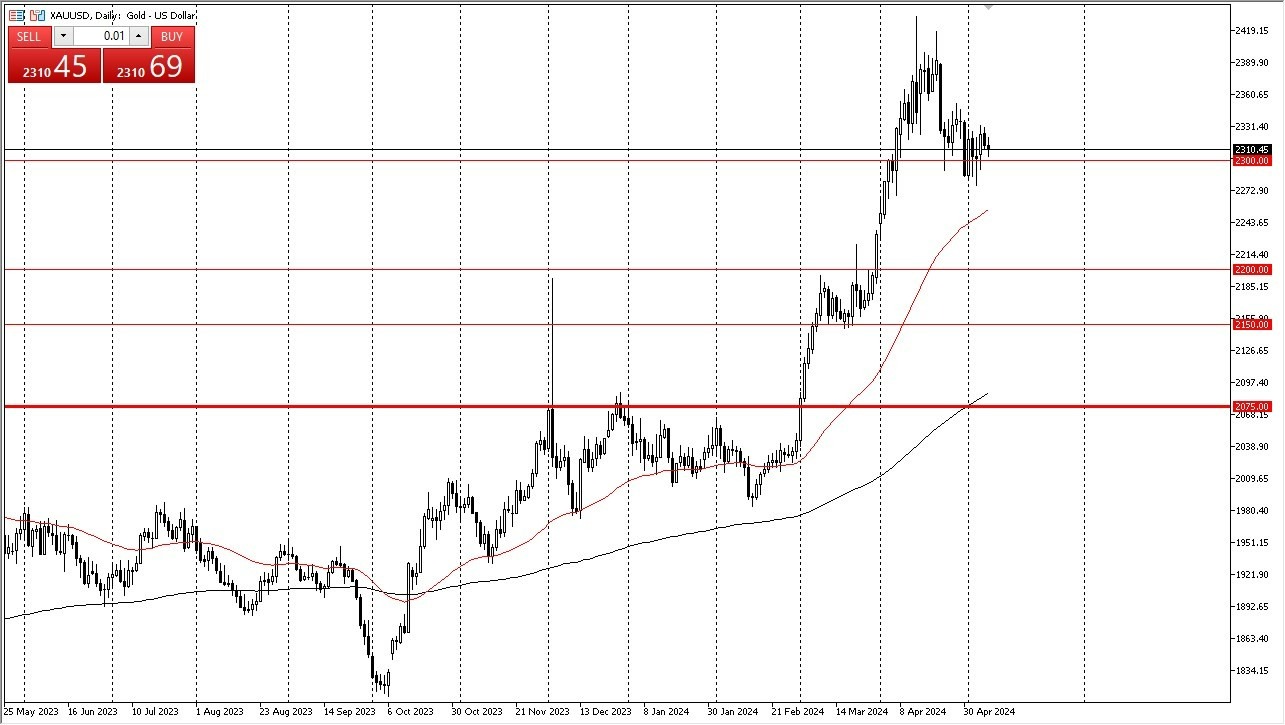

- Gold was rather choppy during the early hours on Wednesday, but we do still have a significant amount of support below that comes into the picture to offer a bit of a potential buying opportunity.

- After all, gold has a lot of things working for it right now as the geopolitical situation continues to be an absolute mess.

Furthermore, we've been in an uptrend for a while, so I don't really see an argument for any type of shorting of the market, even if we were to get a bit of profit taking. We are focusing mainly on the $2,300 level and perhaps even just a little bit below there.

With the 50 day EMA approaching this area, it should only serve to solidify it as important support. If we can break above the $2,350 level, then it opens up a move back to the highs that were just above the $2,400 region. In general, this looks like a bullish flag that is getting ready to kick off and continue the overall uptrend. At this point, it would probably only take some type of random headline out there to really get the market spooked and have gold rallying. Even if we were to break down below here, I think there's even more support near the $2,200 level. And I do think that gold ends up being one of your better trades this year, albeit probably very noisy.

Top Forex Brokers

Position sizing matters

Keep in mind that the gold markets can be extraordinarily volatile, and therefore you need to be conscious of your position sizing as there are a lot of different things moving around at the moment. However, I also believe that the gold market is strong for a reason and should continue to be so. Given enough time, it's very likely that gold not only reaches the high levels that we have seen previously but break above there and go looking into the $2500 level over the longer term. Given enough time, I believe that gold will turn things around in order to continue the previous bullish run.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.