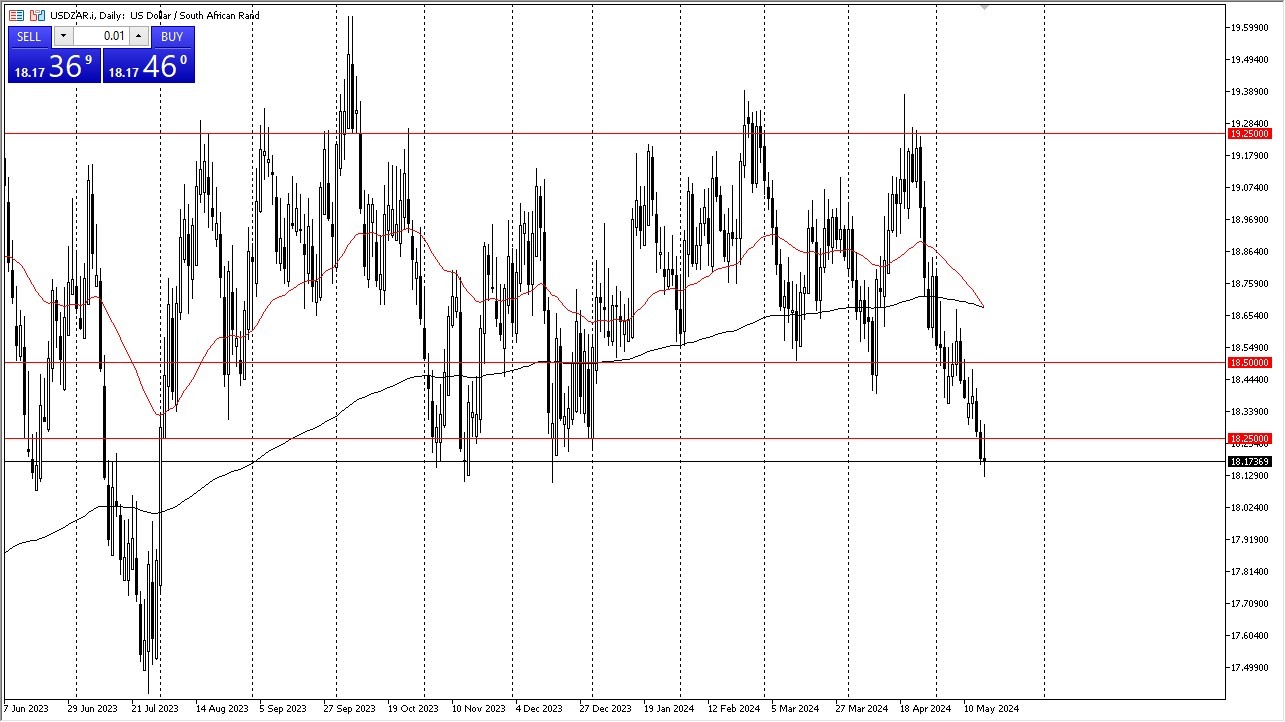

- It was a very choppy trading session on Friday in the US dollar against the South African rand.

- As we initially tried to rally in what would make sense as we are in a general vicinity that has been supported quite often in the past.

But since then, we've turned right back around, and it looks like the market isn't quite ready to go anywhere. That being said, this does set up one of my favorite trades, which is essentially a binary trade. What I mean by this is that if one particular thing happens, I take that trade, and if the other happens, then I take that trade.

Top Forex Brokers

The Upside, and the Down

So, if we were to break above the top of what looks like, it's going to end up being an inverted hammer. I'm a buyer of this USD/ZAR pair, mainly due to the fact that it is at a major support level. And of course, it shows that resiliency came back into the market to push the greenback higher. On the other hand, if we were to break down below the bottom of the candlestick for the day, then I think it opens up a bit of a trap floor down to the 17.70 level.

One thing is for sure, I do not want to be the first trader to put money into the market, so I want the market to tell me what it wants to do once it decides what it wants to do, then it'll be much easier to trade for what it is worth. We are starting to get the so-called Death Cross when the 50 day EMA crosses below the 200 day EMA, but I find that indication more of a longer term buy and hold or sell and hold type of scenario.

In general, I think we are at a major inflection point and the market will make up its mind. Your job as a trader is to let the market make up its mind, and simply follow right along. Just make sure you aren’t trying to “front run” the market.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers with ZAR accounts to choose from.