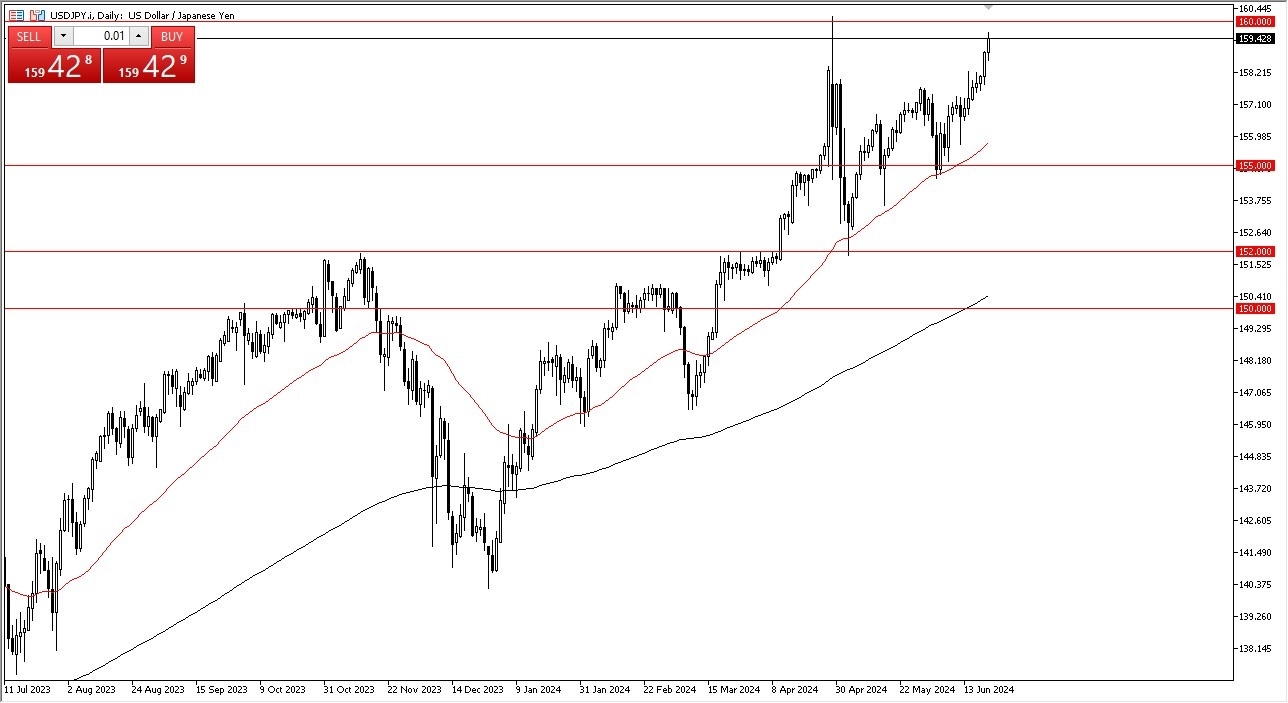

- The US dollar has rallied yet again during the trading session on Friday as the PMI numbers in the United States came out hotter than anticipated.

- This has people betting that the Federal Reserve may not cut rates between now and the end of the year, which is a bit of a surprise to me considering that they basically said that's very possible.

- After all, inflation has been very sticky in the United States, and it was just 6 months ago the people were suggesting that perhaps we could be getting 7 interest rate cuts this year. In other words, it’s astonishing how many people have been blind all year to the reality of inflation sticking around.

Plenty of momentum still

The US dollar continues to beat up on the Japanese yen, which makes a lot of sense. After all, the Bank of Japan can do nothing about its monetary policy other than keep it extraordinarily loose. It has to be loose. The debt in Japan is so out of control that they can't afford to pay it back with any interest whatsoever.

Top Forex Brokers

With this being the case, I think the market is likely to continue to see the Japanese yen get just absolutely crushed by almost anything against it. If we can take out the 160 yen level, this is a pair that could go much higher. After all, the Bank of Japan intervened from there, so that would be the next major barrier to overcome. Ultimately, short-term pullbacks end up in buying opportunities, especially near the 158 yen level, which we just broke out of.

I have no interest in shorting this USD/JPY pair because you have to pay for the privilege of doing so, which would be fine flying in the face of the overall trend. And therefore, I think anytime you get a dip, you have to be looking for some type of bounce in order to take advantage of the value that you could find in the greenback. This goes for pretty much all Japanese yen related currency pairs.

Want to trade our daily forex analysis and predictions? Here's a list of forex brokers in Japan to check out.