WTI Crude Oil

The West Texas Intermediate Crude Oil market has been all over the place during the trading week, and even sold off quite violently on Friday. However, we remain in the same general vicinity that we have been in for a while, and I think at this point we are more likely than not to continue to see a lot of volatility and of course a lot of noise. The $80 level above continues to be a major barrier to overcome, and quite frankly I don’t think it’s very easily done. With that being the case, you have to look at this through the prism of sideways choppiness.

USD/JPY

The US dollar continues to be strong against the Japanese yen, as we have seen a lot of noisy behavior in general. Ultimately, I think this is a scenario where traders will pay close attention to interest rate differential which of course continues to favor the United States dollar. The Bank of Japan of course is still stuck with its monetary policy being very loose, so you need to keep in mind that we will continue to see buyers jumping into this market in order to take advantage of value. The ¥155 level underneath should continue to be supported, right along with the ¥152 level. Above, we have the ¥160 level as a potential barrier.

Top Forex Brokers

Bitcoin

Bitcoin has also been very noisy during the week, testing the $67,000 level for support at the end. Ultimately, this is an area that I think will continue to attract a lot of attention, but even if we were to break down below it, the actual “floor in the market” is closer to the $60,000 level, an area we had bounce from previously. If we can break above the $73,000 level, then it’s possible that we go much higher.

NASDAQ 100

The NASDAQ 100 plunged during a huge part of the week, but it does look like it’s finding a little bit of support in an area that previously had been resistant. At this point, it looks like it is offering a little bit of value, but I would also be a bit cautious as there is so much volatility. The 17,850 level underneath should continue to be a massive support, right along with the 17,000 level. I am a buyer and not a seller, despite the fact that I am a bit nervous jumping in with a huge position at the moment.

S&P 500

The S&P 500 fell during the week, but it looks as if it is trying to find some type of support as we head into the weekend. I think that the 5000 level underneath is going to be a major support level that a lot of people will be cognizant of a, as it is a large, round, psychologically significant figure. It’s obvious that the 5300 level continues to be a bit of a headache, but once we break above there it’s likely that the S&P 500 will go higher, looking toward the 5500 level given enough time.

Silver

Silver initially shot higher again during the course of the week but has been absolutely decimated. At this point, it looks like we are doing everything we can to test the $30 level, an area that I think will end up being very important before it is all said and done. If we were to break down below the $30 level, we could see the market go looking to the $28.50 level. On the other hand, if we do rally from here expect the $32.50 level to be very difficult to get above.

DAX

The German index has been pretty wild during the course of the week, but it still is very much in an uptrend, and it makes sense that we will eventually see some type of continuation. The €18,250 level is an area that we have seen a lot of support at, and I think we also have even more support below, near the €18,000 level. I have no interest in shorting this market, and if we do continue to pull back, I think that we will only end up seeing more value in a market that has been strong for some time. Keep in mind that Germany will lead the European Union higher overall, so this is one of the most important markets to follow.

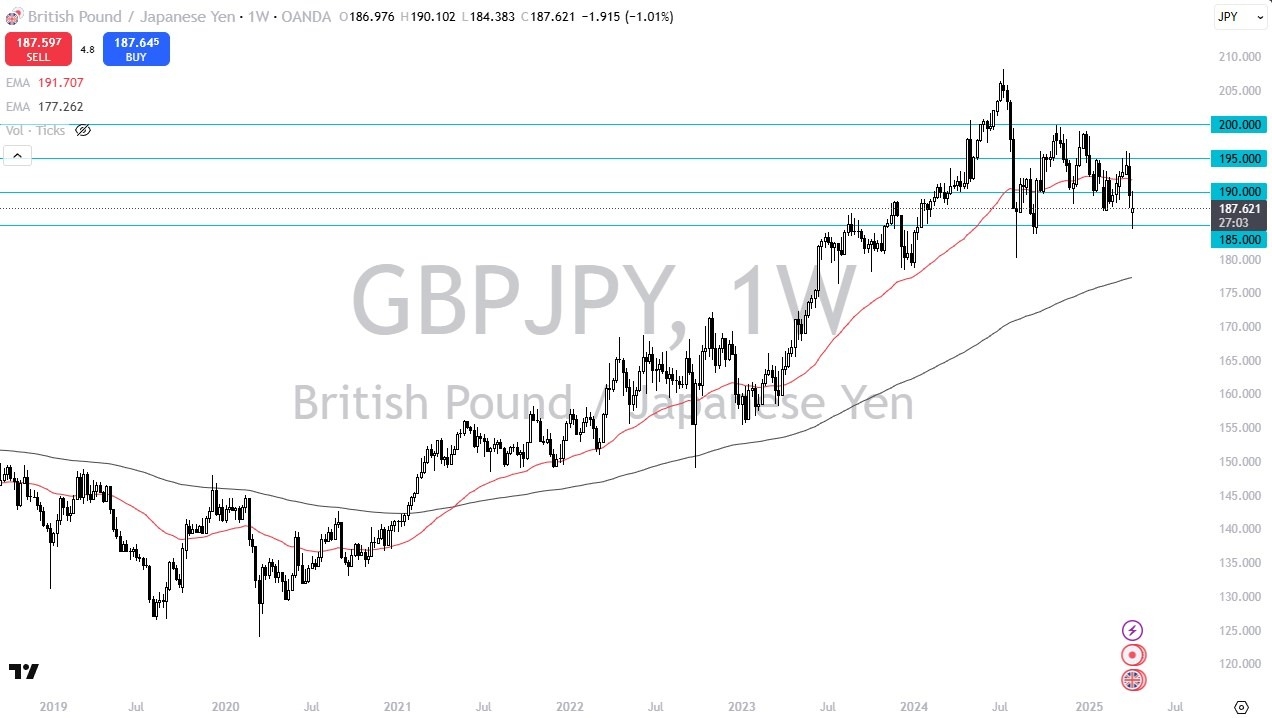

GBP/JPY

The British pound has been back and forth during the course of the week, as it continues to beat up on the Japanese yen. That being said, we are hovering around the ¥200 level, and the interest rate differential between the United Kingdom and Japan will continue to have traders looking to the upside. I think short-term pullbacks at this point in time continue to be of interest, with the ¥198 level offering support, followed by the ¥195 level.

Ready to trade my weekly Forex forecast? Here are the best Forex brokers to choose from.