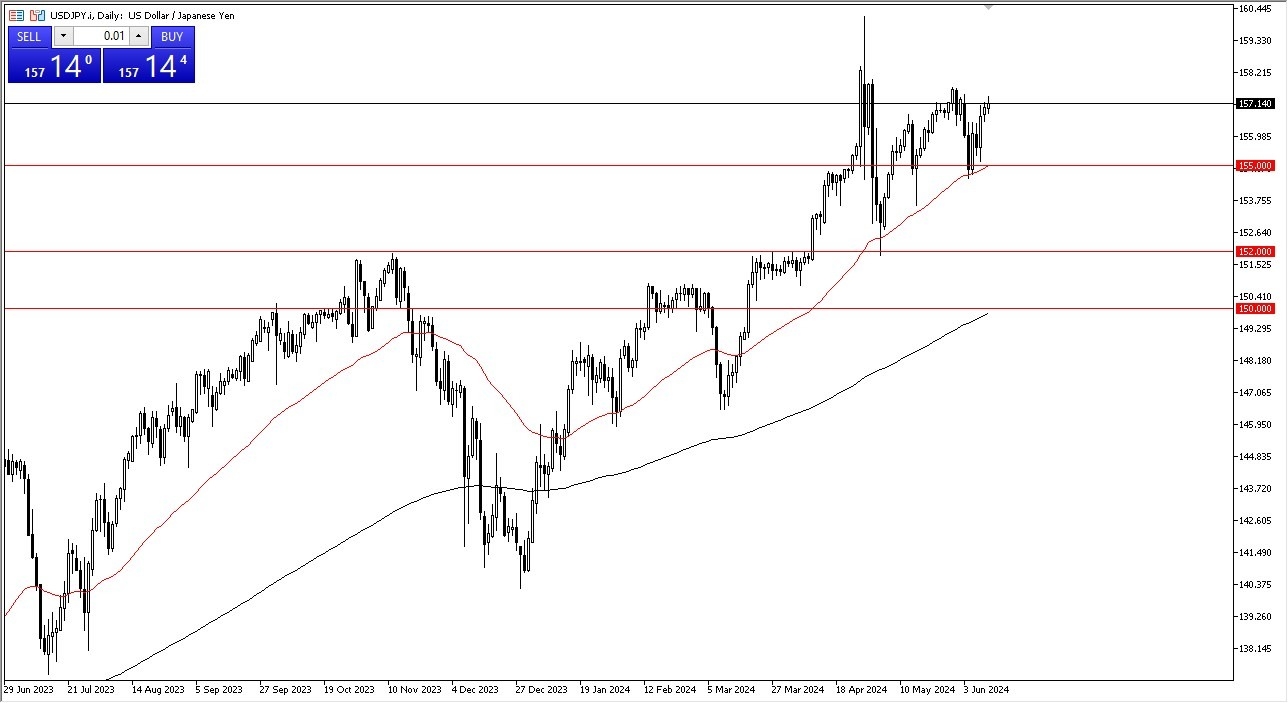

- The US dollar has rallied a bit against the Japanese yen, but you can see it is struggling a little bit to continue going higher.

- This makes a certain amount of sense because we do have the FOMC meeting on Wednesday.

- And that of course will attract a lot of attention and a lot of people will be concerned as to whether or not the Federal Reserve can stay tight or if they will start to open the door for interest rate cuts.

Quite frankly, it's about the only thing that could save the yen at this point, due to the fact that the Bank of Japan certainly can't do much. Speaking of the Bank of Japan, they do have a meeting on Friday, but I anticipate that being noise more than anything else. I don't expect it to be anything that is worth paying close attention to from a longer term standpoint. Unless, of course, for some reason they raise rates underneath current levels. We have the ¥155 level offer and a massive support level that I think a lot of people will pay close attention to. Not only is it an area that is a large, round, psychologically significant figure, but it's also an area where we've seen the 50 day EMA come into the picture as well to the upside.

Top Forex Brokers

If We Break Higher…

If we can break above the 158 level, then we could see the market go looking to the 160 level, which is where the Bank of Japan intervened previously. I do think eventually the market will take that back and blows through it. Ultimately, this is a buy on the dips market, and you do get paid at the end of every session to hold it.

So that's something that you should always keep in the back of your mind. If we get a sudden lurch lower during the FOMC meeting, I have no issues whatsoever buying this market and taking advantage of cheap greenbacks. This is the momentum position of the longer-term market, and of course the interest payment at the end of everyday continues to be attractive.

Ready to trade our USD/JPY Forex analysis? We’ve made a list of the Top-Rated Forex Brokers in Japan worth trading with.