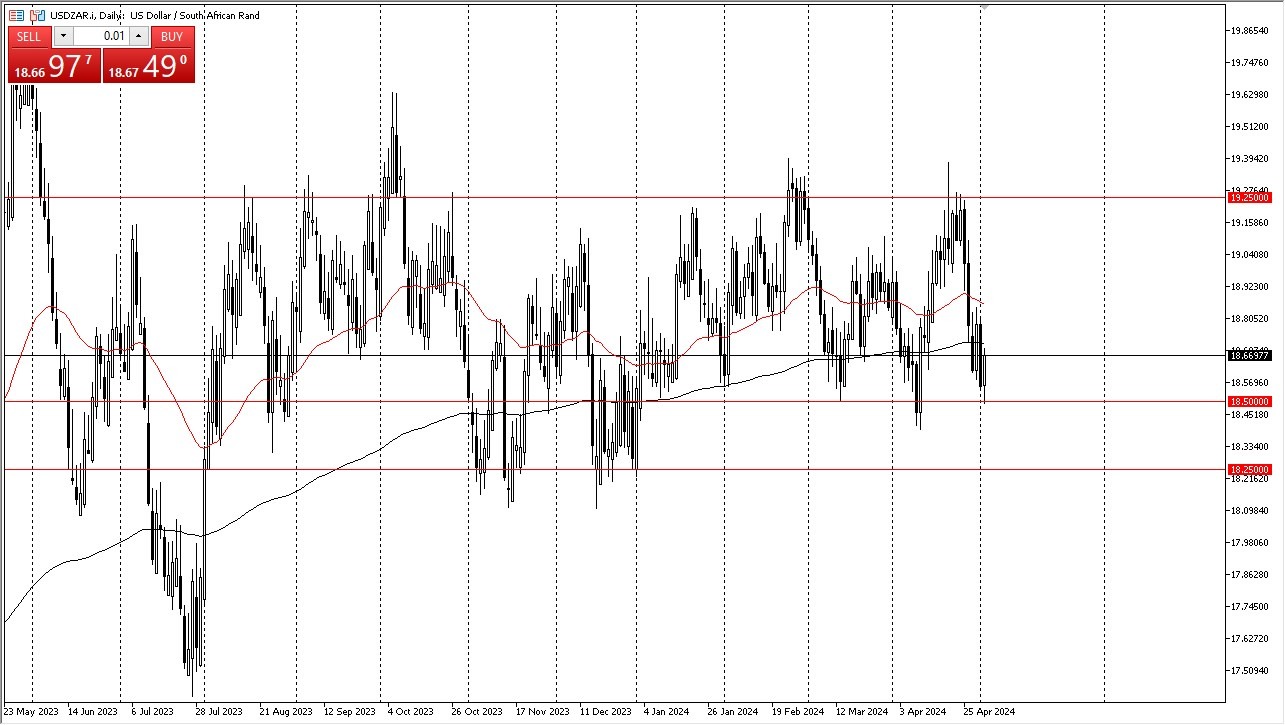

- The US dollar has bounced from the 18.5 level against the South African Rand, an area that has been important multiple times.

- Because of this, I think you have a situation where we continue to see a lot of the same sideways action, and as we head into a jobs report on Friday, coming out of America does make a certain amount of sense that we would see a lot of volatility.

That being said, when you step away from the short-term behavior in this market, you can see that support extends all the way down to the 18.25 level. And we have been stuck in a really well-defined range between 18.25 and 19.25 since October of last year, perhaps even as early as the third week of that month.

Top Forex Brokers

So, with that being said, I think you are going to continue to see a lot of range bound trading. In this environment, on a dip, I would be willing to have a go at this pair, but I wouldn't necessarily throw my life savings into it either. This is a market that will, more likely than not, remain somewhat choppy and sideways, so you have to be cautious about becoming overexposed. But at the same time, it has been so reliable that you have to look at it through the prism of being well defined and therefore very tradable at this point. We found support at the very top of the support range. So, what I'm hoping for is a little bit of a pullback during the jobs report that I can take advantage of and start buying the USD/ZAR.

Emerging Market Currencies

Make sure you are careful trading these emerging market currencies, because liquidity can be an issue, and of course there are a lot of fundamental factors that you may or may not be cognizant of. Ultimately, they do tend to move on their own, and they can be quite volatile. However, this is one of the more stable ones at the moment, so therefore it is most certainly worth paying close attention to.

Ready to trade USD/ZAR? Get our top recommended Forex brokers in South Africa here: