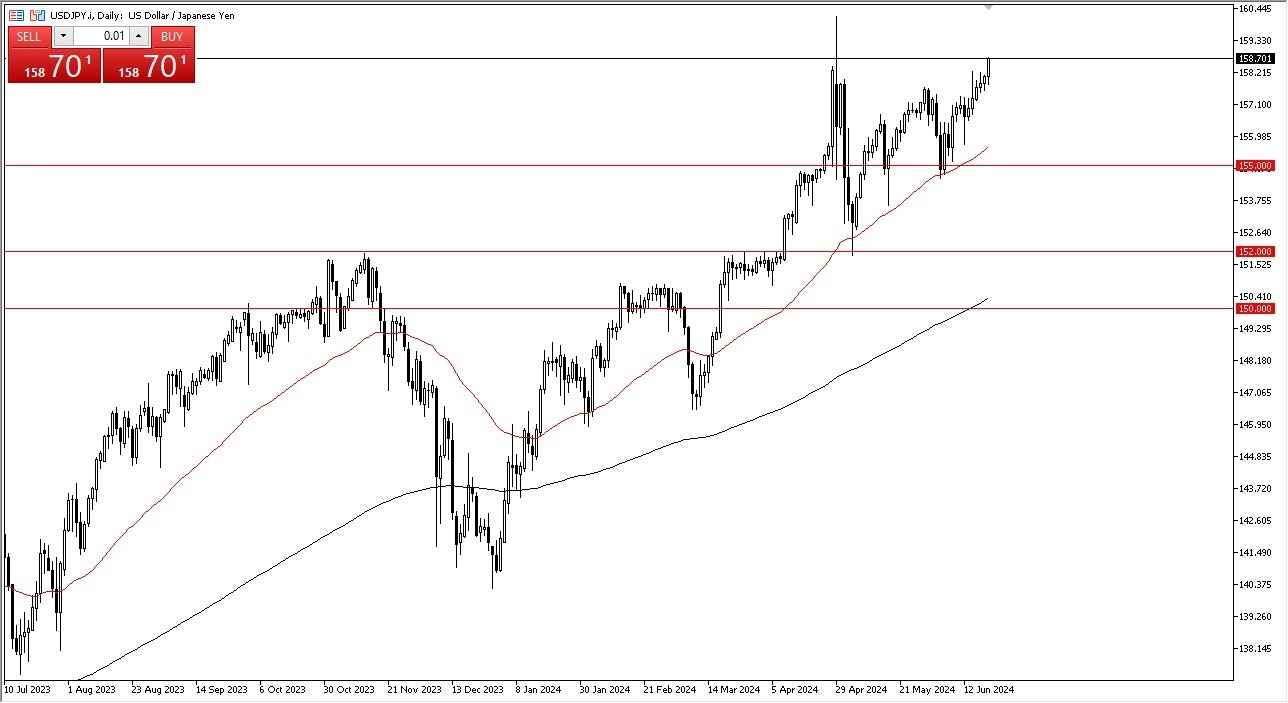

- The US dollar has continued to plow higher against the Japanese yen during the trading session on Thursday.

- All things being equal, this is a market that I think continues to see a lot of buying pressure to the upside.

- With the situation where traders have continued to play the interest rate differential, I think this makes a lot of sense.

Furthermore, you have to keep in mind that the Swiss National Bank did cut rates earlier in the day, and although that's not a direct influence on this market, it does suggest that other central banks around the world are in fact going to keep cutting.

What does this mean for Japan?

Top Forex Brokers

If Switzerland's cutting, the Bank of Japan's very unlikely to raise rates because quite frankly, it would throw the economy into a nasty recession, perhaps even worse. After all, the economy is very fragile. It has been very fragile for some time in Japan. And I think that continues to be the case going forward. Short-term dips continue to be buying opportunities as we have the ability to find value and of course get paid at the end of every day. The interest rate differential continues to be wide enough to drive a truck through. And I think that's the story here.

It's probably only a matter of time before we break out above the 160 yen level and continue to go much higher. That was the area where the Bank of Japan stepped in and intervened. If it gets broken, that could lead to more FOMO trading. And I do think we're in the midst of trying to make that happen right now. Underneath the 50 day EMA and the 155 yen level, both offer support levels that people will be paying close attention to, assuming that we can even drop that far.

Ultimately, USD/JPY is a market that will continue to pay traders who are patient enough to hang onto their positions, which is exactly what I have been doing for several months. Remember, trends in the currency markets tend to last much longer than people believe, and therefore you get paid to think more in the longer-term in a situation like this.

Ready to trade our daily forex forecast? Here are the best forex brokers in Japan to choose from.