- The US dollar rallied a bit during the early hours on Monday and continued to show signs of resiliency during the trading session.

- Ultimately, this is a market that I think will continue to see plenty of upward momentum against the Japanese yen, as the interest rate differential continues to favor the higher pricing of this pair.

- This is a market that I think any time we pull back, you have to be looking at the overall trend, and the fact that the Bank of Japan flinched when it came to the meeting on Friday of last week.

Technical Analysis

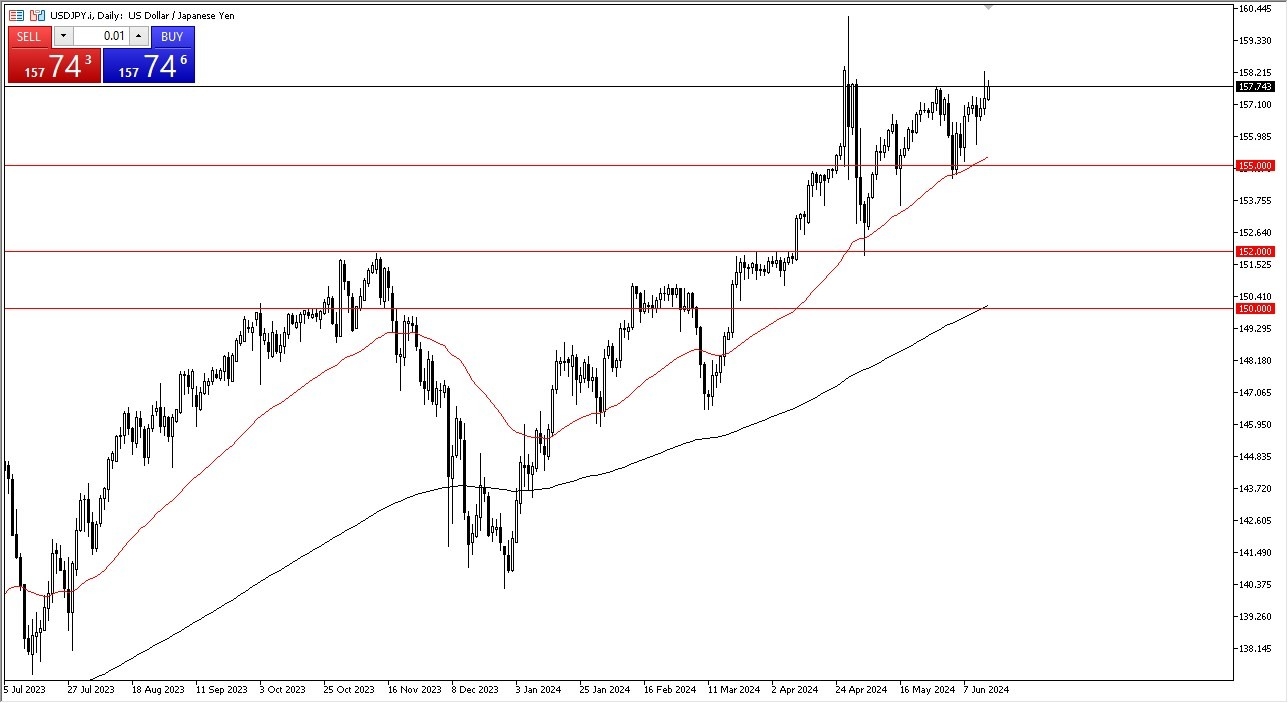

The technical analysis of course has been very bullish, and he continues to be so going forward. The 50-Day EMA is sitting just above the ¥155 level, an area that of course has been very important multiple times. I think at this point in time, the market is likely to continue to see this area as a potential value spot, so I do think that if we pull back at all, we will more likely than not see plenty of buyers willing to step in and defend this level.

Top Forex Brokers

The next support level course is going to be the ¥152 level, and then followed by the ¥150 level where the 200-Day EMA currently resides. In general, this is a market that continues to find plenty of buyers regardless, especially as the interest rate differential continues to favor the US dollar. With that in mind, I think it’s probably only a matter of time before we see the market take off to the upside, with an eye on the ¥160 level, an area that we see the Bank of Japan recently intervened at. I think that is an area that the market will have to contend with, but eventually I do expect that we not only reach the ¥160 level, but eventually break above there. If and when we do, then it becomes more or less a “buy-and-hold” type of situation.

Want to trade our daily forex analysis and predictions? Here's a list of forex brokers in Japan to check out.