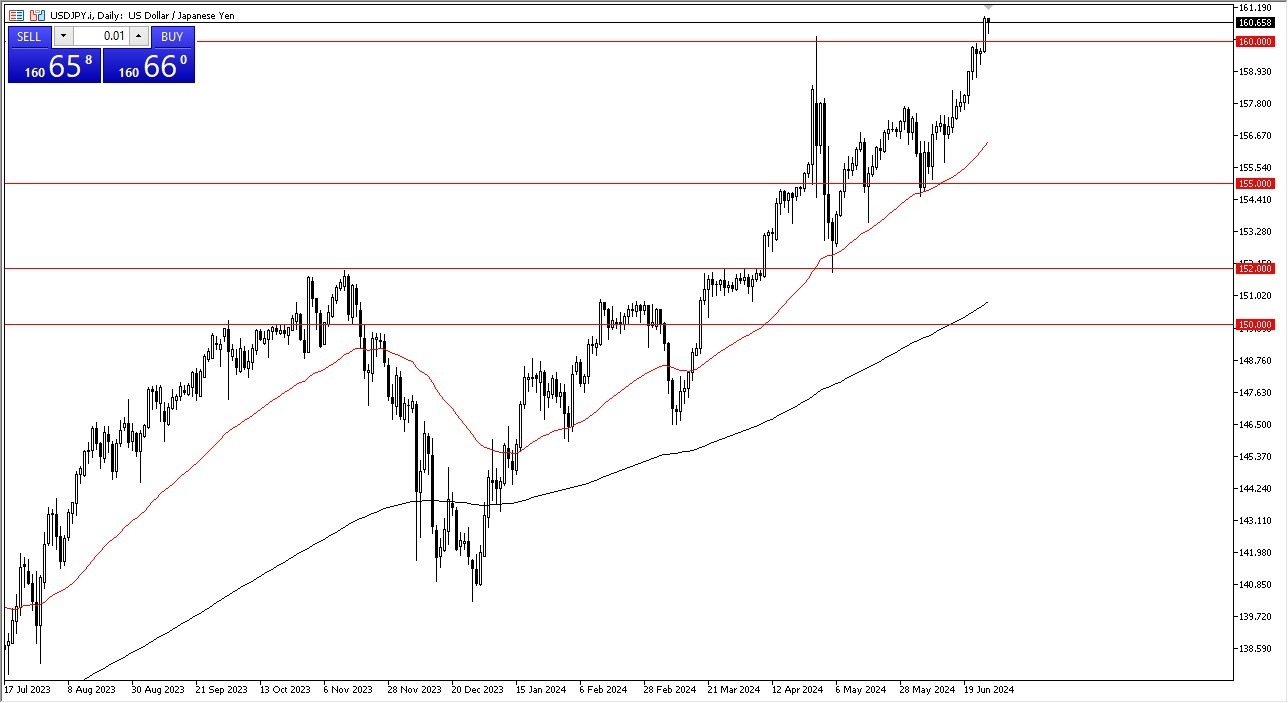

- In my daily dollar yen analysis, I see a market that is very bullish.

- Despite the fact that we did pull back a bit during the early hours of Thursday, it looks like this continues to be a buy on the dip market.

- The U S dollar pulling back to the 160 yen level is rather interesting due to the fact that it is a large round psychologically significant figure, but it's also where the Bank of Japan stepped in and intervened previously.

With the Friday announcement of the Core PCE Price Index numbers in America, that could have a major influence on what happens with Federal Reserve monetary policy. After all, it's one of their favorite inflation indicators, so of course the market pays close attention.

Top Forex Brokers

160 JPY Matters

If we were to break down below the 160 yen level, I do think that there are multiple support levels worth paying attention to. The 158 yen level is an area that I'd be interested in. After that, then the 50 day EMA in even as low as 155 yen. This of course is assuming that it is not Bank of Japan intervention that pushes us back down because we're already starting to hear little bits and pieces of that possibly in the marketplace.

So, at this point I remain very bullish. I would love to see the Bank of Japan intervene so I could buy the dollar three or four handles lower, but at this point it'll be difficult to simply wait for that. You have to trade the market in front of you. I do think that the Friday announcement of the Core PCE Price Index is going to be the big story here. So, if we get something kind of in line, then maybe a little bit of a pullback occurs, and we buy that. If it's a little bit under, maybe a little bit of a pullback occurs and then we do jump into the USD/JPY market eventually as well. The one thing that could cause the Bank of Japan to get involved is if the Core PC Price Index numbers come out much hotter than anticipated.

Want to trade our daily USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.