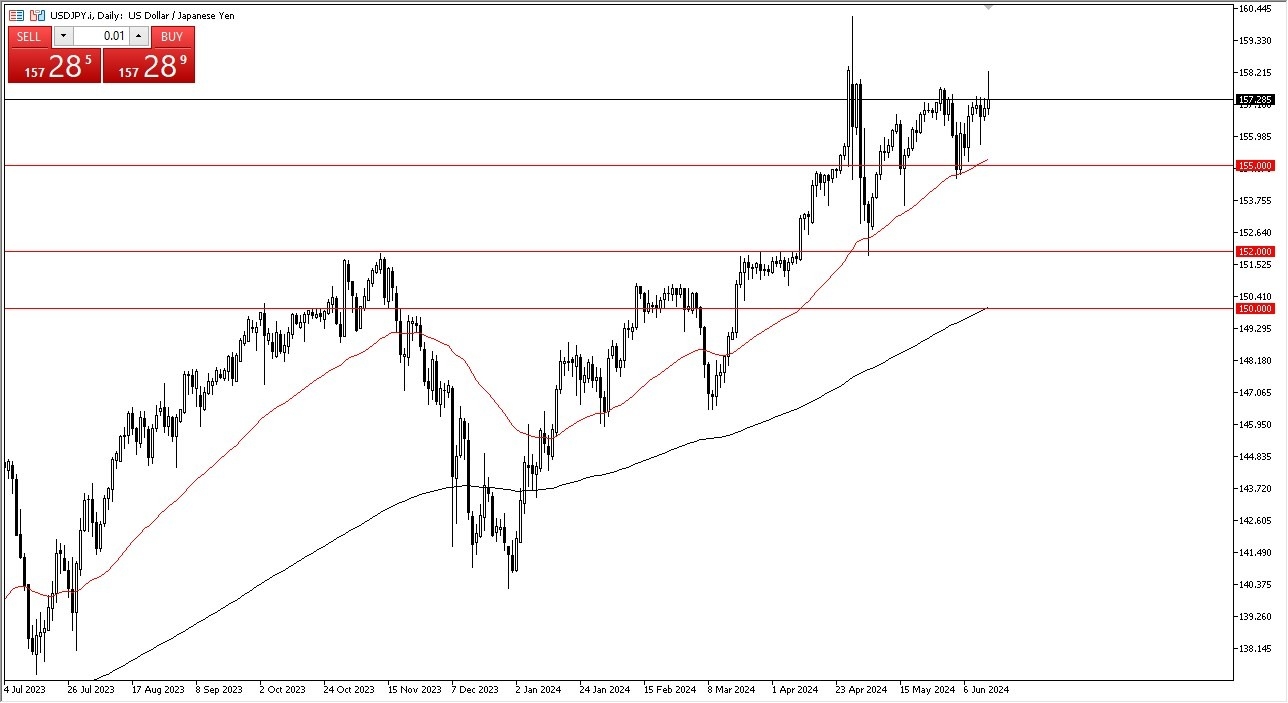

- The US dollar has rallied quite nicely during the early hours on Friday against the Japanese Yen, breaking above the 158 Yen level.

- That being said, there was a Bank of Japan meeting that of course rattled the markets and therefore we have seen a lot of volatility since then.

- Nonetheless, this is a market that is bullish, and I do think continues to go higher.

When you look at the chart, it doesn't take a lot of imagination to see an ascending triangle, and typically those will resolve to the upside. Furthermore, you have to keep in mind that the interest rate differential continues to favor the United States, and that of course is a major driver of where this pair may go in the future. If we can break above the 158 yen level, that would obviously be a victory, but I think the real fight is beyond there, and it's closer to the 160 yen, that seems to be the area that the Bank of Japan found intolerable and jumped into the market to intervene several weeks ago. On the downside, if we see the US dollar fall from here, I think the most obvious support level is close to the 155 yen level, not only due to the fact that it has shown itself to be resilient previously, but we also have the 50-day EMA hanging around that same general area.

Top Forex Brokers

Buying on the Dips

With this, I think that would be a potentially excellent opportunity, assuming that we even get it. I have no interest in shorting this market, you have to pay swap to do so, and of course would be swimming upstream as it were as the trend is so obviously bullish. I'm a buyer of dips, I'm a holder of this pair, and will continue to be both. With that being the case, I do believe that this is still a very much “long term trade” just waiting to happen.

Want to trade our daily forex analysis and predictions? Here's a list of forex brokers in Japan to check out.